Banking - Yojana

Banking - Yojana

Banking - Yojana

- TAGS

- banking

- yojana

- yojana.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Generated by PDFKit.NET Evaluation<br />

Structure of 'WorldInsurance<br />

P V Nishanth and Anindita Mitra<br />

The insurance. industry has shown signs of development<br />

consequent to economic growth' including industrial and<br />

other activities of world economies~However, the spread<br />

and development of the insurance business is dominated<br />

by afew industrially developed economies. It is necessary<br />

to popularize insurance in countries like India, China and<br />

Africa wher~most of the world ~poor inhabit.<br />

THE WORLD insurance<br />

. industry recorded growth<br />

since it was founded. The<br />

earliest reference to insurance was<br />

found in Babyionia, Greece and<br />

Rome. Since then there has been<br />

a rapid growth in total insurance<br />

business throughout the world. It<br />

wasdeveloped and spread its wings<br />

widely in the most developed<br />

countries of the world, and now it<br />

has been observed that the<br />

awareness of insurance has spread<br />

to the developing countries as well<br />

who also contribute to the world<br />

demand for insurance. Since the<br />

less developed coun tries have<br />

limited development of markets<br />

for saving, credit and insurance<br />

and heavy production risks are<br />

involved in the major activity of<br />

agriculture, these take an active<br />

role in banking and insurance.<br />

America and Europe together<br />

contribute more than 90 per cent<br />

of the total wo'rld insurance<br />

business in terms of premium<br />

in'come. Life insurance business<br />

accounts for the bulk of the total<br />

insurance business, 79 per cent in<br />

Asia, 45 percent in Latin America<br />

and 40 percent in other<br />

continents. Thus average life<br />

insurance business (US $1321<br />

billion) was65 per cen t of the total<br />

insurance business in the world in<br />

1999. The Asian life market<br />

recorded 7.5 percent-real growth<br />

and constituted 43.59 per cent of<br />

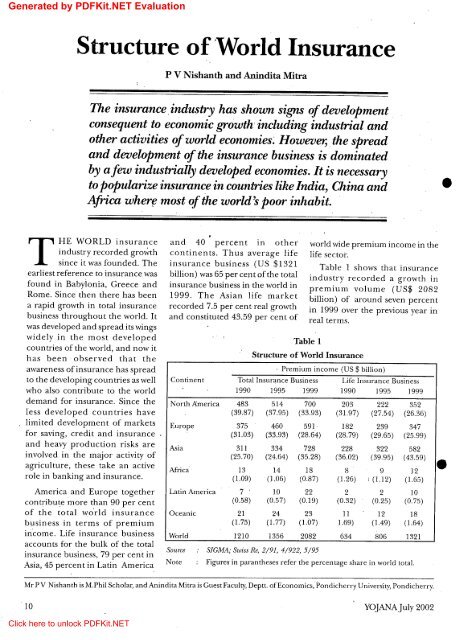

Table 1<br />

Structure of World Insurance<br />

world wide premium income in the<br />

life sector.<br />

Table 1 shows that insurance<br />

industry recorded a growth in<br />

premium volume (US$ 2082<br />

billion) of around seven percent<br />

in 1999 over the previous year in<br />

real terms.<br />

, Premium income (US $ billion)<br />

Continent Total Insurance Business Life Insurance Business<br />

~<br />

1990 1995 1999 1990 1995 1999<br />

North .America 483 514 700 203 222 352<br />

(39.87) (37.95) (33.93) (31.97) (27.54) (26.36)<br />

Europe 375 460 591 182 239 347<br />

(31.03) (33.93) (28.64) (28.79) (29.65) (25.99)<br />

Asia 311 334 728 228 322 582<br />

(25.70) (24.64) (35.28) (36.02) (39.95) (43.59)<br />

Africa 13 14 18 8 9 12<br />

( 1.09) 0.06) (0.87) (1.26) : (1.12) (1.65 )<br />

Latin America 7 . 10 22 2 2 10<br />

(0.58) (0.57) (0.19) (0.32) (0.25) (0.75)<br />

Oceanic 21 24 23 11 12 18<br />

(1.75) (1. 77) (1.07) 1.69) (1.49) (1.64)<br />

World 1210 1356 2082 634 806 1321<br />

Source<br />

Note<br />

SIGMA; Swiss Re, 2/91, 4/922,5/95<br />

Figures in parantheses refer the percentage share in world total.<br />

Mr PV Nishanth is M.Phi! Scholar, and Anindita Mitra is Guest Faculty, Deptt. ofEconomics,Pondicherry University, Pondicherry.<br />

10 YOJANAJuly2002<br />

Click here to unlock PDFKit.NET<br />

•<br />

•