Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

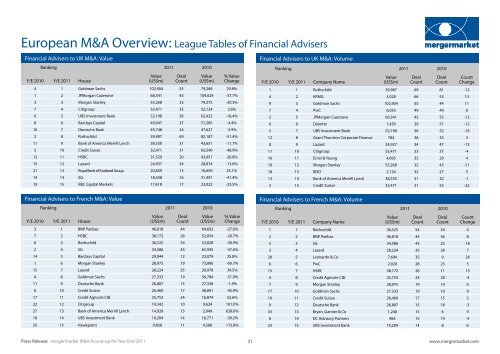

European M&A Overview: League Tables of Financial Advisers<br />

Financial Advisers to UK M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

4 1 Goldman Sachs 102,904 55 79,268 29.8%<br />

1 2 JPMorgan Cazenove 68,341 43 109,624 -37.7%<br />

3 3 Morgan Stanley 55,268 32 79,275 -30.3%<br />

7 4 Citigroup 53,471 33 52,134 2.6%<br />

6 5 UBS Investment Bank 52,198 36 62,423 -16.4%<br />

8 6 Barclays Capital 49,047 27 51,285 -4.4%<br />

10 7 Deutsche Bank 45,748 24 47,627 -3.9%<br />

2 8 Rothschild 39,987 69 82,187 -51.4%<br />

11 9 Bank of America Merrill Lynch 38,530 31 43,651 -11.7%<br />

5 10 Credit Suisse 32,471 31 63,540 -48.9%<br />

12 11 HSBC 31,529 20 43,051 -26.8%<br />

15 12 Lazard 24,937 34 28,874 -13.6%<br />

21 13 Royal Bank of Scotland Group 20,839 13 16,659 25.1%<br />

14 14 SG 18,438 16 31,491 -41.4%<br />

19 15 RBC Capital Markets 17,618 17 23,022 -23.5%<br />

Financial Advisers to French M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

3 1 BNP Paribas 46,818 44 64,692 -27.6%<br />

7 2 HSBC 38,172 26 52,054 -26.7%<br />

6 3 Rothschild 36,525 54 52,828 -30.9%<br />

2 4 SG 34,586 43 65,945 -47.6%<br />

14 5 Barclays Capital 29,044 12 23,079 25.8%<br />

1 6 Morgan Stanley 28,975 19 73,806 -60.7%<br />

15 7 Lazard 28,224 35 20,978 34.5%<br />

4 8 Goldman Sachs 27,333 19 56,784 -51.9%<br />

11 9 Deutsche Bank 26,807 15 27,338 -1.9%<br />

8 10 Credit Suisse 26,460 17 48,891 -45.9%<br />

17 11 Credit Agricole CIB 25,753 24 16,874 52.6%<br />

22 12 Citigroup 19,342 10 9,624 101.0%<br />

27 13 Bank of America Merrill Lynch 14,928 13 2,049 628.6%<br />

18 14 UBS Investment Bank 10,204 14 16,771 -39.2%<br />

25 15 Hawkpoint 9,858 11 4,568 115.8%<br />

Financial Advisers to UK M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

21<br />

www.mergermarket.com<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Deal<br />

Count<br />

Count<br />

Change<br />

1 1 Rothschild 39,987 69 81 -12<br />

4 2 KPMG 5,028 66 53 13<br />

9 3 Goldman Sachs 102,904 55 44 11<br />

7 4 PwC 6,055 49 49 0<br />

2 5 JPMorgan Cazenove 68,341 43 55 -12<br />

6 6 Deloitte 1,450 39 51 -12<br />

5 7 UBS Investment Bank 52,198 36 52 -16<br />

12 8 Grant Thornton Corporate Finance 784 36 33 3<br />

8 9 Lazard 24,937 34 47 -13<br />

11 10 Citigroup 53,471 33 37 -4<br />

16 11 Ernst & Young 4,695 33 29 4<br />

10 12 Morgan Stanley 55,268 32 43 -11<br />

18 13 BDO 2,124 32 27 5<br />

13 14 Bank of America Merrill Lynch 38,530 31 32 -1<br />

3 15 Credit Suisse 32,471 31 53 -22<br />

Financial Advisers to French M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Deal<br />

Count<br />

1 1 Rothschild 36,525 54 54 0<br />

2 2 BNP Paribas 46,818 44 36 8<br />

Count<br />

Change<br />

5 3 SG 34,586 43 25 18<br />

3 4 Lazard 28,224 35 28 7<br />

20 5 Leonardo & Co 7,694 35 9 26<br />

6 6 PwC 2,920 28 23 5<br />

15 7 HSBC 38,172 26 11 15<br />

4 8 Credit Agricole CIB 25,753 24 28 -4<br />

7 9 Morgan Stanley 28,975 19 19 0<br />

17 10 Goldman Sachs 27,333 19 10 9<br />

10 11 Credit Suisse 26,460 17 15 2<br />

9 12 Deutsche Bank 26,807 15 18 -3<br />

33 13 Bryan, Garnier & Co 1,240 15 6 9<br />

8 14 DC Advisory Partners 964 15 19 -4<br />

23 15 UBS Investment Bank 10,204 14 8 6

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)