Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

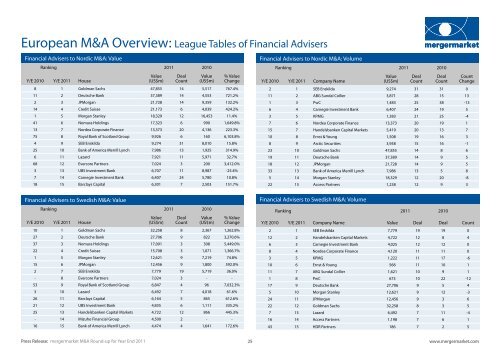

European M&A Overview: League Tables of Financial Advisers<br />

Financial Advisers to Nordic M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

8 1 Goldman Sachs 47,855 14 5,517 767.4%<br />

11 2 Deutsche Bank 37,389 14 4,553 721.2%<br />

2 3 JPMorgan 21,728 14 9,359 132.2%<br />

14 4 Credit Suisse 21,173 6 4,039 424.2%<br />

1 5 Morgan Stanley 18,329 12 16,453 11.4%<br />

41 6 Nomura Holdings 17,323 6 990 1,649.8%<br />

13 7 Nordea Corporate Finance 13,373 20 4,136 223.3%<br />

75 8 Royal Bank of Scotland Group 9,926 6 160 6,103.8%<br />

4 9 SEB Enskilda 9,274 31 8,010 15.8%<br />

25 10 Bank of America Merrill Lynch 7,986 13 1,925 314.9%<br />

6 11 Lazard 7,921 11 5,971 32.7%<br />

68 12 Evercore Partners 7,024 3 200 3,412.0%<br />

3 13 UBS Investment Bank 6,707 11 8,987 -25.4%<br />

7 14 Carnegie Investment Bank 6,407 24 5,780 10.8%<br />

18 15 Barclays Capital 6,301 7 2,503 151.7%<br />

Financial Advisers to Swedish M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

10 1 Goldman Sachs 32,258 8 2,367 1,262.8%<br />

27 2 Deutsche Bank 27,706 9 822 3,270.6%<br />

37 3 Nomura Holdings 17,091 3 308 5,449.0%<br />

22 4 Credit Suisse 15,708 3 1,071 1,366.7%<br />

1 5 Morgan Stanley 12,621 9 7,219 74.8%<br />

15 6 JPMorgan 12,456 9 1,800 592.0%<br />

2 7 SEB Enskilda 7,779 19 5,719 36.0%<br />

- 8 Evercore Partners 7,024 3 - -<br />

53 9 Royal Bank of Scotland Group 6,847 4 96 7,032.3%<br />

3 10 Lazard 6,492 7 4,018 61.6%<br />

26 11 Barclays Capital 6,164 5 865 612.6%<br />

21 12 UBS Investment Bank 4,835 6 1,111 335.2%<br />

25 13 Handelsbanken Capital Markets 4,722 12 866 445.3%<br />

- 14 Mizuho Financial Group 4,500 2 - -<br />

16 15 Bank of America Merrill Lynch 4,474 4 1,641 172.6%<br />

Financial Advisers to Nordic M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

25<br />

www.mergermarket.com<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Deal<br />

Count<br />

2 1 SEB Enskilda 9,274 31 31 0<br />

Count<br />

Change<br />

11 2 ABG Sundal Collier 3,871 28 15 13<br />

1 3 PwC 1,483 25 38 -13<br />

6 4 Carnegie Investment Bank 6,407 24 19 5<br />

3 5 KPMG 1,383 21 25 -4<br />

7 6 Nordea Corporate Finance 13,373 20 19 1<br />

15 7 Handelsbanken Capital Markets 5,419 20 13 7<br />

10 8 Ernst & Young 1,508 19 16 3<br />

8 9 Arctic Securities 3,958 15 16 -1<br />

23 10 Goldman Sachs 47,855 14 8 6<br />

19 11 Deutsche Bank 37,389 14 9 5<br />

18 12 JPMorgan 21,728 14 9 5<br />

33 13 Bank of America Merrill Lynch 7,986 13 5 8<br />

5 14 Morgan Stanley 18,329 12 20 -8<br />

22 15 Access Partners 1,238 12 9 3<br />

Financial Advisers to Swedish M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name Value Deal Deal Count<br />

2 1 SEB Enskilda 7,779 19 19 0<br />

12 2 Handelsbanken Capital Markets 4,722 12 8 4<br />

6 3 Carnegie Investment Bank 4,025 12 12 0<br />

8 4 Nordea Corporate Finance 4,120 11 11 0<br />

3 5 KPMG 1,222 11 17 -6<br />

10 6 Ernst & Young 568 11 10 1<br />

11 7 ABG Sundal Collier 1,621 10 9 1<br />

1 8 PwC 673 10 22 -12<br />

17 9 Deutsche Bank 27,706 9 5 4<br />

5 10 Morgan Stanley 12,621 9 12 -3<br />

24 11 JPMorgan 12,456 9 3 6<br />

22 12 Goldman Sachs 32,258 8 3 5<br />

7 13 Lazard 6,492 7 11 -4<br />

16 14 Access Partners 1,198 7 6 1<br />

43 15 HDR Partners 186 7 2 5

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)