Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>LOGÍSTICA</strong> & <strong>TRANSPORTE</strong><br />

connections, in particular freight railway links, between ports<br />

in the Atlantic façade (e.g. Gijon) and in the Mediterranean<br />

coast (e.g. Valencia, Murcia), and the industrial production<br />

centres in the interior of the Iberian Peninsula. This would<br />

include a better use of the rail infrastructure for freight<br />

transport.<br />

Competition in port services to raise ports'<br />

efficiency and competitiveness<br />

Spanish ports play an important role for regional development<br />

purposes. A national long-term strategy for port development,<br />

establishing investment priorities for ports according to their<br />

role and function would help to ensure a better use of the<br />

extensive network of Spanish ports. In line with that strategy,<br />

ports should be able to adopt more efficient pricing policies,<br />

facilitating maritime trade options and ensuring long term<br />

recovery of infrastructural costs.<br />

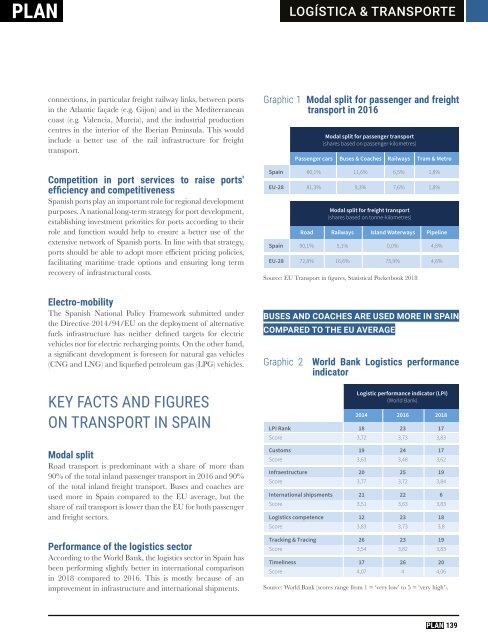

Graphic 1 Modal split for passenger and freight<br />

transport in 2016<br />

Modal split for passenger transport<br />

(shares based on passenger-kilometres)<br />

Passenger cars Buses & Coaches Railways Tram & Metro<br />

Spain 80,1% 11,6% 6,5% 1,8%<br />

EU-28 81,3% 9,3% 7,6% 1,8%<br />

Modal split for freight transport<br />

(shares based on tonne-kilometres)<br />

Road Railways Island Waterways Pipeline<br />

Spain 90,1% 5,1% 0,0% 4,8%<br />

EU-28 72,8% 16,6% 75,9% 4,6%<br />

Source: EU Transport in figures, Statistical Pocketbook 2018<br />

Electro-mobility<br />

The Spanish National Policy Framework submitted under<br />

the Directive 2014/94/EU on the deployment of alternative<br />

fuels infrastructure has neither defined targets for electric<br />

vehicles nor for electric recharging points. On the other hand,<br />

a significant development is foreseen for natural gas vehicles<br />

(CNG and LNG) and liquefied petroleum gas (LPG) vehicles.<br />

KEY FACTS AND FIGURES<br />

ON TRANSPORT IN SPAIN<br />

Modal split<br />

Road transport is predominant with a share of more than<br />

90% of the total inland passenger transport in 2016 and 90%<br />

of the total inland freight transport. Buses and coaches are<br />

used more in Spain compared to the EU average, but the<br />

share of rail transport is lower than the EU for both passenger<br />

and freight sectors.<br />

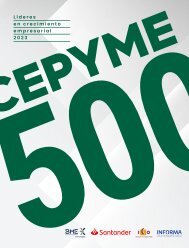

Performance of the logistics sector<br />

According to the World Bank, the logistics sector in Spain has<br />

been performing slightly better in international comparison<br />

in 2018 compared to 2016. This is mostly because of an<br />

improvement in infrastructure and international shipments.<br />

BUSES AND COACHES ARE USED MORE IN SPAIN<br />

COMPARED TO THE EU AVERAGE<br />

Graphic 2 World Bank Logistics performance<br />

indicator<br />

Logistic performance indicator (LPI)<br />

(World Bank)<br />

2014 2016 2018<br />

LPI Rank 18 23 17<br />

Score 3,72 3,73 3,83<br />

Customs 19 24 17<br />

Score 3,63 3,48 3,62<br />

Infraestructure 20 25 19<br />

Score 3,77 3,72 3,84<br />

International shipsments 21 22 6<br />

Score 3,51 3,63 3,83<br />

Logistics competence 12 23 18<br />

Score 3,83 3,73 3,8<br />

Tracking & Tracing 26 23 19<br />

Score 3,54 3,82 3,83<br />

Timeliness 17 26 20<br />

Score 4,07 4 4,06<br />

Source: World Bank (scores range from 1 = ‘very low’ to 5 = ‘very high’).<br />

139