Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global M&A Overview: Demerger<br />

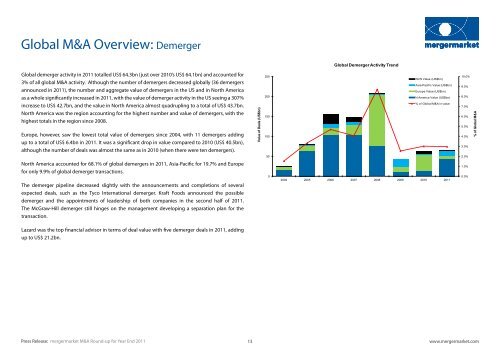

Global demerger activity in 2011 totalled US$ 64.3bn (just over 2010’s US$ 64.1bn) and accounted for<br />

3% of all global M&A activity. Although the number of demergers decreased globally (36 demergers<br />

announced in 2011), the number and aggregate value of demergers in the US and in North America<br />

as a whole significantly increased in 2011, with the value of demerger activity in the US seeing a 307%<br />

increase to US$ 42.7bn, and the value in North America almost quadrupling to a total of US$ 43.7bn.<br />

North America was the region accounting for the highest number and value of demergers, with the<br />

highest totals in the region since 2008.<br />

Europe, however, saw the lowest total value of demergers since 2004, with 11 demergers adding<br />

up to a total of US$ 6.4bn in 2011. It was a significant drop in value compared to 2010 (US$ 40.5bn),<br />

although the number of deals was almost the same as in 2010 (when there were ten demergers).<br />

North America accounted for 68.1% of global demergers in 2011, Asia-Pacific for 19.7% and Europe<br />

for only 9.9% of global demerger transactions.<br />

The demerger pipeline decreased slightly with the announcements and completions of several<br />

expected deals, such as the Tyco International demerger. Kraft Foods announced the possible<br />

demerger and the appointments of leadership of both companies in the second half of 2011.<br />

The McGraw-Hill demerger still hinges on the management developing a separation plan for the<br />

transaction.<br />

Lazard was the top financial advisor in terms of deal value with five demerger deals in 2011, adding<br />

up to US$ 21.2bn.<br />

Value of Deals (US$bn)<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Global Demerger Activity Trend<br />

RoW Value (US$bn)<br />

Asia-Pacific Value (US$bn)<br />

Europe Value (US$bn)<br />

N.America Value (US$bn)<br />

% of Global M&A in value<br />

2004 2005 2006 2007 2008 2009 2010 2011<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

13<br />

www.mergermarket.com<br />

10.0%<br />

9.0%<br />

8.0%<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

% of Global M&A

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)