Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ohio Public Employees Retirement System<br />

<strong>2011</strong> Annual <strong>Investment</strong> <strong>Plan</strong><br />

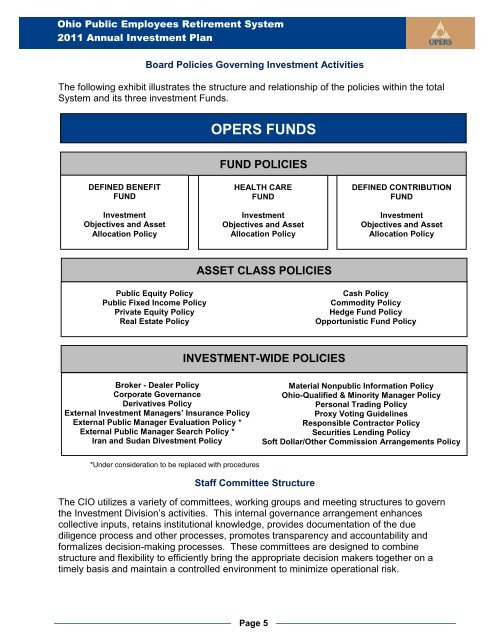

Board Policies Governing <strong>Investment</strong> Activities<br />

The following exhibit illustrates the structure and relationship of the policies within the total<br />

System and its three investment Funds.<br />

DEFINED BENEFIT<br />

FUND<br />

<strong>Investment</strong><br />

Objectives and Asset<br />

Allocation Policy<br />

Public Equity Policy<br />

Public Fixed Income Policy<br />

Private Equity Policy<br />

Real Estate Policy<br />

Broker - Dealer Policy<br />

Corporate Governance<br />

Derivatives Policy<br />

External <strong>Investment</strong> Managers’ Insurance Policy<br />

External Public Manager Evaluation Policy *<br />

External Public Manager Search Policy *<br />

Iran and Sudan Divestment Policy<br />

*Under consideration to be replaced with procedures<br />

<strong>OPERS</strong> FUNDS<br />

FUND POLICIES<br />

HEALTH CARE<br />

FUND<br />

<strong>Investment</strong><br />

Objectives and Asset<br />

Allocation Policy<br />

ASSET CLASS POLICIES<br />

INVESTMENT-WIDE POLICIES<br />

Staff Committee Structure<br />

The CIO utilizes a variety of committees, working groups and meeting structures to govern<br />

the <strong>Investment</strong> Division’s activities. This internal governance arrangement enhances<br />

collective inputs, retains institutional knowledge, provides documentation of the due<br />

diligence process and other processes, promotes transparency and accountability and<br />

formalizes decision-making processes. These committees are designed to combine<br />

structure and flexibility to efficiently bring the appropriate decision makers together on a<br />

timely basis and maintain a controlled environment to minimize operational risk.<br />

Page 5<br />

DEFINED CONTRIBUTION<br />

FUND<br />

<strong>Investment</strong><br />

Objectives and Asset<br />

Allocation Policy<br />

Cash Policy<br />

Commodity Policy<br />

Hedge Fund Policy<br />

Opportunistic Fund Policy<br />

Material Nonpublic Information Policy<br />

Ohio-Qualified & Minority Manager Policy<br />

Personal Trading Policy<br />

Proxy Voting Guidelines<br />

Responsible Contractor Policy<br />

Securities Lending Policy<br />

Soft Dollar/Other Commission Arrangements Policy