Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ohio Public Employees Retirement System<br />

<strong>2011</strong> Annual <strong>Investment</strong> <strong>Plan</strong><br />

Expected Asset Growth<br />

Defined Contribution Fund<br />

Since its inception on January 2, 2003 the Defined Contribution Fund’s assets have grown<br />

to $393 million. For the year through August 31, asset growth has been $33 million.<br />

Future growth of the Defined Contribution Fund assets is expected to be slightly above<br />

historical averages due to the addition of nearly 2,000 new participants each year.<br />

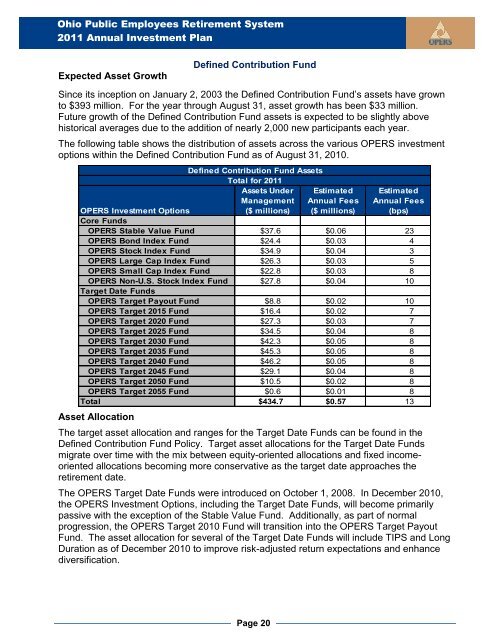

The following table shows the distribution of assets across the various <strong>OPERS</strong> investment<br />

options within the Defined Contribution Fund as of August 31, 2010.<br />

<strong>OPERS</strong> <strong>Investment</strong> Options<br />

Defined Contribution Fund Assets<br />

Total for <strong>2011</strong><br />

Assets Under<br />

Management<br />

($ millions)<br />

Page 20<br />

Estimated<br />

Annual Fees<br />

($ millions)<br />

Estimated<br />

Annual Fees<br />

(bps)<br />

Core Funds<br />

<strong>OPERS</strong> Stable Value Fund $37.6 $0.06 23<br />

<strong>OPERS</strong> Bond Index Fund $24.4 $0.03 4<br />

<strong>OPERS</strong> Stock Index Fund $34.9 $0.04 3<br />

<strong>OPERS</strong> Large Cap Index Fund $26.3 $0.03 5<br />

<strong>OPERS</strong> Small Cap Index Fund $22.8 $0.03 8<br />

<strong>OPERS</strong> Non-U.S. Stock Index Fund $27.8 $0.04 10<br />

Target Date Funds<br />

<strong>OPERS</strong> Target Payout Fund $8.8 $0.02 10<br />

<strong>OPERS</strong> Target 2015 Fund $16.4 $0.02 7<br />

<strong>OPERS</strong> Target 2020 Fund $27.3 $0.03 7<br />

<strong>OPERS</strong> Target 2025 Fund $34.5 $0.04 8<br />

<strong>OPERS</strong> Target 2030 Fund $42.3 $0.05 8<br />

<strong>OPERS</strong> Target 2035 Fund $45.3 $0.05 8<br />

<strong>OPERS</strong> Target 2040 Fund $46.2 $0.05 8<br />

<strong>OPERS</strong> Target 2045 Fund $29.1 $0.04 8<br />

<strong>OPERS</strong> Target 2050 Fund $10.5 $0.02 8<br />

<strong>OPERS</strong> Target 2055 Fund $0.6 $0.01 8<br />

Total $434.7 $0.57 13<br />

Asset Allocation<br />

The target asset allocation and ranges for the Target Date Funds can be found in the<br />

Defined Contribution Fund Policy. Target asset allocations for the Target Date Funds<br />

migrate over time with the mix between equity-oriented allocations and fixed incomeoriented<br />

allocations becoming more conservative as the target date approaches the<br />

retirement date.<br />

The <strong>OPERS</strong> Target Date Funds were introduced on October 1, 2008. In December 2010,<br />

the <strong>OPERS</strong> <strong>Investment</strong> Options, including the Target Date Funds, will become primarily<br />

passive with the exception of the Stable Value Fund. Additionally, as part of normal<br />

progression, the <strong>OPERS</strong> Target 2010 Fund will transition into the <strong>OPERS</strong> Target Payout<br />

Fund. The asset allocation for several of the Target Date Funds will include TIPS and Long<br />

Duration as of December 2010 to improve risk-adjusted return expectations and enhance<br />

diversification.