Banking - Yojana

Banking - Yojana

Banking - Yojana

- TAGS

- banking

- yojana

- yojana.gov.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Generated by PDFKit.NET Evaluation<br />

operated, feature highly<br />

concentrated markets since they<br />

serve consumer's interest with<br />

minimum risk.<br />

Table 5 gives a clear picture of<br />

the market share of various<br />

countries with respect to life<br />

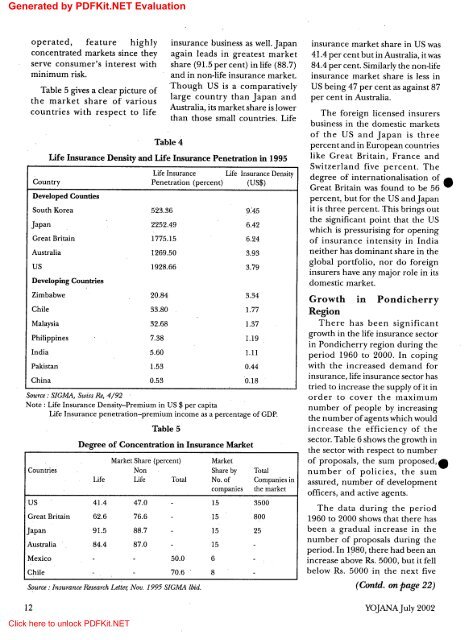

Table 4<br />

Life Insurance Density and Life Insurance Penetration in 1995<br />

Source: SIGMA, Swiss Re,4/92<br />

Note: Life Insurance Density-Premium in US $ per capita<br />

Life Insurance penetration-premium income as a percentage of GDP.<br />

Source: Insurance Research Letter; Nov. 1995 SIGMA [bid.<br />

insurance business as well. japan<br />

again leads in greatest market<br />

share (91.5 per cent) in life (88.7)<br />

and in non-life insurance market.<br />

Though US is a comparatively<br />

large country than japan and<br />

Australia, its market share is lower<br />

than those small countries. Life<br />

Life Insurance Life Insurance Density<br />

Country Penetration (percent) (US$)<br />

Developed Counties<br />

South Korea 523.36 9.'45<br />

Japan 2252.49 6.42<br />

Great Britain 1775.15 6.24<br />

Australia 1269.50 3.93<br />

US 1928.66 3.79<br />

Developing Countries<br />

Zimbabwe 20.84 3.34<br />

Chile 33.80 1.77<br />

Malaysia 32.68 1.37<br />

Philippines 7.38 1.19<br />

India 5.60 1.11<br />

Pakistan 1.53 0.44<br />

China 0.53 0.18<br />

Countries<br />

Table 5<br />

Degree of Concentration in Insurance Market<br />

Market Share (percent)<br />

Non<br />

Life Life Total<br />

US 41.4 47.0<br />

Great Britain 62.6 76.6<br />

Japan 91.5 88.7<br />

Australia 84.4 87.0<br />

Mexico 50.0<br />

Chile 70.6<br />

Market:<br />

Share by Total<br />

No. of Companies in<br />

companies the market<br />

15 3500<br />

15 800<br />

15 25<br />

15<br />

6<br />

8<br />

insurance market share in US was<br />

41.4 per cent but in Australia, it was<br />

84.4 per cent. Similarly the non-life<br />

insurance market share is less in<br />

US being 47 per cent as against 87<br />

per cent in Australia.<br />

The foreign licensed insurers<br />

business in the domestic markets<br />

of the US and japan is three<br />

percent and in European countries<br />

like Great Britain, France and<br />

Switzerland five percent. The<br />

degree of internationalisation of •<br />

Great Britain was found to be 56<br />

percent, but for the US and japan<br />

it is three percent. This brings out<br />

the significant point that the US<br />

which is pressurising for opening<br />

of insurance intensity in India<br />

neither has dominant share in the<br />

global portfolio, nor do foreign<br />

insurers have any major role in its<br />

domestic market.<br />

Growth in Pondicherry<br />

Region<br />

There has been significant<br />

growth in the life insurance sector<br />

in Pondicherry region during the<br />

period 1960 to 2000. In coping<br />

with the increased demand for<br />

insurance, life insurance sector has<br />

tried to increase the supply of it in<br />

order to cover the maximum<br />

number of people by increasing<br />

the number of agents which would<br />

increase the efficiency of the<br />

sector. Table 6 shows the growth in<br />

the sector with respect to number<br />

of proposals, the sum proposed,.<br />

number of policies, the sum<br />

assured, number of development<br />

officers, and active agents.<br />

The data during the period<br />

1960 to 2000 shows that there has<br />

been a gradual increase in the<br />

number of proposals during the<br />

period. In 1~80, there had been an<br />

increase above Rs. 5000, but it fell<br />

below Rs. 5000 iQ the next five<br />

(Contd. on page 22)<br />

12 YOJANAJuly 2002<br />

Click here to unlock PDFKit.NET