Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

US M&A Overview<br />

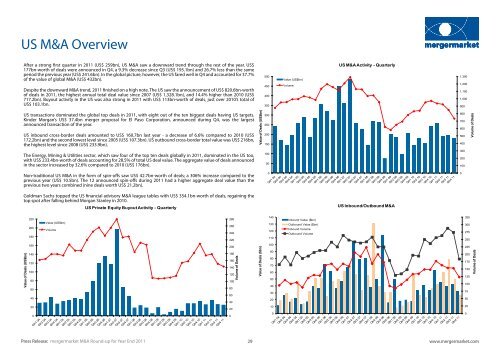

After a strong first quarter in 2011 (US$ 259bn), US M&A saw a downward trend through the rest of the year. US$<br />

177bn-worth of deals were announced in Q4, a 9.3% decrease since Q3 (US$ 195.1bn) and 26.7% less than the same<br />

period the previous year (US$ 241.6bn). In the global picture, however, the US fared well in Q4 and accounted for 37.7%<br />

of the value of global M&A (US$ 432bn).<br />

Despite the downward M&A trend, 2011 finished on a high note. The US saw the announcement of US$ 820.6bn-worth<br />

of deals in 2011, the highest annual total deal value since 2007 (US$ 1,328.1bn), and 14.4% higher than 2010 (US$<br />

717.2bn). Buyout activity in the US was also strong in 2011 with US$ 113bn-worth of deals, just over 2010’s total of<br />

US$ 103.1bn.<br />

US transactions dominated the global top deals in 2011, with eight out of the ten biggest deals having US targets.<br />

Kinder Morgan’s US$ 37.4bn merger proposal for El Paso Corporation, announced during Q4, was the largest<br />

announced transaction of the year.<br />

US inbound cross-border deals amounted to US$ 160.7bn last year - a decrease of 6.6% compared to 2010 (US$<br />

172.2bn) and the second lowest level since 2005 (US$ 107.3bn). US outbound cross-border total value was US$ 216bn,<br />

the highest level since 2008 (US$ 233.9bn).<br />

The Energy, Mining & Utilities sector, which saw four of the top ten deals globally in 2011, dominated in the US too,<br />

with US$ 233.4bn-worth of deals accounting for 28.5% of total US deal value. The aggregate value of deals announced<br />

in the sector increased by 32.6% compared to 2010 (US$ 176bn).<br />

Non-traditional US M&A in the form of spin-offs saw US$ 42.7bn-worth of deals; a 306% increase compared to the<br />

previous year (US$ 10.5bn). The 12 announced spin-offs during 2011 had a higher aggregate deal value than the<br />

previous two years combined (nine deals worth US$ 21.2bn).<br />

Goldman Sachs topped the US financial advisory M&A league tables with US$ 354.1bn-worth of deals, regaining the<br />

top spot after falling behind Morgan Stanley in 2010.<br />

US Private Equity Buyout Activity - Quarterly<br />

Value of Deals (US$bn)<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Value (US$bn)<br />

Volume<br />

280<br />

260<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Volume of Deals<br />

Value of Deals (US$bn)<br />

Value of Deals ($bn)<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Value (US$bn)<br />

Volume<br />

Inbound Value ($bn)<br />

Outbound Value ($bn)<br />

Inbound Volume<br />

Outbound Volume<br />

US M&A Activity - Quarterly<br />

US Inbound/Outbound M&A<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

29<br />

www.mergermarket.com<br />

1,300<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

325<br />

300<br />

275<br />

250<br />

225<br />

200<br />

175<br />

150<br />

125<br />

100<br />

75<br />

50<br />

25<br />

0<br />

Volume of Deals<br />

Volume of Deals

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)