Press Release - Mergermarket

Press Release - Mergermarket

Press Release - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

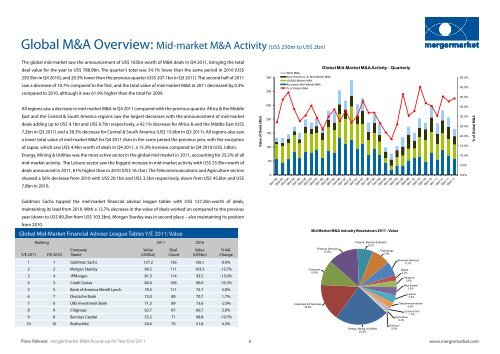

Global M&A Overview: Mid-market M&A Activity (US$ 250m to US$ 2bn)<br />

The global mid-market saw the announcement of US$ 165bn-worth of M&A deals in Q4 2011, bringing the total<br />

deal value for the year to US$ 788.9bn. The quarter’s total was 34.1% lower than the same period in 2010 (US$<br />

250.5bn in Q4 2010), and 20.3% lower than the previous quarter (US$ 207.1bn in Q3 2011). The second half of 2011<br />

saw a decrease of 10.7% compared to the first, and the total value of mid-market M&A in 2011 decreased by 0.3%<br />

compared to 2010, although it was 61.9% higher than the total for 2009.<br />

All regions saw a decrease in mid-market M&A in Q4 2011 compared with the previous quarter. Africa & the Middle<br />

East and the Central & South America regions saw the largest decreases with the announcement of mid-market<br />

deals adding up to US$ 4.1bn and US$ 9.7bn respectively, a 42.1% decrease for Africa & and the Middle East (US$<br />

7.2bn in Q3 2011) and a 38.3% decrease for Central & South America (US$ 15.6bn in Q3 2011). All regions also saw<br />

a lower total value of mid-market M&A for Q4 2011 than in the same period the previous year, with the exception<br />

of Japan, which saw US$ 4.4bn worth of deals in Q4 2011, a 15.3% increase compared to Q4 2010 (US$ 3.8bn).<br />

Energy, Mining & Utilities was the most active sector in the global mid-market in 2011, accounting for 23.2% of all<br />

mid-market activity. The Leisure sector saw the biggest increase in mid-market activity with US$ 25.9bn-worth of<br />

deals announced in 2011, 61% higher than in 2010 (US$ 16.1bn). The Telecommunications and Agriculture sectors<br />

showed a 56% decrease from 2010 with US$ 20.1bn and US$ 3.5bn respectively, down from US$ 45.6bn and US$<br />

7.8bn in 2010.<br />

Goldman Sachs topped the mid-market financial advisor league tables with US$ 127.2bn-worth of deals,<br />

maintaining its lead from 2010. With a 13.7% decrease in the value of deals worked on compared to the previous<br />

year (down to US$ 89.2bn from US$ 103.3bn), Morgan Stanley was in second place – also maintaining its position<br />

from 2010.<br />

Global Mid-Market Financial Adviser League Tables Y/E 2011: Value<br />

Ranking 2011 2010<br />

Company<br />

Value Deal<br />

Value % Val.<br />

Y/E 2011 Y/E 2010 Name<br />

(US$bn) Count (US$bn) Change<br />

1 1 Goldman Sachs 127.2 156 126.1 0.9%<br />

2 2 Morgan Stanley 89.2 111 103.3 -13.7%<br />

3 4 JPMorgan 81.3 114 93.5 -13.0%<br />

4 3 Credit Suisse 80.4 106 96.0 -16.3%<br />

5 5 Bank of America Merrill Lynch 79.5 111 75.7 5.0%<br />

6 7 Deutsche Bank 72.0 89 70.7 1.7%<br />

7 6 UBS Investment Bank 71.5 89 73.6 -2.9%<br />

8 9 Citigroup 63.7 87 60.7 5.0%<br />

9 8 Barclays Capital 55.2 71 68.8 -19.7%<br />

10 10 Rothschild 54.0 79 51.8 4.3%<br />

Value of Deals ($bn)<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

RoW M&A<br />

Asia-Pacific ex Jp Mid-Market M&A<br />

US Mid-Market M&A<br />

European Mid-Market M&A<br />

% of Global M&A<br />

Industrials & Chemicals<br />

15.6%<br />

Global Mid-Market M&A Activity - Quarterly<br />

Mid Market M&A Industry Breakdown 2011 - Value<br />

<strong>Press</strong> <strong>Release</strong>: mergermarket M&A Round-up for Year End 2011<br />

6<br />

www.mergermarket.com<br />

Consumer<br />

10.8%<br />

Financial Services<br />

12.9%<br />

Pharma, Medical & Biotech<br />

6.7%<br />

Energy, Mining & Utilities<br />

23.2%<br />

Technology<br />

7.8%<br />

Business Services<br />

6.1%<br />

Media<br />

2.3%<br />

Transport<br />

2.8%<br />

Real Estate<br />

3.5%<br />

Leisure<br />

3.3%<br />

Telecommunications<br />

2.5%<br />

Construction<br />

1.5%<br />

Agriculture<br />

0.4%<br />

Defence<br />

0.5%<br />

50.0%<br />

45.0%<br />

40.0%<br />

35.0%<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

% of Global M&A

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)