14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

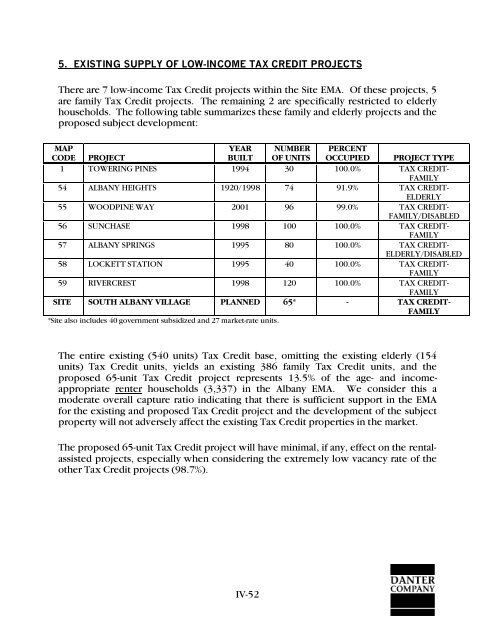

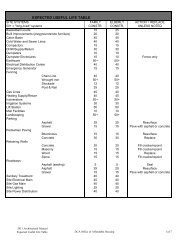

5. EXISTING SUPPLY OF LOW-INCOME TAX CREDIT PROJECTS<br />

There are 7 low-income Tax Credit projects within the Site EMA. Of these projects, 5<br />

are family Tax Credit projects. The remaining 2 are specifically restricted to elderly<br />

households. The following table summarizes these family and elderly projects and the<br />

proposed subject development:<br />

MAP<br />

YEAR NUMBER PERCENT<br />

CODE PROJECT<br />

BUILT OF UNITS OCCUPIED PROJECT TYPE<br />

1 TOWERING PINES 1994 30 100.0% TAX CREDIT-<br />

FAMILY<br />

54 ALBANY HEIGHTS 1920/1998 74 91.9% TAX CREDIT-<br />

ELDERLY<br />

55 WOODPINE WAY 2001 96 99.0% TAX CREDIT-<br />

FAMILY/DISABLED<br />

56 SUNCHASE 1998 100 100.0% TAX CREDIT-<br />

FAMILY<br />

57 ALBANY SPRINGS 1995 80 100.0% TAX CREDIT-<br />

ELDERLY/DISABLED<br />

58 LOCKETT STATION 1995 40 100.0% TAX CREDIT-<br />

FAMILY<br />

59 RIVERCREST 1998 120 100.0% TAX CREDIT-<br />

FAMILY<br />

SITE SOUTH ALBANY VILLAGE PLANNED 65* - TAX CREDIT-<br />

FAMILY<br />

*Site also includes 40 government subsidized and 27 market-rate units.<br />

The entire existing (540 units) Tax Credit base, omitting the existing elderly (154<br />

units) Tax Credit units, yields an existing 386 family Tax Credit units, and the<br />

proposed 65-unit Tax Credit project represents 13.5% <strong>of</strong> the age- and incomeappropriate<br />

renter households (3,337) in the Albany EMA. We consider this a<br />

moderate overall capture ratio indicating that there is sufficient support in the EMA<br />

for the existing and proposed Tax Credit project and the development <strong>of</strong> the subject<br />

property will not adversely affect the existing Tax Credit properties in the market.<br />

The proposed 65-unit Tax Credit project will have minimal, if any, effect on the rentalassisted<br />

projects, especially when considering the extremely low vacancy rate <strong>of</strong> the<br />

other Tax Credit projects (98.7%).<br />

IV-52