Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Asia-Pacific (ex. Japan) M&A Overview<br />

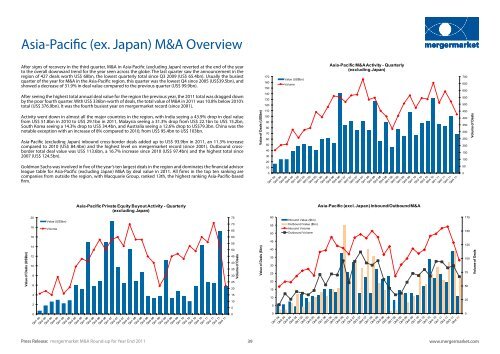

After signs of recovery in the third quarter, M&A in Asia-Pacific (excluding Japan) reverted at the end of the year<br />

to the overall downward trend for the year seen across the globe. The last quarter saw the announcement in the<br />

region of 427 deals worth US$ 68bn, the lowest quarterly total since Q3 2009 (US$ 65.4bn). Usually the busiest<br />

quarter of the year for M&A in the Asia-Pacific region, this quarter was the lowest Q4 since 2005 (US$39.5bn), and<br />

showed a decrease of 31.9% in deal value compared to the previous quarter (US$ 99.9bn).<br />

After seeing the highest total annual deal value for the region the previous year, the 2011 total was dragged down<br />

by the poor fourth quarter. With US$ 336bn-worth of deals, the total value of M&A in 2011 was 10.8% below 2010’s<br />

total (US$ 376.9bn). It was the fourth busiest year on mergermarket record (since 2001).<br />

Activity went down in almost all the major countries in the region, with India seeing a 43.9% drop in deal value<br />

from US$ 51.8bn in 2010 to US$ 29.1bn in 2011, Malaysia seeing a 31.3% drop from US$ 22.1bn to US$ 15.2bn,<br />

South Korea seeing a 14.3% drop to US$ 34.4bn, and Australia seeing a 12.6% drop to US$79.3bn. China was the<br />

notable exception with an increase of 8% compared to 2010, from US$ 95.4bn to US$ 103bn.<br />

Asia-Pacific (excluding Japan) inbound cross-border deals added up to US$ 93.9bn in 2011, an 11.3% increase<br />

compared to 2010 (US$ 84.4bn) and the highest level on mergermarket record (since 2001). Outbound crossborder<br />

total deal value was US$ 113.6bn, a 16.7% increase since 2010 (US$ 97.4bn) and the highest total since<br />

2007 (US$ 124.5bn).<br />

Goldman Sachs was involved in five of the year’s ten largest deals in the region and dominates the financial advisor<br />

league table for Asia-Pacific (excluding Japan) M&A by deal value in 2011. All firms in the top ten ranking are<br />

companies from outside the region, with Macquarie Group, ranked 13th, the highest ranking Asia-Pacific-based<br />

firm.<br />

Value of Deals (US$bn)<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Value (US$bn)<br />

Volume<br />

Asia-Pacific Private Equity Buyout Activity - Quarterly<br />

(excluding Japan)<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Volume of Deals<br />

Value of Deals (US$bn)<br />

Value of Deals ($bn)<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Value (US$bn)<br />

Volume<br />

Inbound Value ($bn)<br />

Outbound Value ($bn)<br />

Inbound Volume<br />

Outbound Volume<br />

Asia-Pacific M&A Activity - Quarterly<br />

(excluding Japan)<br />

Asia-Pacific (excl. Japan) Inbound/Outbound M&A<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

39<br />

www.mergermarket.com<br />

700<br />

650<br />

600<br />

550<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

175<br />

150<br />

125<br />

100<br />

75<br />

50<br />

25<br />

0<br />

Volume of Deals<br />

Volume of Deals

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)