14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

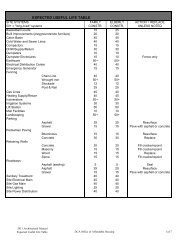

As the preceding table illustrates, the capture rates for the proposed project ranges<br />

from 1.0% for a one-bedroom unit to 4.8% for a two-bedroom unit. The overall project<br />

has a capture rate <strong>of</strong> 3.4%. This is an excellent ratio <strong>of</strong> support for a family project and<br />

indicates that there is sufficient support for the proposed project. The proposed<br />

project should have no negative effects on the existing Tax Credit projects in the<br />

market given these excellent capture ratios and the limited supply <strong>of</strong> recently<br />

developed and new housing in the market.<br />

ABSORPTION<br />

Although not all are included in this report, The Danter Company has developed<br />

additional methodologies to analyze support for a proposed project through 30+ years<br />

<strong>of</strong> market research. Two primary indicators <strong>of</strong> the success <strong>of</strong> a project are stepup/down<br />

support (internal support from conventional rentals) and comparable<br />

market rent analysis (evaluation <strong>of</strong> the value <strong>of</strong> the proposed rents). These<br />

calculations have been made to assist in estimating absorption.<br />

The proposed South Albany Village is expected to have units available in June 2004.<br />

When responding to only income-qualified tenants, absorption <strong>of</strong> the 132 proposed<br />

units is expected to average 12 to 14 units per month, resulting in a 9.0- to 10.5-month<br />

absorption period to achieve a 93% occupancy level.<br />

Prior studies have shown that absorption tends to be seasonal, with up to 64% <strong>of</strong><br />

annual absorption taking place in the "peak" summer months (May through August).<br />

The shoulder season (the two months on either side <strong>of</strong> the peak season) generally<br />

accounts for approximately 24% <strong>of</strong> annual absorption. The "<strong>of</strong>f" season, November<br />

through February, typically accounts for the remaining 12% <strong>of</strong> absorption. While<br />

these percentages do not hold true in all markets, they give a good indication <strong>of</strong> the<br />

potential seasonal variations in absorption.<br />

H. SUPPLY ANALYSIS<br />

1. FIELD SURVEY OF CONVENTIONAL APARTMENTS<br />

A total <strong>of</strong> 5,837 conventional apartment units in 59 projects were surveyed in the Site<br />

EMA. A total <strong>of</strong> 4,704 <strong>of</strong> these units are in 46 market-rate developments. The<br />

remaining 1,133 units are located in 13 subsidized developments. There are no<br />

vacancies among these units. Following is an analysis <strong>of</strong> the market-rate and<br />

subsidizied units in the EMA.<br />

IV-38