Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Investment Plan 2011 - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ohio Public Employees Retirement System<br />

<strong>2011</strong> Annual <strong>Investment</strong> <strong>Plan</strong><br />

United States<br />

Although clearly improved in the last 18 months, the US economy still faces many<br />

headwinds.<br />

� The biggest impediment to a stronger recovery is the anemic housing market. Just<br />

about every measure of the market—housing starts, sales, inventories, foreclosures—<br />

shows a market with profound problems. Housing prices stopped falling in 2009, but<br />

have stalled in the last few months. A strong housing market is one of the hallmarks of<br />

post-WWII recoveries. We do not expect the housing market to improve much in <strong>2011</strong>.<br />

� Restrained consumption growth. Household savings rates have increased to 6.0%, a<br />

reasonable level, but other measures are not encouraging. Net Worth is still well below<br />

the peak in 2007 and remains at 2004 levels (even worse in inflation-adjusted terms).<br />

The tough job market does not help consumer confidence. We expect modest<br />

consumption growth in <strong>2011</strong>—around 2.0% to 2.5%.<br />

� Fiscal problems at the Federal, State, and local level. We worry that some states and<br />

municipalities face even more cut-backs and budgetary woes in <strong>2011</strong>.<br />

� Continued restraint in the financial sector as it nurses back to health.<br />

There are strengths in the US economy.<br />

� Corporate sector. US corporations adjusted very quickly and rebounded back to<br />

profitability very quickly. They have ample cash reserves, so they could start investing<br />

and hiring very quickly.<br />

� A lower dollar could spark a round of export growth. After improving dramatically from<br />

2007 to 2009, the trade deficit has worsened in the last few quarters. However, the<br />

declining dollar and moderate growth in the emerging markets should provide a lift to<br />

exports in <strong>2011</strong>.<br />

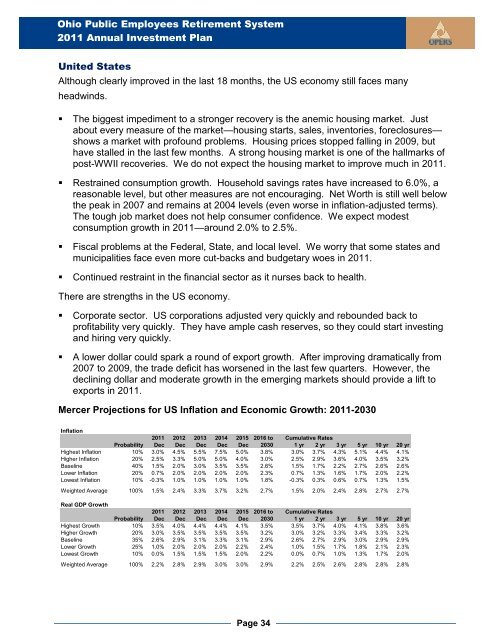

Mercer Projections for US Inflation and Economic Growth: <strong>2011</strong>-2030<br />

Inflation<br />

<strong>2011</strong> 2012 2013 2014 2015 2016 to Cumulative Rates<br />

Probability Dec Dec Dec Dec Dec 2030 1 yr 2 yr 3 yr 5 yr 10 yr 20 yr<br />

Highest Inflation 10% 3.0% 4.5% 5.5% 7.5% 5.0% 3.8% 3.0% 3.7% 4.3% 5.1% 4.4% 4.1%<br />

Higher Inflation 20% 2.5% 3.3% 5.0% 5.0% 4.0% 3.0% 2.5% 2.9% 3.6% 4.0% 3.5% 3.2%<br />

Baseline 40% 1.5% 2.0% 3.0% 3.5% 3.5% 2.6% 1.5% 1.7% 2.2% 2.7% 2.6% 2.6%<br />

Lower Inflation 20% 0.7% 2.0% 2.0% 2.0% 2.0% 2.3% 0.7% 1.3% 1.6% 1.7% 2.0% 2.2%<br />

Lowest Inflation 10% -0.3% 1.0% 1.0% 1.0% 1.0% 1.8% -0.3% 0.3% 0.6% 0.7% 1.3% 1.5%<br />

Weighted Average 100% 1.5% 2.4% 3.3% 3.7% 3.2% 2.7% 1.5% 2.0% 2.4% 2.8% 2.7% 2.7%<br />

Real GDP Growth<br />

<strong>2011</strong> 2012 2013 2014 2015 2016 to Cumulative Rates<br />

Probability Dec Dec Dec Dec Dec 2030 1 yr 2 yr 3 yr 5 yr 10 yr 20 yr<br />

Highest Growth 10% 3.5% 4.0% 4.4% 4.4% 4.1% 3.5% 3.5% 3.7% 4.0% 4.1% 3.8% 3.6%<br />

Higher Growth 20% 3.0% 3.5% 3.5% 3.5% 3.5% 3.2% 3.0% 3.2% 3.3% 3.4% 3.3% 3.2%<br />

Baseline 35% 2.6% 2.9% 3.1% 3.3% 3.1% 2.9% 2.6% 2.7% 2.9% 3.0% 2.9% 2.9%<br />

Lower Growth 25% 1.0% 2.0% 2.0% 2.0% 2.2% 2.4% 1.0% 1.5% 1.7% 1.8% 2.1% 2.3%<br />

Lowest Growth 10% 0.0% 1.5% 1.5% 1.5% 2.0% 2.2% 0.0% 0.7% 1.0% 1.3% 1.7% 2.0%<br />

Weighted Average 100% 2.2% 2.8% 2.9% 3.0% 3.0% 2.9% 2.2% 2.5% 2.6% 2.8% 2.8% 2.8%<br />

Page 34