Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TOBACCO INDUSTRY<br />

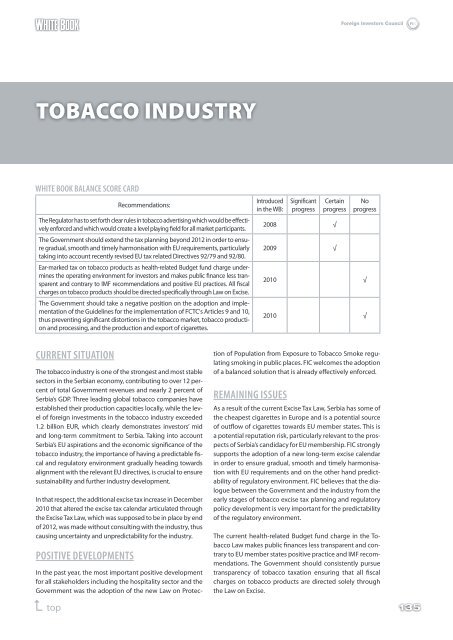

WHitE BooK BaLancE ScorE card<br />

cUrrEnt SitUation<br />

The tobacco industry is one of the strongest and most stable<br />

sectors in the Serbian economy, contributing to over 12 percent<br />

of total Government revenues and nearly 2 percent of<br />

Serbia’s GDP. Three leading global tobacco companies have<br />

established their production capacities locally, while the level<br />

of foreign investments in the tobacco industry exceeded<br />

1.2 billion EUR, which clearly demonstrates investors’ mid<br />

and long-term commitment to Serbia. Taking into account<br />

Serbia’s EU aspirations and the economic significance of the<br />

tobacco industry, the importance of having a predictable fiscal<br />

and regulatory environment gradually heading towards<br />

alignment with the relevant EU directives, is crucial to ensure<br />

sustainability and further industry development.<br />

In that respect, the additional excise tax increase in December<br />

2010 that altered the excise tax calendar articulated through<br />

the Excise Tax Law, which was supposed to be in place by end<br />

of 2012, was made without consulting with the industry, thus<br />

causing uncertainty and unpredictability for the industry.<br />

PoSitiVE dEVELoPmEntS<br />

In the past year, the most important positive development<br />

for all stakeholders including the hospitality sector and the<br />

Government was the adoption of the new Law on Protec-<br />

� top<br />

Recommendations:<br />

The Regulator has to set forth clear rules in tobacco advertising which would be effectively<br />

enforced and which would create a level playing field for all market participants.<br />

The Government should extend the tax planning beyond 2012 in order to ensure<br />

gradual, smooth and timely harmonisation with EU requirements, particularly<br />

taking into account recently revised EU tax related Directives 92/79 and 92/80.<br />

Ear-marked tax on tobacco products as health-related Budget fund charge undermines<br />

the operating environment for investors and makes public finance less transparent<br />

and contrary to IMF recommendations and positive EU practices. All fiscal<br />

charges on tobacco products should be directed specifically through Law on Excise.<br />

The Government should take a negative position on the adoption and implementation<br />

of the Guidelines for the implementation of FCTC's Articles 9 and 10,<br />

thus preventing significant distortions in the tobacco market, tobacco production<br />

and processing, and the production and export of cigarettes.<br />

Introduced<br />

in the WB:<br />

tion of Population from Exposure to Tobacco Smoke regulating<br />

smoking in public places. FIC welcomes the adoption<br />

of a balanced solution that is already effectively enforced.<br />

rEmaininG iSSUES<br />

Significant<br />

progress<br />

Certain<br />

progress<br />

2008 √<br />

2009 √<br />

No<br />

progress<br />

2010 √<br />

2010 √<br />

As a result of the current Excise Tax Law, Serbia has some of<br />

the cheapest cigarettes in Europe and is a potential source<br />

of outflow of cigarettes towards EU member states. This is<br />

a potential reputation risk, particularly relevant to the prospects<br />

of Serbia’s candidacy for EU membership. FIC strongly<br />

supports the adoption of a new long-term excise calendar<br />

in order to ensure gradual, smooth and timely harmonisation<br />

with EU requirements and on the other hand predictability<br />

of regulatory environment. FIC believes that the dialogue<br />

between the Government and the industry from the<br />

early stages of tobacco excise tax planning and regulatory<br />

policy development is very important for the predictability<br />

of the regulatory environment.<br />

The current health-related Budget fund charge in the Tobacco<br />

Law makes public finances less transparent and contrary<br />

to EU member states positive practice and IMF recommendations.<br />

The Government should consistently pursue<br />

transparency of tobacco taxation ensuring that all fiscal<br />

charges on tobacco products are directed solely through<br />

the Law on Excise.<br />

135