406d06a2ba_0c840376de

406d06a2ba_0c840376de

406d06a2ba_0c840376de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

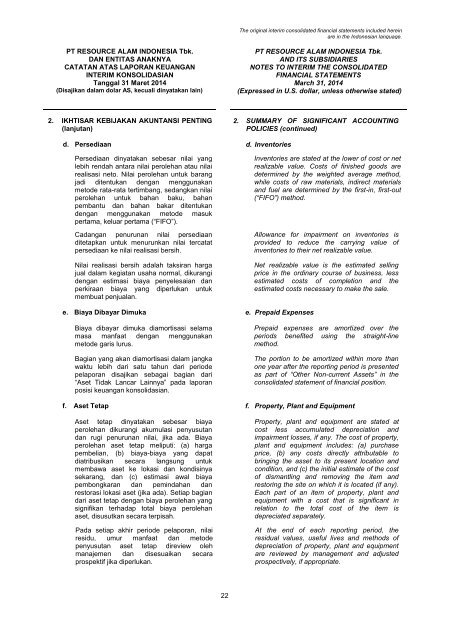

The original interim consolidated financial statements included hereinare in the Indonesian language.PT RESOURCE ALAM INDONESIA Tbk.DAN ENTITAS ANAKNYACATATAN ATAS LAPORAN KEUANGANINTERIM KONSOLIDASIANTanggal 31 Maret 2014(Disajikan dalam dolar AS, kecuali dinyatakan lain)PT RESOURCE ALAM INDONESIA Tbk.AND ITS SUBSIDIARIESNOTES TO INTERIM THE CONSOLIDATEDFINANCIAL STATEMENTSMarch 31, 2014(Expressed in U.S. dollar, unless otherwise stated)2. IKHTISAR KEBIJAKAN AKUNTANSI PENTING(lanjutan)2. SUMMARY OF SIGNIFICANT ACCOUNTINGPOLICIES (continued)d. Persediaan d. InventoriesPersediaan dinyatakan sebesar nilai yanglebih rendah antara nilai perolehan atau nilairealisasi neto. Nilai perolehan untuk barangjadi ditentukan dengan menggunakanmetode rata-rata tertimbang, sedangkan nilaiperolehan untuk bahan baku, bahanpembantu dan bahan bakar ditentukandengan menggunakan metode masukpertama, keluar pertama (“FIFO”).Cadangan penurunan nilai persediaanditetapkan untuk menurunkan nilai tercatatpersediaan ke nilai realisasi bersih.Nilai realisasi bersih adalah taksiran hargajual dalam kegiatan usaha normal, dikurangidengan estimasi biaya penyelesaian danperkiraan biaya yang diperlukan untukmembuat penjualan.Inventories are stated at the lower of cost or netrealizable value. Costs of finished goods aredetermined by the weighted average method,while costs of raw materials, indirect materialsand fuel are determined by the first-in, first-out(“FIFO”) method.Allowance for impairment on inventories isprovided to reduce the carrying value ofinventories to their net realizable value.Net realizable value is the estimated sellingprice in the ordinary course of business, lessestimated costs of completion and theestimated costs necessary to make the sale.e. Biaya Dibayar Dimuka e. Prepaid ExpensesBiaya dibayar dimuka diamortisasi selamamasa manfaat dengan menggunakanmetode garis lurus.Bagian yang akan diamortisasi dalam jangkawaktu lebih dari satu tahun dari periodepelaporan disajikan sebagai bagian dari“Aset Tidak Lancar Lainnya” pada laporanposisi keuangan konsolidasian.Prepaid expenses are amortized over theperiods benefited using the straight-linemethod.The portion to be amortized within more thanone year after the reporting period is presentedas part of “Other Non-current Assets” in theconsolidated statement of financial position.f. Aset Tetap f. Property, Plant and EquipmentAset tetap dinyatakan sebesar biayaperolehan dikurangi akumulasi penyusutandan rugi penurunan nilai, jika ada. Biayaperolehan aset tetap meliputi: (a) hargapembelian, (b) biaya-biaya yang dapatdiatribusikan secara langsung untukmembawa aset ke lokasi dan kondisinyasekarang, dan (c) estimasi awal biayapembongkaran dan pemindahan danrestorasi lokasi aset (jika ada). Setiap bagiandari aset tetap dengan biaya perolehan yangsignifikan terhadap total biaya perolehanaset, disusutkan secara terpisah.Pada setiap akhir periode pelaporan, nilairesidu, umur manfaat dan metodepenyusutan aset tetap direview olehmanajemen dan disesuaikan secaraprospektif jika diperlukan.Property, plant and equipment are stated atcost less accumulated depreciation andimpairment losses, if any. The cost of property,plant and equipment includes: (a) purchaseprice, (b) any costs directly attributable tobringing the asset to its present location andcondition, and (c) the initial estimate of the costof dismantling and removing the item andrestoring the site on which it is located (if any).Each part of an item of property, plant andequipment with a cost that is significant inrelation to the total cost of the item isdepreciated separately.At the end of each reporting period, theresidual values, useful lives and methods ofdepreciation of property, plant and equipmentare reviewed by management and adjustedprospectively, if appropriate.22