14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• The project amenities the proposed project plans to <strong>of</strong>fer are similar to and, in<br />

some cases, much greater than its competitors.<br />

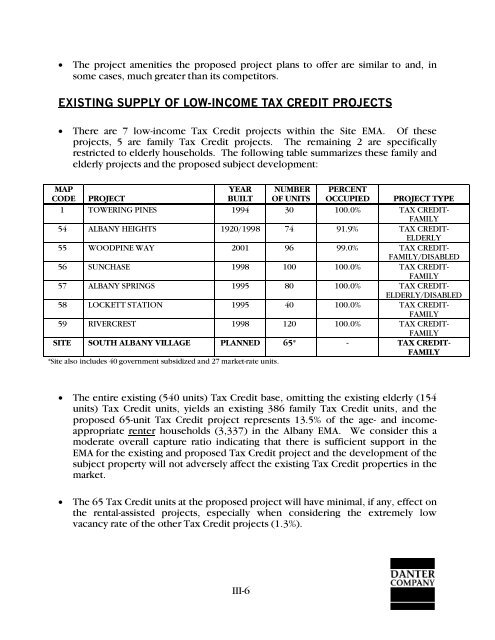

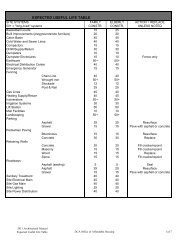

EXISTING SUPPLY OF LOW-INCOME TAX CREDIT PROJECTS<br />

• There are 7 low-income Tax Credit projects within the Site EMA. Of these<br />

projects, 5 are family Tax Credit projects. The remaining 2 are specifically<br />

restricted to elderly households. The following table summarizes these family and<br />

elderly projects and the proposed subject development:<br />

MAP<br />

YEAR NUMBER PERCENT<br />

CODE PROJECT<br />

BUILT OF UNITS OCCUPIED PROJECT TYPE<br />

1 TOWERING PINES 1994 30 100.0% TAX CREDIT-<br />

FAMILY<br />

54 ALBANY HEIGHTS 1920/1998 74 91.9% TAX CREDIT-<br />

ELDERLY<br />

55 WOODPINE WAY 2001 96 99.0% TAX CREDIT-<br />

FAMILY/DISABLED<br />

56 SUNCHASE 1998 100 100.0% TAX CREDIT-<br />

FAMILY<br />

57 ALBANY SPRINGS 1995 80 100.0% TAX CREDIT-<br />

ELDERLY/DISABLED<br />

58 LOCKETT STATION 1995 40 100.0% TAX CREDIT-<br />

FAMILY<br />

59 RIVERCREST 1998 120 100.0% TAX CREDIT-<br />

FAMILY<br />

SITE SOUTH ALBANY VILLAGE PLANNED 65* - TAX CREDIT-<br />

FAMILY<br />

*Site also includes 40 government subsidized and 27 market-rate units.<br />

• The entire existing (540 units) Tax Credit base, omitting the existing elderly (154<br />

units) Tax Credit units, yields an existing 386 family Tax Credit units, and the<br />

proposed 65-unit Tax Credit project represents 13.5% <strong>of</strong> the age- and incomeappropriate<br />

renter households (3,337) in the Albany EMA. We consider this a<br />

moderate overall capture ratio indicating that there is sufficient support in the<br />

EMA for the existing and proposed Tax Credit project and the development <strong>of</strong> the<br />

subject property will not adversely affect the existing Tax Credit properties in the<br />

market.<br />

• The 65 Tax Credit units at the proposed project will have minimal, if any, effect on<br />

the rental-assisted projects, especially when considering the extremely low<br />

vacancy rate <strong>of</strong> the other Tax Credit projects (1.3%).<br />

III-6