Activities (1,3 MB) - Colruyt Group

Activities (1,3 MB) - Colruyt Group

Activities (1,3 MB) - Colruyt Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

102<br />

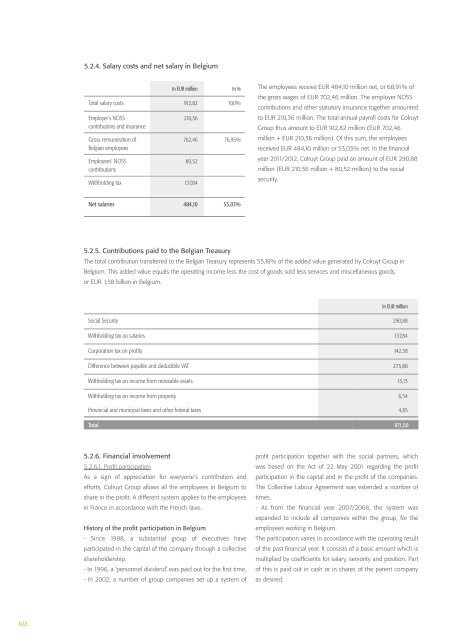

5.2.4. Salary costs and net salary in Belgium<br />

In EUR million In %<br />

Total salary costs 912,82 100%<br />

Employer’s NOSS<br />

contributions and insurance<br />

Gross remuneration of<br />

Belgian employees<br />

Employees’ NOSS<br />

contributions<br />

210,36<br />

702,46 76,95%<br />

80,52<br />

Withholding tax 137,84<br />

Net salaries 484,10 53,03%<br />

The employees receive EUR 484,10 million net, or 68,91% of<br />

the gross wages of EUR 702,46 million. The employer NOSS<br />

contributions and other statutory insurance together amounted<br />

to EUR 210,36 million. The total annual payroll costs for <strong>Colruyt</strong><br />

<strong>Group</strong> thus amount to EUR 912,82 million (EUR 702,46<br />

million + EUR 210,36 million). Of this sum, the employees<br />

received EUR 484,10 million or 53,03% net. In the financial<br />

year 2011/2012, <strong>Colruyt</strong> <strong>Group</strong> paid an amount of EUR 290,88<br />

million (EUR 210,36 million + 80,52 million) to the social<br />

security.<br />

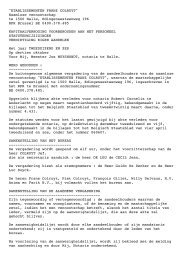

5.2.5. Contributions paid to the Belgian Treasury<br />

The total contribution transferred to the Belgian Treasury represents 55,18% of the added value generated by <strong>Colruyt</strong> <strong>Group</strong> in<br />

Belgium. This added value equals the operating income less the cost of goods sold less services and miscellaneous goods,<br />

or EUR 1,58 billion in Belgium.<br />

In EUR million<br />

Social Security 290,88<br />

Withholding tax on salaries 137,84<br />

Corporation tax on profits 142,38<br />

Difference between payable and deductible VAT 275,88<br />

Withholding tax on income from moveable assets 13,13<br />

Withholding tax on income from property 6,54<br />

Provincial and municipal taxes and other federal taxes 4,85<br />

Total 871,50<br />

5.2.6. Financial involvement<br />

5.2.6.1. Profit participation<br />

As a sign of appreciation for everyone’s contribution and<br />

efforts, <strong>Colruyt</strong> <strong>Group</strong> allows all the employees in Belgium to<br />

share in the profit. A different system applies to the employees<br />

in France in accordance with the French laws.<br />

History of the profit participation in Belgium<br />

- Since 1988, a substantial group of executives have<br />

participated in the capital of the company through a collective<br />

shareholdership.<br />

- In 1996, a ‘personnel dividend’ was paid out for the first time.<br />

- In 2002, a number of group companies set up a system of<br />

profit participation together with the social partners, which<br />

was based on the Act of 22 May 2001 regarding the profit<br />

participation in the capital and in the profit of the companies.<br />

The Collective Labour Agreement was extended a number of<br />

times.<br />

- As from the financial year 2007/2008, the system was<br />

expanded to include all companies within the group, for the<br />

employees working in Belgium.<br />

The participation varies in accordance with the operating result<br />

of the past financial year. It consists of a basic amount which is<br />

multiplied by coefficients for salary, seniority and position. Part<br />

of this is paid out in cash or in shares of the parent company<br />

as desired.