Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FOREIGN EXCHANGE<br />

OPERATIONS<br />

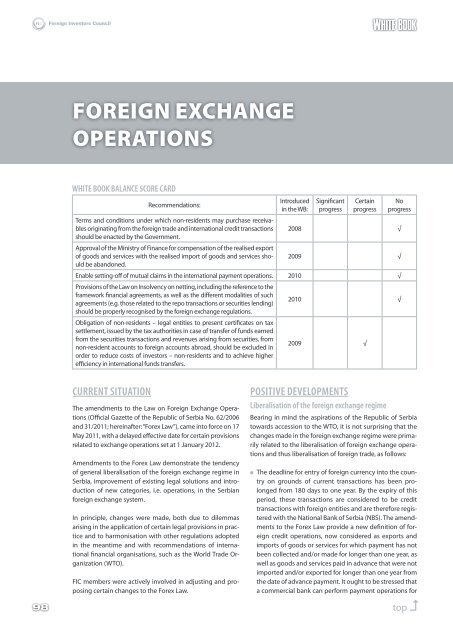

WHitE BooK BaLancE ScorE card<br />

Recommendations:<br />

Introduced<br />

in the WB:<br />

Significant<br />

progress<br />

Certain<br />

progress<br />

No<br />

progress<br />

Terms and conditions under which non-residents may purchase receivables<br />

originating from the foreign trade and international credit transactions<br />

should be enacted by the Government.<br />

Approval of the Ministry of Finance for compensation of the realised export<br />

2008 √<br />

of goods and services with the realised import of goods and services should<br />

be abandoned.<br />

2009 √<br />

Enable setting-off of mutual claims in the international payment operations.<br />

Provisions of the Law on Insolvency on netting, including the reference to the<br />

2010 √<br />

framework financial agreements, as well as the different modalities of such<br />

agreements (e.g. those related to the repo transactions or securities lending)<br />

should be properly recognised by the foreign exchange regulations.<br />

Obligation of non-residents – legal entities to present certificates on tax<br />

settlement, issued by the tax authorities in case of transfer of funds earned<br />

2010 √<br />

from the securities transactions and revenues arising from securities, from<br />

non-resident accounts to foreign accounts abroad, should be excluded in<br />

order to reduce costs of investors – non-residents and to achieve higher<br />

efficiency in international funds transfers.<br />

2009 √<br />

cUrrEnt SitUation<br />

The amendments to the Law on Foreign Exchange Operations<br />

(Official Gazette of the Republic of Serbia No. 62/2006<br />

and 31/2011; hereinafter: “Forex Law”), came into force on 17<br />

May 2011, with a delayed effective date for certain provisions<br />

related to exchange operations set at 1 January 2012.<br />

Amendments to the Forex Law demonstrate the tendency<br />

of general liberalisation of the foreign exchange regime in<br />

Serbia, improvement of existing legal solutions and introduction<br />

of new categories, i.e. operations, in the Serbian<br />

foreign exchange system.<br />

In principle, changes were made, both due to dilemmas<br />

arising in the application of certain legal provisions in practice<br />

and to harmonisation with other regulations adopted<br />

in the meantime and with recommendations of international<br />

financial organisations, such as the World Trade Organization<br />

(WTO).<br />

FIC members were actively involved in adjusting and proposing<br />

certain changes to the Forex Law.<br />

PoSitiVE dEVELoPmEntS<br />

Liberalisation of the foreign exchange regime<br />

Bearing in mind the aspirations of the Republic of Serbia<br />

towards accession to the WTO, it is not surprising that the<br />

changes made in the foreign exchange regime were primarily<br />

related to the liberalisation of foreign exchange operations<br />

and thus liberalisation of foreign trade, as follows:<br />

The deadline for entry of foreign currency into the country<br />

on grounds of current transactions has been prolonged<br />

from 180 days to one year. By the expiry of this<br />

period, these transactions are considered to be credit<br />

transactions with foreign entities and are therefore registered<br />

with the National Bank of Serbia (NBS). The amendments<br />

to the Forex Law provide a new definition of foreign<br />

credit operations, now considered as exports and<br />

imports of goods or services for which payment has not<br />

been collected and/or made for longer than one year, as<br />

well as goods and services paid in advance that were not<br />

imported and/or exported for longer than one year from<br />

the date of advance payment. It ought to be stressed that<br />

a commercial bank can perform payment operations for<br />

98 top �