Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

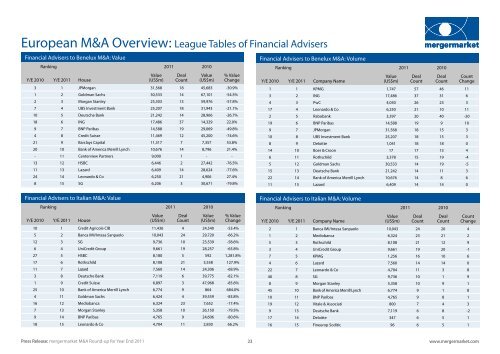

European M&A Overview: League Tables of Financial Advisers<br />

Financial Advisers to Benelux M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

3 1 JPMorgan 31,568 18 45,683 -30.9%<br />

1 2 Goldman Sachs 30,533 14 67,101 -54.5%<br />

2 3 Morgan Stanley 25,303 13 59,976 -57.8%<br />

7 4 UBS Investment Bank 25,207 18 31,943 -21.1%<br />

10 5 Deutsche Bank 21,242 14 28,966 -26.7%<br />

18 6 ING 17,486 37 14,329 22.0%<br />

9 7 BNP Paribas 14,588 19 29,069 -49.8%<br />

4 8 Credit Suisse 11,469 12 45,200 -74.6%<br />

21 9 Barclays Capital 11,317 7 7,357 53.8%<br />

20 10 Bank of America Merrill Lynch 10,676 14 8,796 21.4%<br />

- 11 Centerview Partners 9,000 1 - -<br />

13 12 HSBC 6,446 2 27,442 -76.5%<br />

11 13 Lazard 6,409 14 28,624 -77.6%<br />

24 14 Leonardo & Co 6,250 21 4,906 27.4%<br />

8 15 SG 6,206 3 30,671 -79.8%<br />

Financial Advisers to Italian M&A: Value<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 House<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Value<br />

(US$m)<br />

% Value<br />

Change<br />

10 1 Credit Agricole CIB 11,436 4 24,540 -53.4%<br />

5 2 Banca IMI/Intesa Sanpaolo 10,043 24 29,720 -66.2%<br />

12 3 SG 9,736 10 23,539 -58.6%<br />

6 4 UniCredit Group 9,661 19 28,257 -65.8%<br />

27 5 HSBC 8,180 5 592 1,281.8%<br />

17 6 Rothschild 8,108 21 3,558 127.9%<br />

11 7 Lazard 7,560 14 24,306 -68.9%<br />

3 8 Deutsche Bank 7,119 6 39,775 -82.1%<br />

1 9 Credit Suisse 6,897 3 47,968 -85.6%<br />

25 10 Bank of America Merrill Lynch 6,774 9 864 684.0%<br />

4 11 Goldman Sachs 6,424 4 39,559 -83.8%<br />

16 12 Mediobanca 6,324 23 7,652 -17.4%<br />

7 13 Morgan Stanley 5,358 10 26,150 -79.5%<br />

9 14 BNP Paribas 4,765 9 24,606 -80.6%<br />

18 15 Leonardo & Co 4,704 11 2,830 66.2%<br />

Financial Advisers to Benelux M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011 23<br />

www.mergermarket.com<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Deal<br />

Count<br />

Count<br />

Change<br />

1 1 KPMG 1,747 57 46 11<br />

3 2 ING 17,486 37 31 6<br />

4 3 PwC 4,030 26 23 3<br />

17 4 Leonardo & Co 6,250 21 10 11<br />

2 5 Rabobank 3,397 20 40 -20<br />

19 6 BNP Paribas 14,588 19 9 10<br />

9 7 JPMorgan 31,568 18 15 3<br />

10 8 UBS Investment Bank 25,207 18 15 3<br />

8 9 Deloitte 1,041 18 18 0<br />

14 10 Boer & Croon 17 17 13 4<br />

6 11 Rothschild 3,378 15 19 -4<br />

5 12 Goldman Sachs 30,533 14 19 -5<br />

15 13 Deutsche Bank 21,242 14 11 3<br />

22 14 Bank of America Merrill Lynch 10,676 14 8 6<br />

11 15 Lazard 6,409 14 14 0<br />

Financial Advisers to Italian M&A: Volume<br />

Ranking 2011 2010<br />

Y/E 2010 Y/E 2011 Company Name<br />

Value<br />

(US$m)<br />

Deal<br />

Count<br />

Deal<br />

Count<br />

2 1 Banca IMI/Intesa Sanpaolo 10,043 24 20 4<br />

1 2 Mediobanca 6,324 23 21 2<br />

5 3 Rothschild 8,108 21 12 9<br />

Count<br />

Change<br />

3 4 UniCredit Group 9,661 19 20 -1<br />

7 5 KPMG 1,256 16 10 6<br />

4 6 Lazard 7,560 14 14 0<br />

22 7 Leonardo & Co 4,704 11 3 8<br />

40 8 SG 9,736 10 1 9<br />

8 9 Morgan Stanley 5,358 10 9 1<br />

45 10 Bank of America Merrill Lynch 6,774 9 1 8<br />

10 11 BNP Paribas 4,765 9 8 1<br />

19 12 Vitale & Associati 800 7 4 3<br />

9 13 Deutsche Bank 7,119 6 8 -2<br />

17 14 Deloitte 347 6 5 1<br />

16 15 Fineurop Soditic 96 6 5 1

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)