14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

14490 full.pdf - Georgia Department of Community Affairs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ecipient) is 1 to 2 per month. However, HUD Section 8 Voucher holders could also<br />

change their place <strong>of</strong> residence at the end <strong>of</strong> a lease term, becoming a potential<br />

source <strong>of</strong> supply.<br />

There is a list <strong>of</strong> 73 applicants waiting to join the Dougherty County HUD Section 8<br />

Voucher program. The number <strong>of</strong> Vouchers currently available is perceived as stable.<br />

There was an increase <strong>of</strong> 10 Vouchers in September 2001.<br />

The proposed project includes 40 Rental Assistance units, which will draw some<br />

tenants from the waiting list for housing assistance.<br />

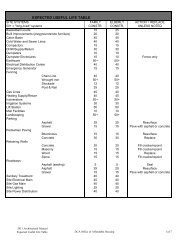

COMPARABLE MARKET RENT ANALYSIS<br />

Comparable market rent analysis establishes the rent potential renters would expect<br />

to pay for the subject units in the open market without income restrictions.<br />

Comparable market rent is based on a regression analysis for the area apartment<br />

market. For each unit type, the regression analysis compares net rent by<br />

comparability index for all market-rate developments. This evaluation provides a<br />

comparison <strong>of</strong> existing market rents to those at the proposed project. A variety <strong>of</strong><br />

factors influence a property’s ability to actually achieve the comparable market rent,<br />

including the number <strong>of</strong> units at that comparable market rent, the step-up support<br />

base at that rent range, and the age and condition <strong>of</strong> the subject property and<br />

competitive units.<br />

Considering the proposed unit and project amenities and an appealing aesthetic<br />

quality, the proposed South Albany Village Apartments is anticipated to have an<br />

overall comparability rating <strong>of</strong> 26.0. The overall rating is based on ratings <strong>of</strong> 9.5 for<br />

unit amenities, 8.5 for project amenities, and 8.0 for aesthetic quality.<br />

Rents within the Albany Site EMA have increased at an established annual rate <strong>of</strong> 3.1%<br />

over the past few years.<br />

There are 1,354 one-bedroom units within the Site EMA. Rents for these units range<br />

from $277 to $537. Based on the current rent structure <strong>of</strong> one-bedroom units,<br />

present-day rent for a development comparable to the one proposed is $510 per<br />

month. Based on the established rate <strong>of</strong> increase (3.1%), probable one-bedroom rent<br />

is $540 at the anticipated opening in June 2004. The proposed rents <strong>of</strong> $384 to $485<br />

are below the market-driven rent.<br />

There are 2,298 two-bedroom units within the Site EMA. Rents for these units range<br />

from $304 to $674. Based on the current rent structure <strong>of</strong> two-bedroom units,<br />

present-day rents for a development comparable to the one proposed are $610 to<br />

$640 per month. Applying the average annual increase in the Site EMA yields two-<br />

IV-47