SWOT Analysis - Central Europe

SWOT Analysis - Central Europe

SWOT Analysis - Central Europe

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>SWOT</strong> <strong>Analysis</strong><br />

Status of Creative Industries at Pécs<br />

„This project is implemented<br />

through the CENTRAL EUROPE<br />

Programme co-financed by the<br />

ERDF.”

Head of publication: János Keresnyei, president, CICC Association<br />

Edited by: EURES Consulting Ltd., South Transdanubian Cultural Industry Cluster,<br />

CICC Association, Stakeholder team of Pécs Creative Industry<br />

First Published in 2010 by Cultural Innovation Competency Center<br />

All right reserved.

Content<br />

2.1 Short introduction (based on statistical data) ................................................................ 7<br />

2.2 Brief description of the economy ....................................................................................... 8<br />

2.3 General presentation of the administrative system .................................................... 10<br />

2.4 A comprehensive attempt to promote culture and creative industries (cultural<br />

and creative industry related activities) ................................................................................ 11<br />

3.1 Introduction to the major social, geographical and economical changes........ 15<br />

3.2 Brief description of the economy, presentation ........................................................... 16<br />

3.4 Brief presentation of the city’s cultural profile (cultural assets) ................................ 19<br />

4.1 Demographical structure .................................................................................................... 21<br />

4.2 Industrial structure .................................................................................................................. 22<br />

4.3 Cultural structure.................................................................................................................... 27<br />

5.1 Definition of the creative industry ..................................................................................... 29<br />

5.2 The position of the creative industry ............................................................................... 30<br />

5.3 The creative industry in Pecs according to statistical data ..................................... 33<br />

5.4 The situation of the creative industry in the selected subsector .............................. 38<br />

5.5 Summary .................................................................................................................................. 42<br />

6.1 The definition of the public sector .................................................................................... 45<br />

6.2 The position of the public sector ....................................................................................... 45<br />

6.3 The size of the public sector ............................................................................................... 45<br />

6.4The supported activities of the public sector ................................................................. 46<br />

6.5. Summary ................................................................................................................................. 47<br />

7.1 Strengths ................................................................................................................................... 49<br />

7.2 Weaknesses ............................................................................................................................. 50<br />

7.3 Opportunities .......................................................................................................................... 52

7.4 Threats ....................................................................................................................................... 53<br />

7.5 Essence of the <strong>SWOT</strong> analysis (according to 20 questionnaire) .............................. 53<br />

The professional questionnaire used by the analysis: ........................................................ 57<br />

The list of organizations participating in the questionnaire analysis: ............................. 60<br />

The main results of the structured database used in the evaluation of the statistical<br />

analysis (Source: <strong>Central</strong> Statistical Office): ......................................................................... 61<br />

List of employed documents and electronic documents: .............................................. 65

1. Summary (Objectives, expectations methods)<br />

The goal of the present study is the detection of the operational efficiency in<br />

the creative industry in the city of Pecs and the preparation of a situation<br />

analysis and <strong>SWOT</strong> analysis on behalf the sectoral work’s and the services’<br />

coordination. The study is intended to seek more than a simple valuation. The<br />

purpose of our survey is to serve as a basis for further analysis of sectoral<br />

developments and lead to concrete results.<br />

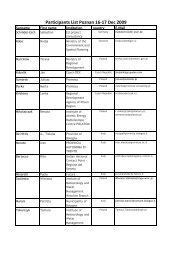

Almost two months of preparatory work preceded it the analysis, as during<br />

the process of the situation analysis of both qualitative and quantitative<br />

methods were used. The qualitative study was based upon the documents<br />

regarding the sector analysis of the city, and on personal interviews carried<br />

out by 20 people (all of them were professionals of the different sub-sectors)<br />

After the data collection the survey questionnaires were recorded and then,<br />

these was prepared to statistical database. In parallel with this process we<br />

collected the available economic and statistical data of the companies<br />

working in the local creative industry, of which 790 items, and nearly 10,000<br />

data were prepared, which served as a basis for a quantitative study. During<br />

the analysis process we debated the two different methods and finally we<br />

came to the creation’s essence of the <strong>SWOT</strong> analysis. (See Figure 1!)

1. Figure Methodology of the analysis used in the study

2. The general profile of the country (administrative system, demographic<br />

trends, employment, economic development, and attempts to promote<br />

culture and creative industries in the national indicators)<br />

2.1 Short introduction (based on statistical data)<br />

Hungary's key statistics are as follows:<br />

Form of government: Republic (EU member since 2004)<br />

Capital: Budapest<br />

Area: 93.036 km² (CSO, 2010)<br />

Population according to census: 10 198 315 persons (CSO, 2001)<br />

Density: 107,5 persons/km² (CSO, 2010)<br />

GDP (CSO, 2009a): 26 753 906 (Mio HUF)<br />

Per capita GDP (CSO, 2009a): 2 665 (thousand HUF)<br />

Hungary is located in the northern hemisphere temperate climate belt, in<br />

<strong>Central</strong> <strong>Europe</strong>, at the middle section of the Danube River, enclosed by the<br />

Carpathian Mountains. To the west, Austria to the north, Slovakia, to the<br />

northeast Ukraine, to the east Romania, and to the south of the former<br />

Yugoslavia, Serbia, Croatia and Slovenia bordering the country. The area of<br />

Hungary is 93,036 square kilometres.<br />

The total population of the country at the 2010th of September was 9 998<br />

thousands (CSO Flash Report 2010 January-September), which since 1981 due<br />

to the low birth rate and high number of deaths is decreasing and has an<br />

aging structure. At the same time, 4,320,681 homes were held accountable in<br />

the country (CSO, 2010a). It is considered relatively homogenous in terms of<br />

nationality as 92.3% of the population declared themselves as Hungarians,<br />

and the Hungarian language is spoken by 99% of the population (CSO, 2001).<br />

Hungary's territorial administration has two main levels. At territorial level 19<br />

counties and the capital (Budapest) while at the local level 3152 towns and<br />

villages is found (CSO, 2009a).

Among the settlements there are 328 municipalities the rests are villages. The<br />

cities include 23 provincial towns and the capital, and the latter is divided into<br />

23 districts. Out of the villages there are 118 large ones. [16] These territorial<br />

units possess their own municipality. In Budapest two-tier local government<br />

system operates, which consist of the Metropolitan municipalities and district<br />

authorities. There is no hierarchical relationship among the counties and<br />

municipal governments. (CSO, 2009b)<br />

Out of the two basic levels, there are two more territorial levels, the designing-<br />

statistical region and the micro-region. Originally both were created for<br />

statistical purposes and under the regional institutional framework, but they<br />

form as well as the territorial basis of organizing some administrative and<br />

municipal functions.<br />

The 7 regions were established with the grouping of the counties and the<br />

capital, and the 174 micro-regions within the boundaries of the counties with<br />

the grouping of municipalities. Budapest forms a separate micro-region (CSO,<br />

2009).<br />

Regarding the Local Self-Government Act, the County Town Municipal<br />

Council in its own territory - corresponding changes - assume their own<br />

competence of the county government functions and powers. Cities with<br />

County Rights however, are not allowed to form a distinct territorial<br />

administrative unit; they are entitled only to specific municipal law.<br />

2.2 Brief description of the economy<br />

Hungary's economic system according to the constitution is based on a social<br />

market economy, which has to ensure fair competition, and everyone<br />

involved in state-guaranteed minimum economic security. Hungary is a<br />

member of the advanced industrial countries comprising the OECD, on the<br />

basis of the economic performance it belongs to the developed countries,<br />

but in the <strong>Europe</strong>an Union it has tended to count to the poor.

Gross domestic product (GDP) at current prices in 2009 was HUF 26 753 906<br />

million (CSO, 2009a). The per capita gross domestic product is scattered<br />

moderate. Among the regions of country in 2008, the wealthiest was <strong>Central</strong>-<br />

Hungary (4 424 000 HUF / person), the poorest the South- Plains (2 398 000 HUF<br />

/ person). (CSO, 2009a)<br />

The average wages in Hungary, compared to the world standard is high and<br />

but they are low in comparison to the <strong>Europe</strong>an Union's average wage, gross<br />

wages in 2008 averaged 213 thousand forint (HUF 129 thousand net). (CSO,<br />

2008) The unemployment rate of 10,0% (CSO 2009d) is relatively low, but the<br />

tendency is that the capital-intensive industries are developing, which<br />

providing livelihood mainly for highly skilled workers. Among people with non-<br />

marketable skills or low skills exist a high level of structural unemployment, and<br />

poverty is also significant.<br />

Hungary just as the other developed countries has an increasingly aging<br />

population, and the rate of activity of 55% (CSO, 2010b) is extremely low, i.e.<br />

a smaller working population producing high value, supporting many inactive<br />

(student, retired, unemployed) people. Hungary consumes more goods that it<br />

creates, ergo the state budget is showing a deficit, the public debt levels<br />

equals about 78,3% (CSO, 2010c) of the annual gross domestic product<br />

(GDP).<br />

The role of the service sector is continuously increasing in the Hungarian<br />

economy, and over the past fifteen years investments were flowing to the<br />

transportation and other service sectors. Still, the economic structure can be<br />

described as advanced industrial country. Regarding the development of the<br />

Hungarian economy the predominantly multinational companies industrial<br />

activity, manufacturing, mechanical engineering, automotive, electronics<br />

goods are in terms of absolute importance. Some of those companies are<br />

producing more than half of the exported products, and are paying more<br />

than half of the tax revenue of the budget. Hungary's, a poor country,<br />

regarding natural resources, the economy rely mostly on imports; balance of<br />

payments and external balance is in deficit.

The aim of the Hungarian economy after 1989 was a transition from a<br />

planned to a market economy. Hungary as a member of the <strong>Europe</strong>an Union<br />

the world's largest single market, in accordance with the objectives of the<br />

<strong>Europe</strong>an Union’s economic policy aspiring to replace the Forint to Euro to<br />

achieve low interest rates, manageable fiscal deficits and government debt<br />

levels to meet the requirement of the Maastricht criteria’s low inflation rate.<br />

2.3 General presentation of the administrative system<br />

Hungary's territorial administration has two main levels. At territorial level 19<br />

counties and the capital (Budapest) while at the local level 3152 towns and<br />

villages is found.<br />

Among the settlements there are 328 municipalities the rests are villages. The<br />

cities include 23 provincial towns and the capital, and the latter is divided into<br />

23 districts. Out of the villages there are 118 large ones. [16] These territorial<br />

units possess their own municipality. In Budapest two-tier local government<br />

system operates, which consist of the Metropolitan municipalities and district<br />

authorities. There is no hierarchical relationship among the counties and<br />

municipal governments. (CSO, 2009b)<br />

Out of the two basic levels, there are two more territorial levels, the designing-<br />

statistical region and the micro-region. Originally both were created for<br />

statistical purposes and under the regional institutional framework, but they<br />

form as well as the territorial basis of organizing some administrative and<br />

municipal functions.<br />

The 7 regions were established with the grouping of the counties and the<br />

capital, and the 174 micro-regions within the boundaries of the counties with<br />

the grouping of municipalities. Budapest forms a separate micro-region.<br />

(CSO, 2009c)<br />

Regarding the Local Self-Government Act, the County Town Municipal<br />

Council in its own territory - corresponding changes - assume their own<br />

competence of the county government functions and powers. Cities with

County Rights however, are not allowed to form a distinct territorial<br />

administrative unit, they are entitled only to specific municipal law.<br />

2. Figure Mid-level administrative structure of Hungary<br />

2.4 A comprehensive attempt to promote culture and creative industries<br />

(cultural and creative industry related activities)<br />

The Cultural Industry makes up the 3.1% of the active population, generates<br />

2.6% of GDP in the <strong>Europe</strong>an Union although the EU wouldn’t even spend 1%<br />

of the average GDP on the broader culture.<br />

At the end of the 1990’s the share of culture was approximately 3% of the<br />

GDP, decreasing slightly during the decade. The structure of the funding has<br />

been thoroughly changed lately. By the mid-decade, a multisectoral cultural<br />

institutions were established, in which, properly in a market economy, the<br />

culture market oriented part was dominated More recently 70% of the cultural<br />

spending was cost and fee income (including public budgetary institutions<br />

such as the museum's revenue), 17% of the state (budget) support, 13% in

various non-profit organizations, foundations, associations, public utility<br />

companies, performance value, (a significant part comes from large public<br />

foundations, which also benefited from the budget). The big national cultural<br />

developments are tending to be real estate development projects to cover<br />

the time being.

3. Presentation of the city – The general demographic geographic and<br />

economic situation<br />

Pécs situated in <strong>Central</strong>-<strong>Europe</strong> in the Carpathian Basin. From the north it is<br />

bordered by the Mecsek mountains, from the south flat terrains. The city is<br />

close to the Croatian border in the southwest part of the country. The south<br />

part of Pécs is relatively flat, while the northern part is creeping up the<br />

southern slopes and valleys of the Mecsek. The position of Pécs is extremely<br />

favourable from climatologic point of view at the border of a still quite<br />

forested area.<br />

In sultry summer evenings cool air flows and cleans the city launched from the<br />

Mecsek Mountain. The city is open from the south, protected from the north<br />

by the ridges of the Mecsek, which is emerging suddenly from average of<br />

120-130 meter high flatland of Pécs , and reaches the height of 400-600<br />

meters.<br />

In the western part of the Mecsek the 592-meter high Jakab hill; just right<br />

above the city in the <strong>Central</strong>-Mecsek the 612 meter high Tubes, the 535 meter<br />

high Misina is to be found. [18] The settlement’s sections stretch up to the<br />

slopes of an average height of 200-250 meters.<br />

The Mecsek is dissected by various valleys, which improves significantly the<br />

climate of our city which doesn’t possess any warm water reservoir or lake in<br />

the vicinity. Water coming from the slopes of the Mecsek is gathered by the<br />

Pécsi-víz flowing of the NE-SW direction drives it to the Fekete-víz (Black-<br />

water), which flows into Drávába.<br />

At the analyses of Pécs it is necessary to examine the values of the past. The<br />

sudden and shocking loss of the traditional industries determine the present<br />

economical situation for example the leather industry, coal, - and uranium<br />

mining, and the traditional machinery production. From the creative<br />

industries’ point of view it can be established that one of the most famous<br />

creative product of Pécs is the Zsolnay porcelain, which gets its special<br />

metallic colour and glitter from the usage of eosin enamel.

31 bank and insurance company’s branch and regional management<br />

functions in Pécs. Recently the Municipality of Pécs established new industrial<br />

areas. First, in the immediate interior of the city - a long tradition of<br />

representatives of local industries: machinery, leather and the precision<br />

engineering – then in the eastern and southern industrial areas with fully<br />

recultivation. Thus was established the Pécs Industrial Park area of 50 hectares<br />

near the main highways.<br />

Demography<br />

For quite a long time, the city's population has grown more dynamically than<br />

the national average (in the 1970s, peaked), from the early '90s, however, it<br />

has been started significantly decreasing. Between 1985 and 2005 the<br />

population of Pécs decreased by 12.3% (20,988 persons). In Pécs , similar to<br />

nationally representative rates, the number of women is higher than men. The<br />

proportion of older people is more than 3% of young people (14 years).<br />

Two city of Pécs , is one of the most important centre of officially recognized<br />

national minorities in Hungary: the Germans and the Croats. It is interesting to<br />

note that while the entire population of the city is decreasing, the number of<br />

minorities increased slightly over the last few decades, although it is applies<br />

mostly to the Gypsies. The number of Germans in 1980 were 996, in 1990 were,<br />

1704, so it had increased. The number of Croats also slightly increased: in<br />

1980, there were 629 of them, in 1990, 637 people, and in 2001, 820 people<br />

declared themselves Croat nationality in Pécs. We should note though that<br />

slight growth in number in the statistical data, is due to the changing of social<br />

atmosphere and the new census questionnaire.

3. Figure The age pyramid of the city of Pécs<br />

3.1 Introduction to the major social, geographical and economical changes<br />

The post-Communist times severely affected the city, the industrial plants<br />

almost without exception were closed by the reason of uneconomic, the new<br />

industrial location remained an insignificant level compared to the former<br />

times, and unemployment has grown enormously. In the 1990s the proximity of<br />

the Yugoslav war set back the tourism industry considerably as well.<br />

Although during the past decade and a half the city's economic structure has<br />

changed - more and more of the knowledge, health, cultural industries came<br />

into focus - but what has not changed was that Pécs remained a multi-<br />

faceted town, where the ethnic traditions, values merged. It also helped in<br />

the effort to materialize, that Pécs has won the 2005th 19 October 2010<br />

<strong>Europe</strong>an Capital of Culture (ECOC) title (ahead of Miskolc and Eger), which<br />

has sparked real big development projects in the city. As the large-scale

projects, such as a Concert-hall, the knowledge-centre and the Zsolnay<br />

Cultural Quarter hasn’t finished yet for the first half year of 2010,<br />

Pécs arranged alternative sites for the programmes (Pécs National Theatre,<br />

the University of Hall of the Medical University, and the Synagogue). The M6<br />

and M60 motorway, which connects Budapest with Pécs was completed and<br />

with the V/C corridor it has developed one of the most important regional<br />

traffic line. In this year, the life of whole city has been heavily astir due to the<br />

ECC investments. In addition, a spectacular increase has been realised at the<br />

number of tourists in our city. According to researches and data of the TDM<br />

the tourist occupancy rate increased by 25 percent compared to the<br />

previous year’s March and April.<br />

3.2 Brief description of the economy, presentation<br />

In Numbers (CSO, 2010):<br />

� GDP 1.557 billion HUF<br />

� GDP/person: 1.596.000 HUF<br />

� Investment 90 566 million HUF<br />

� Registered number of businesses: 24 268 pcs. (2006)<br />

� Number of nonprofit organizations: 162 pcs. (2006)<br />

� Unemployment: 14%<br />

� Number of registered unemployed (2009): 41,9 thousand person<br />

The economic performance of the South-Transdanubian region over the past<br />

few years was positioned at the breaking point of the Hungarian regional<br />

differences, moving away from the dynamic territories and towards the<br />

lagging regions of. The eastern part of the country.<br />

In the region each element which determining the dynamics on a territorial<br />

growth, the gap rather widened and the negative marks ruled:<br />

– The rate of employment and the rate of the GDP/employed persons are<br />

relatively deteriorated;<br />

– The foreign presence in the region's economy is very weak;

– The economic structure is out of date and there was no appreciable sign<br />

of modernization - in addition the weak manufacturing were producing<br />

mainly into the domestic market, and was weak in export, there wasn’t<br />

any major industry or company to which the regional development –<br />

such as industry clusters form could be supported<br />

Pécs according to its size of population and the role it fulfils in the regional<br />

settlement structure the largest city in the Transdanubian and the main town<br />

and country planning centre. The city’s regional centre's role is based upon<br />

it’s traditionally fulfilled duty, far radiating intellectual base, its university which<br />

was the first founded university in the country, cultural attractions, and<br />

significant economic potential.<br />

Pécs is a service centre, the three quarters of the earners are working in the<br />

tertiary sector, and the rate of intellectuals is dominating. In the last decade<br />

several international commercial companies established in the city, and quite<br />

a lot of firms built up here its storage and distribution centre at national level.<br />

Thus, the previously mainly industrial nature of the local economy is now<br />

converted to services-based trade and logistics economy.<br />

Pécs with its economic, cultural, scientific performance is one of the most<br />

dynamic, progressive and the best quality of life providing city, whose spiritual<br />

radiance reaches far beyond the region and the country's borders. The city<br />

tries to achieve according to its concept of urban development planning to<br />

- become the pole of the national and international knowledge-based<br />

economy development;<br />

- be a major player in the field of the culture, education, science at national<br />

level;<br />

- have an effective and competence promoting infrastructural environment;<br />

- fulfil further on its regional role with the very important principle of<br />

partnership;<br />

- be a city of its well organized administration providing its inhabitants a good<br />

quality of life.

4. Figure Sectoral composition of economy based on the number of employees in Pécs<br />

3.3 Brief presentation of the city in the <strong>Europe</strong>an hierarchy and networks (main<br />

junctions)<br />

Pécs so far hasn’t played an important role in the Euroregional network, which<br />

partly due to its structural position within <strong>Europe</strong>, and partly the external<br />

periphery of the country's transport occlusion is linked.<br />

The Danube-Drava-Sava Euroregion was established in 1998, which was the<br />

first important step toward the broadening relations of the city. The city's<br />

incorporation of the <strong>Europe</strong>an territorial network has a strategic importance in<br />

the economic and cultural terms as well. The speciality of the present situation<br />

is that linkage into the economic bloodstream, the economic reversal of<br />

subsidence depends on the success of today's cultural record: the cultural<br />

and intellectual heritage and continuity could be the dimension, which is a<br />

real opportunity for the city to the spatial structure of <strong>Europe</strong>an integration,<br />

and to become a real investment and travel destination.

The EKF provides considerable and non-recurring potential to Pécs , to get<br />

integrated into <strong>Europe</strong>'s economic and intellectual-cultural fabric. Luckily,<br />

and certainly not by chance that Istanbul-Pécs-Essen are the three <strong>Europe</strong>an<br />

Capitals of Culture 2010. This east-west axis gives visibility and structural<br />

possibility for the three cities and the around organized spatial dimensions<br />

(partner cities, countries) to improve their position.<br />

From north to south the Scandinavia-Budapest-Ploce (V/ C corridor) axis is<br />

getting increasingly updated and real in the EU, which involving Hungary into<br />

the <strong>Europe</strong>an transport network, to which Pécs also will have the transport<br />

links. In the cross section of these new (transport, economic, cultural) axes,<br />

and opportunities the city has to find its development directions, which<br />

hopefully would moderate, and may be stop the South-Transdanubian<br />

Region breaking off from the more dynamic regions, and promote the<br />

economy, increase social cohesion, stop the migration from a thousand years<br />

old cultural centre, and make it again an attractive and successful city.<br />

It has to be examined, whether these axes are considered also to be of<br />

strategic importance in the partner countries, so the economic terms of Pécs,<br />

in particular, may become a driving force particularly in the tourism.<br />

Examined the potential for the development of cooperation with those<br />

countries (including those specific cities, regions, institutions and investors) that<br />

lie along this axis, focusing on tourism and increasing investment, and that<br />

along these axis Pécs become an increasingly growing important link and<br />

intermediate pier.<br />

3.4 Brief presentation of the city’s cultural profile (cultural assets)<br />

Pécs is one of the most ancient and rich city in national monuments, the<br />

administrative and spiritual centre of the Southern-Transdanubian region. The<br />

city’s cultural life is prominent in the field of the music and fine arts wide-<br />

ranging accepted in the country. There are 59 galleries, museums and<br />

exhibition halls in the city of Pécs according to our survey. Larger collections -<br />

Modern Hungarian Art Gallery, Csontváry Museum, Ferenc Martyn Museum,<br />

Museum of Victor Vasarely, Amerigo Tot Museum, Schaár Elizabeth: "Street" -

urban and private galleries are offering the full, and unique presentation of<br />

the 20th century’s Hungarian art. The National Theatre of Pécs has theatrical,<br />

ballet, musical comedy and opera section as well. Beside the National<br />

Theatre are operating the Croat Theatre the University and the Third Theatre<br />

too, but the student acting has got decennial tradition too. A symphonic<br />

orchestra operating, the concert life is rather significant even in national level.<br />

Pécs is also quite unique as it owns a independent puppet theatre.<br />

The city traditionally characterized by vibrant intellectual life that is home to,<br />

inter alia, the University of Pécs Days, Days of University, the Pécs’ days or the<br />

Pécs National Theatre Festival (PNTF) and the Cinepécs International Film<br />

Festival as well. Here operates country largest university regarding the number<br />

of students, with 31 thousand of them attending the various courses.<br />

In 2010, together with the city of Essen and Istanbul – Pécs is one of <strong>Europe</strong>'s<br />

cultural capitals. The title is awarded to the 2010 year, a number of<br />

investments made possible by the <strong>Europe</strong>an Union. The Pécs2010 Cultural<br />

Capital of <strong>Europe</strong> project has four investment priorities: Conference and<br />

Concert Centre, South-Transdanubian Regional Library, Knowledge Centre,<br />

and the Zsolnay Cultural Quarter. They also complement the revitalization of<br />

public spaces and parks.<br />

There are three cinemas now in Pécs. The Apolló movie theatre in the<br />

downtown is the permanent cinema in the city. Here one usually project art<br />

films in two separate halls. The second oldest cinema is the Urania, which was<br />

the first cinema in the country built in Bauhaus style. The cinema is the<br />

member of the ArtMovie-network and the Europa Cinemas supports it as well.<br />

There is a multiplex movie in the city, which can be found in the Pécs Plaza<br />

the so-called Cinema City. There they project commercial type films in ten<br />

different halls.<br />

The first concert hall of the city, which bears the name of Zoltán Kodály, will<br />

be opened at the 16 th of December 2010. The conference and concert hall is

designed to accommodate as many as 1000 visitors was built in the Balokány<br />

quarter near the Zsolnay China Factory.<br />

Since 2009 has been held the Festival of Literature in May. At the time of the<br />

four-day festival the elite of the Hungarian literature life appear in the city.<br />

Then book readings, book presentations, interviews with authors are taking<br />

place in a public festival atmosphere, in public squares, streets and in cultural<br />

institutions. Actors recite poems and besides tale telling afternoons for the kids<br />

it can be seen drawn illustrations from fairy tale as well. The concert and<br />

festival to host cross-border stitched journals, from a series of literary, which<br />

holds the title of literature caravan. The literature heritage of the city has been<br />

promoted by the professional organizations since the renaissance poet and<br />

bishop Janus Pannonius. It shows the significance of the literature’s creative<br />

aspects that in our city there are 87 companies involved printing and editing<br />

or press activities. The Jelenkor publisher is quite significant in the whole<br />

country.<br />

Pécs is one of the pop musical centres of Hungary since the 1960’s. The most<br />

famous band from Pécs is the “Kispál és a Borz”, which created a tradition as<br />

well as a style. With the accented presence of the popular music is coherent<br />

the high number of pop festivals, international music entertainments. The pop<br />

festivals are connected with the other type of festivals so one can emphasize<br />

the following programs: Fishing on Orfű, Student days in the Pécs University,<br />

the Heritage festival, the Rockmarathon, Mediterranean Autumn, and the<br />

Batta Deam.<br />

4. Development<br />

4.1 Demographical structure<br />

Pécs city's population on the 1 st of January 2010th was 157 680 people, but<br />

the permanent population is about a thousand fewer because of the<br />

differences was made up by people who are living in the city on a temporary<br />

basis and the ones who are only commuting elsewhere, but normally they are<br />

Pécs citizens. There hasn’t made any survey yet what was composition of the

two groups but it is quite possible that the majority living in the city temporarily<br />

are university students. It is also assumed that the others living elsewhere are<br />

also mostly students, but the rate of the people living temporarily out of the<br />

city due to work is also significant. Between the two groups there is a<br />

significant difference. After completing the university the majority of students<br />

leaving Pécs, but in turn those who were due to work elsewhere rarely move<br />

back to Pécs. Since young people are involved in both cases, a very bad age<br />

structure triggers the formation. The effect is similar to the one mentioned in<br />

the agglomeration section previously. The moving out most of the city is<br />

typical among the 30's, 40-year-olds who’s existential situation is stable, and<br />

already possessing the necessary resources to build single-family houses and<br />

the needed one or two vehicles as well.<br />

In Hungary, the aging index of approximately 100%, i.e. there are the same<br />

numbers of inhabitants over 65, as the 15 years of age. Pécs situation is not<br />

much better. There are some settlements belong to the agglomeration of<br />

Pécs where, this figure is significantly better than the national average. The<br />

ones moving out belong to the most active age groups, and of course they<br />

take the kids with them too, while the parents usually stay in Pécs, thereby<br />

providing the family a kind of "double-residency".<br />

Here, however, should take into account that the ethnic composition of the<br />

settlements’ population also affects the index value. The vitality index shows<br />

that out of the number of 18-59 year-olds how many per cent belong to the<br />

age group of 18-39 years. This indicator is 53.70% of national context. The<br />

value of the country's big cities - except for Pécs - is placed above the<br />

national average. The vitality of the region’s county’s seat hardly differ from<br />

each other, but all three are below the national average. The variance of the<br />

settlements belong to the Pécs agglomeration is quite significant.<br />

4.2 Industrial structure<br />

Decades before the change of regime Baranya County belonged to the<br />

major industrialized counties. Obviously the mining as well as the processing<br />

industry selling products to the CMEA market included the food and textile

industry played an important role of that success. After the old system had<br />

collapsed these sectors were cutting down, and out of the resources the old<br />

capacities only a few of small and medium-sized enterprises were created.<br />

The result was that by the end of the 90’s Baranya (Pécs is also included) fell<br />

behind to the end of the line in the field of industrial production in the country.<br />

(PBKIK Data line, 2009)<br />

The per capita industrial output value of the Baranya County according to<br />

the CSO yearly editions in 2005 was 697,400 HUF only Szabolcs-Szatmár-Bereg<br />

county reached weaker results than that. The national average that time was<br />

1,623,000 HUF per person, while counting the most industrialized county<br />

Komárom-Esztergom 7,584,400 HUF was produced. The production value per<br />

employee all the region has achieved better results then Baranya, which<br />

indicates that the productivity was extremely low. The county’s - and thus the<br />

city of Pécs’ - competitiveness of the industry is one of the weakest ones. Out<br />

of the industrial sale only 24.4% is the export, only Tolna County has got lower

atio. Csongrád, Hajdú-Bihar counties have similarly poor export ratio whereas<br />

the productivity indices slightly better.<br />

There are three sector which plays a major role of the industrial development’<br />

performance in Baranya county: the electricity, gas, steam, water supply,<br />

food, beverages, and tobacco productions, and mechanical engineering.<br />

Sale gives more than 20%, electricity, gas, steam and water supply gives 38%<br />

of the industrial production. Major representatives are the companies<br />

belonging to the PannonPower Holding (electricity and heat production), the<br />

E. ON group of companies: the South-Transdanubian Electricity Supply<br />

Company Ltd. and the South-Transdanubian Gas Supply Co. (electricity and<br />

natural gas sales), Pécs Waterworks Co. (water production and sales), and<br />

the PÉTÁV Ltd. (district heating). The energy sector companies employ a total<br />

of more than 4 thousand people, and, more than 1,800 employees directly in<br />

the city. The annual production value is nearly 55 billion, the sales is 139 billion<br />

HUF, respectively. This sector sale only for the domestic markets, and plays an<br />

important role of energy supplies in the region's economy. The operation<br />

provides employment for many SMEs, however, this sector won’t play a<br />

leading role or boost the local economy. Food, beverages and tobacco<br />

production ensure close to 40% of the annual production and 26.8% of total<br />

sales. Only 13.16% of the turnover came from abroad. According to the<br />

production data it is the strongest, but also the most vulnerable sector in Pécs.<br />

The sector indicators have deteriorated because of the negative trends of<br />

recent years (closing down the MIZO dairy company and the integration into<br />

the South-Pick Szeged Meat Co.). Marketing problems facing the American<br />

Tobacco BAT (the high rate of smuggled goods sold in our country), Pécs<br />

Brewery Co. (low market share and high production costs). We cannot<br />

expect positive change in the near future. This sector won’t play a leading<br />

role in the economy’s stimulation of the city and the region either.<br />

The machine industry provided the 20.9% of the total production value of the<br />

whole industrial production accounted for. This sector took part in the<br />

industrial sales by 16%. The export share within the sales was 85.33%,

espectively. The leading companies within the sector have a very important<br />

role in both the county and city life of Pécs. Primarily the fact that they<br />

provide jobs and regular income for nearly 6 thousand employees, and work<br />

for more than a hundred SMEs mainly in the service area. For those SMEs<br />

belonging to this sector only the Hauni Hungary Machinery Ltd. Provides gives<br />

supply orders. This kind of activity is an energizing effect for the economy, but<br />

today makes only a very small share of the industry's performance. The larger<br />

Elcoteq Hungary Ltd. doesn’t strive for creating such kind of supplying network<br />

with the local firms, instead of that it tries to solve all stages of the production<br />

in the plant itself, or within its own group.<br />

The city alongside with the competitive Pole Project’s planning identified<br />

three important sectors the environment industry, the health industry and<br />

creative industry. One of the most important sub-branches of the health<br />

industry is the biotechnology, which has an accredited cluster. In that cluster<br />

one can find spin-off companies from the university as well as private<br />

companies with significant export activities.<br />

Pole matrix (Source: PBKIK, 2010)

Pécs and South Trensdanubia, the pole of life quality<br />

34 Billion Ft<br />

investment so far in<br />

31 projects<br />

(140 MRD)<br />

R&D&I infrastructure<br />

Clusters<br />

Training ,<br />

learning<br />

Should be evaluated positively, however, that the Elcoteq Hungary Ltd.<br />

devotes more and more emphasis on product development, and has<br />

developed its own division, where more and more young engineers are able<br />

to find jobs.<br />

PTE clinic<br />

University of Kaposvár<br />

agricultural research institue<br />

University of<br />

Kaposv ár<br />

agricultural<br />

research institue<br />

PEIK<br />

BIBNet<br />

Therme<br />

Cluster<br />

PTE AOK<br />

PTE ET<br />

Healthindustry Environment industry Cultural industry<br />

Science<br />

Building<br />

Wine research I.<br />

RÉK<br />

TDM<br />

University of<br />

Kaposv ár<br />

Vocational<br />

training<br />

Beremend<br />

Mecsek -Dráva<br />

biomass<br />

Pannonlaser<br />

researchinstitute<br />

Building engineering<br />

cluster<br />

Knowledge Centre<br />

Creative Incubator<br />

House<br />

Environment<br />

industry<br />

cluster<br />

Creative<br />

Cluster<br />

Zsolnay Cultural<br />

Quarter<br />

Kodály Centre<br />

Ceramic<br />

Cluster<br />

PTE TTK PTE MK<br />

Vocational<br />

training<br />

Bikal ren aissance city<br />

Memorial Park in Mohács<br />

Mecsekextr ém<br />

Castle of Sikl ós<br />

Castle of Pécsvárad<br />

Castle of Szigetv ár<br />

In the field of non-metallic mineral products the Zsolnay Porcelain<br />

Manufactory is relevant. In this essay we are not going to deal with the<br />

company's financial and economic situation. The company's products, it’s<br />

reputation, tradition, and the industrial heritage and through the projects of<br />

the <strong>Europe</strong>an Capital of Culture in the near future it provides hopefully an<br />

important factor in the local economy.<br />

In summary, the industrial enterprises have an important role in the economy<br />

of Pécs and Baranya County, their energizing role, however minor. They are<br />

not considered classically innovative. The possibility of future development is<br />

to be searched rather at the present still not highly appreciated so called<br />

"novel" non-traditional sectors, which could improve significantly the<br />

population's quality of life, such as the environmental industry, health industry<br />

and cultural industry. Their relevance is clearly demonstrated by the

international trends, and the strategy for competitiveness 2020 of the EU<br />

(ec.europa.eu/eu2020)<br />

4.3 Cultural structure<br />

Considering the cultural sector we have to separate the civil, private, and the<br />

institutional sectors. The rate of the three special structural units characterizes<br />

the dynamism of the creative industry, which still could be characterized with<br />

the dominance of the institutional and civil sector. According to our survey<br />

790 company operate in the field of creative industry, which is still quite a low<br />

proportion (4,15% of the other branches). The big cultural infrastructures are<br />

operated by government or state institutions, which situation hasn’t been<br />

changed by the new institutions created through the ECC project. The<br />

creative enterprises are only small-scale suppliers to the institutions, which<br />

prevents the real development of the creative industry. At the analyses of a<br />

city’s creative economy in the past these subject were only marginal issues<br />

mentioned just as breakout points. In the 21st century we have to approach<br />

this subject with a different attitude. One cannot count on the governmental<br />

support that it is possible to get those cultural services for free or at a minimal<br />

cost. The marketing of the culture has started, and we have to recognize that<br />

the culture is not much different from any other goods in the market, that<br />

means the rules of the macroeconomic apply too. In the future – according<br />

to the excellent aptitudes – can become one of the most significant<br />

branches of the economic development of Pécs.<br />

5. The state of the private and the civil sector<br />

The skills knowledge and experience of the local cultural civil society actors is<br />

not sufficiently utilized. The civilian sector in particular is facing difficulties of<br />

sources and capacity, although that is a national-scale problem, still there is<br />

no suitable effort to highlight and support local, talented and worthy<br />

organizations.

- The NGOs further on have communication and infrastructural difficulties;<br />

therefore, they find it difficult to utilize their values, and multiplying them.<br />

- They don’t have a strong system of relationship, their collaborations are<br />

under motivated, promotion opportunities are limited, the absence of<br />

adequate knowledge of cultural values can be difficult to manage, and<br />

expose as a product.<br />

- Communication among the civil society organizations and cultural<br />

institutions is weak; there are duplications in certain sub-areas, whose<br />

demand would be qualitatively and quantitatively better satisfied by the<br />

civilians.<br />

- The region's civil society is rather diverse, including those found in the service<br />

of self-motivated and advocacy organizations. In May 2010 according to<br />

official figures of the CSO, 1,547 non-governmental organizations were<br />

established in Pécs one third of the registered ones were dealing with cultural-<br />

recreational activities. On the average approximately the number of non-<br />

profit organizations in Pécs is 9.8 per 1000 inhabitants.<br />

- The local non-governmental cultural sector in the underground is swelling<br />

with energy in almost all areas of arts and culture, the dedicated players are<br />

waiting only for a call to get invited and share experiences tasks and<br />

opportunities. Many of them have already turned to be professional, and<br />

able to work under pressure with high cost efficiency so the cooperation with<br />

them could bear strategic importance. Notable amateur orchestras: e.g.<br />

Mecsek Dance Ensemble, the Tanac Misina Dance Group, which are<br />

characterized by the efforts to preserve the Hungarian folk dance treasure<br />

and promote it’s achievements and further elaboration of the Hungarian folk<br />

culture, partly through modernization. Priorities: preserving values, and<br />

heritages and enforcement of the new values, as well as the city's cultural<br />

enrichment with the current supply of micro-programs. According to the<br />

database it can be stated that the number of social enterprises in the field of<br />

cultural services in Pécs are only 4 pcs.<br />

The turnover of one out of the four was between 51-300 million HUF; the rests<br />

had less than 20 million HUF. The largest organization employs between 5-9

people, the other three are one each respectively. 65 enterprises carry out<br />

publishing activity. All of them employed less than 50 people, in fact all but<br />

three were micro enterprises employing less than 10 people. Three companies<br />

have reached a turnover between 51-300 million HUF, seven fell under the<br />

category between 21 - 50 million HUF, and the others had fewer than 20<br />

million.<br />

The number of enterprises engaged in research and development is relatively<br />

high compared with other creative industries, currently operates 115 such<br />

companies. One of these sales exceed 300 million HUF, between 51 to 300<br />

million were six companies, another six realized between 21 to 50 million, while<br />

102 firms had less than 20 million HUF. On the headcount basis 3 companies<br />

belong to the small business category (the number of employees were<br />

between 10 to 19), the majority however micro-enterprises with only one<br />

employees, respectively.<br />

5.1 Definition of the creative industry<br />

The creativity and the exploitation of their culture-related industries, the<br />

expansion is not only the result of socio-cultural movements. It is also a<br />

strategy is strengthening <strong>Europe</strong>an competitiveness. New markets with new<br />

services are badly needed to provide development. It is no longer good<br />

enough to do something well, or do better than the competitors, now they<br />

must work together to gang up on groups that can withstand the growing<br />

competition.<br />

The creative industry is including 13 different sectors, which today is one of the<br />

world’s most dynamic industries. It contains lots of different branches like<br />

heritage, arts, leisure as well as web development. The defined "creative<br />

class" member is projected to soon exceed the number of workers in<br />

traditional industrial sectors. The importance of cultural industries, however,<br />

gives not only the number of jobs in a city, or even in the region, but also the<br />

percentage rate with it contributes to the economy's performance. Where<br />

the cultural industry is well developed, there is a higher level of quality of life, a<br />

greater ability to retain the workforce of the settlement, even the highly skilled

ones, and an ability to retain younger generations. The concept of cultural<br />

industry is a somewhat narrower definition then the creative industries’. The<br />

creative industry also implies that in the presence of an appropriate density of<br />

a particular locality or region it could create such a creative milieu, which in<br />

today's knowledge-based economy the prerequisite of the innovation, and<br />

therefore the means and guarantee of the region's ability to attract capital.<br />

Enterprises operating on the previously defined fields are usually categorized<br />

of the methodology based upon their business activities are as follows:<br />

Categories<br />

1 Arts, Crafts, Performing arts<br />

2 Film production, Cinema<br />

Journalism, News agencies,<br />

3 Publishing<br />

4 Museums, Expositions<br />

5 Cultural Trade<br />

6 Architecture<br />

7 Planning, design<br />

8 Advertising<br />

Software-, Interactive Leisure<br />

9 Development<br />

5.2 The position of the creative industry<br />

1. Table Subsectoral areas of the Creative Industry<br />

The most important goal of the creative industry is the strengthening of the<br />

income producing capability of the creative and cultural activities, to<br />

generate such creative industry processes which have innovative and

economic potential, which can result the quality development of the service<br />

systems through the economy generating effects.<br />

TOLERANCE: The visibility and recognition of the creative industry with the<br />

wide range of the society and other developing and/or driving force industrial<br />

branches.<br />

TECHNOLOGY: Introducing the utilization and recycling option namely the<br />

connection of the creative industry to the industrial production,<br />

biotechnology, environmental projects, communication and financial<br />

services.<br />

KNOWLEDGE: Operation of a regularly communicating and cooperating<br />

network, which is able to draw up the common interests, and to decrease the<br />

insensible inside market competition. Building up systems and its transfers.<br />

It has to be introduced into the cultural industry the elsewhere well-<br />

established consumer oriented market methods.<br />

CLUSTERING: Our cluster is the first such creative industry coordinating<br />

organization, which was established by government support through the<br />

Baross project, financed by the DDRFÜ and the NKTH in 2006.<br />

• The mission of the cluster is that it could become the management of<br />

the change of paradigm where it could achieve the more effective<br />

application of the creative industrial capacities and the export of their<br />

products and services. According the surveys on the average 10-12<br />

EURO (Pécs University, 2007) equals to the local purchasing power and<br />

this as a demand isn’t balanced with the supply on the other side. The<br />

local market is significantly distorted by those concerts and<br />

performances which are highly supported by the state or government.<br />

The Southern Transdanubian Cultural Industrial Cluster manages and<br />

generates several forward looking and creative industrial cooperation.<br />

Organizational -<br />

methodical<br />

Market Creative<br />

Industrial<br />

Cluster members<br />

Joint Project Organizing<br />

Scientific – Innovation<br />

related

Southern<br />

Transdanubian Cultural<br />

Industrial Cluster<br />

Southern Folklore<br />

Association<br />

Tourist Cluster of<br />

Szigetvár<br />

Equestrian Cluster of<br />

Siklós<br />

Regional media subbranch<br />

and the<br />

adjoining Film Fund<br />

ECC expert’s materials<br />

and advising activities<br />

Dombóvár Cultural<br />

Strategy<br />

Conferences and<br />

Events<br />

Communications<br />

platform<br />

Pécs Lexicon Film Fund<br />

CULTourist Pécs Registered projects<br />

Zsolnay Cafe Cluster organization<br />

methods<br />

Organizing<br />

Conferences, software<br />

development<br />

University courses<br />

Accredited special<br />

curriculums<br />

Sub-sectors surveys,<br />

Databases<br />

From the creative point of you the national situation isn’t too promising. At the<br />

present even the <strong>Central</strong> Statistic Office doesn’t collect data, which is<br />

appropriate for a creative industrial survey, the latest data is from 2002. The<br />

latest data are supplied by the GFKI (according to the CSO data) and by the<br />

Cultural Innovation Competence Centre (based on TEÁOR) – locally.<br />

According to the CSO data the summarized added value of the creative<br />

industries equals 987 billions of HUF in 2002, which was the 6,7% of the GDP.<br />

The 7% of total number of employment in the country comes from the<br />

creative industries. The national situation is equals to the Capital’s<br />

concentration though, the provincial creative industrial bases producing a<br />

very low figure, and contribute to the GDP and to the employment rate<br />

marginally. In the ECHO magazine at the issue of October 2005 Mr. Zsolt<br />

Szokolay an expert of the field examined the number of the people<br />

employed in the creative sector and its position. According to his survey<br />

approximately 4000 persons are engaged in the Creative sector at the time of<br />

writing. The concentration of the creative class – which is so important for the<br />

development of the creative industry – is rather low in the Southern<br />

Transdanubia, and the added value is lower than the national average.

Therefore the most important motivating factor for the colleagues of the<br />

Southern Transdanubia Cultural Industrial Cluster is the enhancement of the<br />

competitiveness of the Region and the development of knowledge based<br />

creative industry.<br />

5.3 The creative industry in Pécs according to statistical data<br />

The cultural industry’s current state in the city of Pécs is presented on the basis<br />

of statistical data, which is an important complement to methods based on<br />

qualitative analysis. The full analysis was performed of the latest available<br />

2007-2008's period. The number of enterprises operating in Pécs and their<br />

classification are found in the 2. Table below:<br />

Number of registered enterprises<br />

Number of operating<br />

enterprises<br />

Industry,<br />

Out of<br />

Out of<br />

Agriculture Building Service<br />

the Per<br />

the Per<br />

Industry<br />

Total total, thousand Total total, thousand<br />

Branch<br />

joint inhabitants<br />

venture<br />

joint inhabitants<br />

venture<br />

2008 2007<br />

1 348 2 710 21 618 25 676 11 272 164 13 622 7 653 87<br />

2. Table Number of enterprises in Pécs (CSO)<br />

25,676 enterprises were registered in the city in 2008, of which 11,272 worked<br />

in the form of joint venture. The operating firms in 2007 according to the<br />

figures are slightly more than half of all enterprises (53%).<br />

To determine the magnitude of the operating creative industry in Pécs we<br />

acted in accordance with the methodology set out in subsection of 5.1. We<br />

have been acquired from the <strong>Central</strong> Statistical Office (CSO) the public

ecords of those companies, which are classified as creative industries<br />

according to classification of sub branches 1.<br />

The database contains the data of 790 company / institution. For the<br />

companies temporarily out of business or don’t operating ones was used to<br />

detect the expired public debts, so surely the number of operating businesses<br />

in the sector 565 pcs.<br />

The number of industrial enterprises in the creative sector compared to all<br />

active companies in the city we have got the following figure:<br />

5. Figure The rate of the businesses operating in the creative industry in Pécs (CICC<br />

Association Data)<br />

The rate of creative businesses operating in the City is approximately 4% to,<br />

but it is absolutely necessary to emphasize that among the creative<br />

businesses is much higher (71.5%) the proportion of still operating enterprises<br />

then as it is generally experienced in other sectors (53%).<br />

The number of examined businesses divided to sub-sectors is as follows:<br />

1 The analyses cannot be considered as complete and reliable according to the following methodological problem<br />

– the classification could be determined due to the reported and possibly not the real activity – but it still could<br />

be extremely useful to present trends and order of magnitudes. The database used to the analyses can be found in<br />

the appendix section.

6. Figure The division of the particular activities among creative industry businesses (CICC<br />

Association Data)<br />

Most of the registered companies operating in the field of the arts, performing<br />

arts, but the feature of this sub-sector is that most actors working on his/her<br />

own as individuals, so under this category the lowest the proportion of the<br />

corporations, only 40.2%. It is also a high the number of architecture firms, and<br />

the lowest registered businesses one can find in the film production, cultural<br />

trade and software development’s territory.<br />

In the next table we present the form or type of enterprises in the sub-sectors<br />

respectively:<br />

Arts,<br />

Performing<br />

Arts<br />

Film<br />

production,<br />

Cinema<br />

Sub-sector<br />

Unlimited<br />

Partnership<br />

Types of Businesses<br />

Ltd. Chamber, Private<br />

cooperativeEnterprise<br />

Joint stock<br />

company<br />

State, Local<br />

government<br />

Institution<br />

Total<br />

Frequency 76 15 134 1 226<br />

Distribution 33,6% 6,6% 59,3% ,4% 100,0%<br />

Frequency 18 18 1 1 38<br />

Distribution 47,4% 47,4% 2,6% 2,6% 100,0%

Journalism,<br />

News<br />

agencies,<br />

Publishing<br />

Museums,<br />

Expositions<br />

Cultural Trade<br />

Architecture<br />

Planning,<br />

Design<br />

Frequency 43 48 2 1 94<br />

Distribution 45,7% 51,1% 2,1% 1,1% 100,0%<br />

Frequency 20 7 1 30 58<br />

Distribution 34,5% 12,1% 1,7% 51,7% 100,0%<br />

Frequency 14 6 2 22<br />

Distribution 63,6% 27,3% 9,1% 100,0%<br />

Frequency 70 117 2 189<br />

Distribution 37,0% 61,9% 1,1% 100,0%<br />

Frequency 30 53 1 1 85<br />

Distribution 35,3% 62,4% 1,2% 1,2% 100,0%<br />

Advertisement Frequency 31 36 67<br />

Distribution 46,3% 53,7% 100,0%<br />

Software-,<br />

Interactive<br />

leisure<br />

development<br />

Frequency 2 8 1 11<br />

Distribution 18,2% 72,7% 9,1% 100,0%<br />

Frequency 304 308 1 140 7 30 790<br />

Distribution 38,5% 39,0% ,1% 17,7% ,9% 3,8% 100,0%<br />

3. Table Type of businesses in the creative industry in Pécs (CICC Association Data)<br />

The most popular form of business in the arts, performing arts category is the<br />

private enterprises, or the unlimited Partnership form, which are the<br />

characteristics of industries where the number of persons employed are small<br />

(or self-employment is expressly made), respectively, there is no specific cost<br />

of production. Local museums, exhibitions, are typically operating as state, or<br />

local governmental institutions.Further examine the type of businesses we can<br />

state that mainly in the sectors of Software, and Leisure development, the<br />

Design, and Architecture exist more business activities, and higher<br />

employment.<br />

Reviewing the economic data the following trend can be established (See 7.<br />

figure!)

7. Figure Trends of industrial statistic data 2007-2009 (Data in Thousand HUF (CICC Association<br />

Data))<br />

The shock caused by the economic crisis of course can be detected in the<br />

creative industries primarily (we will see later) in the field of architecture. The<br />

industrial enterprises' capital reserves lose weight significantly, but after the<br />

more than 50% decrease in sales in 2008. Year, in 2009, almost 20% increase<br />

observed.<br />

8. Figure Trends of average employment in the creative industry of Pecs 2007-2008 (ps) (CICC<br />

Association Data)

In accordance with the foregoing a tendency to decrease in employment in<br />

2008 could be traced as well, the industry's average employment number,<br />

which is in the year of 2009th already shows an increase, still won’t reach the<br />

level of 2007.<br />

9. Figure Distribution of creative industry businesses by sales categories (CICC Association<br />

Data)<br />

The 9 th figure chart shows that the vast majority of industrial enterprises are<br />

belong to the category under 20 million annual revenue levels. It can be<br />

evaluated as a positive result that almost every tenth firm HUF generates sales<br />

of between 20 million and 50 million HUF annually, 3.6% of them even more.<br />

Over 300 million revenue there is only one company the Zsolnay Porcelain<br />

Manufactory.<br />

5.4 The situation of the creative industry in the selected sub-sector<br />

Out of sub-sectors presented in the previous section I would emphasize three,<br />

one each of the largest, the medium and the smallest proportional operating<br />

areas, covering about two thirds of the whole business sector.

10. Figure Rate of the priority sub-sectors (CICC Association Data)<br />

28% of the creative industrial firms in Pécs have public debt. (See Figure 8!)<br />

Broken down it into the examined three sub-area, we can see that the film<br />

production and film companies are under this ratio, while the journalism, news

agencies, publishing sub brunch is rather in deep trouble.<br />

11. Figure The rate of businesses with expired public dept ratio<br />

Finally, let us examine the main economic indicators of the sub-sectors in the<br />

following table:<br />

Cultural Industry<br />

Sector<br />

Film production,<br />

Cinema<br />

Journalism, News<br />

agencies,<br />

Publishing<br />

Equity Equity Revenues Revenues<br />

(2007) (2008) (2007) (2008)<br />

16.959 17.707 21.608 20.555<br />

Number of<br />

employees<br />

20.048 19.188 40.231 41.413 5,83<br />

Architecture 308.061 63.861 137.503 29.743 3,75<br />

Average total 198.708 47.147 99.993 34.091 4,64<br />

4. Table The main economy indicators in the priority sub-sectors (2007-2008)<br />

We have seen that the architecture composed the quarter of all creative<br />

industrial enterprises in 2007; both equity and magnitude of net sales<br />

exceeded the average size of the enterprises in the other two sub-sector.<br />

Since the economic crisis affected most right that sub-sector - due to the loss

of real estate development and declined investment demand - so clearly,<br />

the average turnover dropped more than 100 million HUF and the companies<br />

used up their reserves (this indicates 80% decline of the equity). The other two<br />

sub-sectors, however, kept itself in spite of the crisis, businesses linked to the<br />

film industry realised an average of 20 million, the media-related companies<br />

could make even double of that revenue. It is also worth to highlight that the<br />

highest employment readiness we find in journalism, news, and publishing<br />

field!<br />

One local literary magazine - at national level is also important -, formulated<br />

the following difficulties, and certainty for future opportunities during the<br />

interview:<br />

Uncertain. There are fears of what will be after the ECC, because these<br />

innovative ideas and proposals could be implemented without exemption<br />

from tendering sources. It is a major challenge to the MIH (House of Arts and<br />

Literature) that how it can operate at the same level after the ECC.<br />

� The most stable source is the public support; the magazine has the most<br />

respect and works best there too.<br />

� The cooperation with the other actors of the cultural industry. E.g.<br />

cooperation with the “Trafik”, “Kultúrkert”(Culture Garden), Sophiane<br />

Heritage Non-profit Ltd. for, synergies are created, everybody brings<br />

their own audience<br />

� The Zsolnay Culture Quarter can hold a positive contribution, but still<br />

there is a certain distancing, even mistrust<br />

� Advertising and marketing activity is weak<br />

� In the PR, the public feedback does not work properly<br />

� The professionalism, and outstanding dedication of the staff<br />

� Institutional diversity, for example House of Arts and Culture doesn’t<br />

exist elsewhere in Hungary<br />

� Serious literary tradition

5.5 Summary<br />

During the interviews with our stakeholders we put four such closed questions<br />

to the interviewees, in which we asked them to set out the allegations on a<br />

scale of assessment of one to five, where the five meant the most favourable

outcome. The result are shown in the chart based on average values of some<br />

of the responses 2:<br />

12. Figure The average values given by the interviewees on the questions<br />

It is clear that the respondents considered the cultural situation of Pécs the<br />

best (3,4) and the city's economic situation is considered the worst (2,1). At<br />

the two responses the two standard deviation values are also low; it is the<br />

unanimous opinion of the respondents confirmed. The frequency and<br />

efficiency of the cooperation within the cultural and creative industries were<br />

considered medium (3) by our interviewees. It has resulted a very mixed<br />

outcome that the respondents’ professional activities or project how fit to the<br />

cultural season program series or how much support it has got through it. In<br />

any case, the given a 2.8-value rather damning nature of this area.<br />

Overall, we can make up very mixed picture in the separately tested areas,<br />

because regarding the sales revenue, employment and economic stability<br />

2 The statistical analyses was based on the 20 questionnaires that means it cannot be viewed as a representational<br />

assay. The questionnaire used during the interviews and the list of the organizations which were took part in the<br />

survey can be found in the appendix section.

the media-related companies have performed well, this very same group has<br />

the highest tax debt. The architectural firms’ turnover and reserves have fallen<br />

significantly due to the crisis, while the film production companies may be<br />

subject to a small number of significant changes in their operation which is<br />

hardly ca be detected.<br />

It can be emphasized in the field of employment and competitiveness the<br />

software, and interactive leisure (game) development, design and<br />

advertising activities, but these are the overalls a small size of scale.

6. The state of the public sector<br />

6.1 The definition of the public sector<br />

Many people think that to distinguish between "State" and "non-state" cultural<br />

organizations are artificial and the discrimination is held purely on formal<br />

grounds. According to the legal background governmental financial support<br />

involves the following activities: museum, archives, and theatrical activities.<br />

These institutions are part of the national cultural infrastructure. The rate of the<br />

governmental support varies with genre and institutions, but always<br />

proportional with the local (county and/or municipal) support.<br />

In our analysis, those organizations are considered to belonging to the public<br />

sector’s , which are entirely or predominantly public and / or activity funded<br />

by local government sources.<br />

6.2 The position of the public sector<br />

In Pécs the local municipality operates the cultural Institutions though<br />

continuously increasing income-generating obligations. Their operation is at<br />

the present a serious burden on the already ailing local authorities and other<br />

major threat is the operation of the new institutions established during the<br />

ECC project. The city received government support promises at the start of<br />

ECC developments for the necessary operation of the institutions (national<br />

institutional status), but unfortunately is still needed to lobby to redeem the<br />

promises. So here we can expect further significant shifts in the expected rate.<br />

6.3 The size of the public sector<br />

It is quite a difficult methodical task to determine the size of the public sector,<br />

the financing structure is difficult to comprehend, but typically the museums<br />

and in press area active institutions and organizations are run (indirectly) by<br />

the government or local self-government. The vast majority, over 80% of the<br />

staff number and revenue of museums are belonging to the public sector<br />

alone.

The state intervention and assistance are mostly palpable by the program<br />

funding of the ECC. After completing the cultural season however, the<br />

central government resources are going to fall back and the maintenance<br />

costs will fall to the local government. Thus, in the future we can count on a<br />

significant shift of rate. Pécs, despite the difficulties, can realize a significant<br />

profit by the end of the 2010 year, as it succeeded to bring together and<br />

coordinate many attractive and colourful performances, and programs to<br />

the city. It is also noteworthy because the economic crisis is felt in a very<br />

eloquent way in the <strong>Europe</strong>an Capital of Culture success rate. The capital of<br />

Lithuania, Vilnius was deeply affected by the crisis despite the series of events;<br />

the revenue from cultural tourism dropped by 15 percent drop while another<br />

<strong>Europe</strong>an Capital of Culture 2009, Linz, Austria could realize only slightly, 11.4<br />

percent increase in hotel room bookings during the ECC year. The Hungarian<br />

experts say the signs are favourable for Pécs, and it is conceivable that results<br />

of the Hungarian city even surpass Linz’s.<br />

6.4The supported activities of the public sector<br />

The biggest problem regarding the cultural events according to one of our<br />

interviewee a contemporary artist of Pécs, that there is a sort of dilettantism<br />

from the part of leadership, they don’t dare not undertake true artistic events,<br />

and partly the decisions are made from above by people who have no<br />

serious artistic background, so they don’t even has any credibility from the<br />

professionals. The standard of the programs are only reached the level of the<br />

junk mass media. With that mentality we won’t be taken seriously in any<br />

national and especially in international forums. Moreover, without adequate<br />

infrastructure framework, we cannot appear in the <strong>Europe</strong>an audience, as<br />

there are no large spaces where with high-quality events, exhibitions can be<br />

held. It appears that the city waived the fine arts, because it carries little<br />

value for the politics, does not provide sufficient opportunity for the politicians<br />

to appear in public. Although Pécs is a cultural stronghold partly because,<br />