406d06a2ba_0c840376de

406d06a2ba_0c840376de

406d06a2ba_0c840376de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

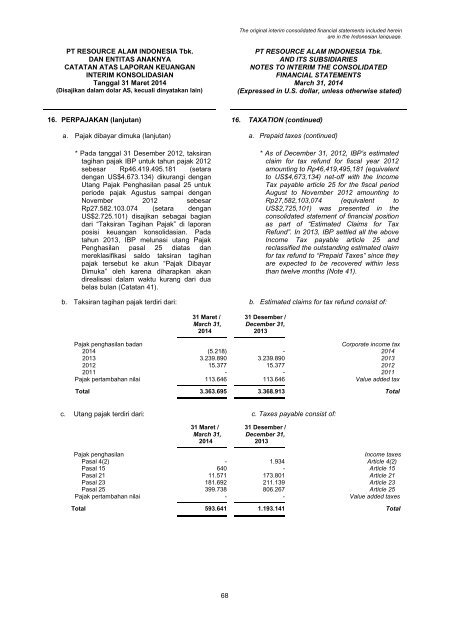

The original interim consolidated financial statements included hereinare in the Indonesian language.PT RESOURCE ALAM INDONESIA Tbk.DAN ENTITAS ANAKNYACATATAN ATAS LAPORAN KEUANGANINTERIM KONSOLIDASIANTanggal 31 Maret 2014(Disajikan dalam dolar AS, kecuali dinyatakan lain)PT RESOURCE ALAM INDONESIA Tbk.AND ITS SUBSIDIARIESNOTES TO INTERIM THE CONSOLIDATEDFINANCIAL STATEMENTSMarch 31, 2014(Expressed in U.S. dollar, unless otherwise stated)16. PERPAJAKAN (lanjutan) 16. TAXATION (continued)a. Pajak dibayar dimuka (lanjutan) a. Prepaid taxes (continued)* Pada tanggal 31 Desember 2012, taksirantagihan pajak IBP untuk tahun pajak 2012sebesar Rp46.419.495.181 (setaradengan US$4.673.134) dikurangi denganUtang Pajak Penghasilan pasal 25 untukperiode pajak Agustus sampai denganNovember 2012 sebesarRp27.582.103.074 (setara denganUS$2.725.101) disajikan sebagai bagiandari “Taksiran Tagihan Pajak” di laporanposisi keuangan konsolidasian. Padatahun 2013, IBP melunasi utang PajakPenghasilan pasal 25 diatas danmereklasifikasi saldo taksiran tagihanpajak tersebut ke akun “Pajak DibayarDimuka” oleh karena diharapkan akandirealisasi dalam waktu kurang dari duabelas bulan (Catatan 41).* As of December 31, 2012, IBP‟s estimatedclaim for tax refund for fiscal year 2012amounting to Rp46,419,495,181 (equivalentto US$4,673,134) net-off with the IncomeTax payable article 25 for the fiscal periodAugust to November 2012 amounting toRp27,582,103,074 (equivalent toUS$2,725,101) was presented in theconsolidated statement of financial positionas part of “Estimated Claims for TaxRefund”. In 2013, IBP settled all the aboveIncome Tax payable article 25 andreclassified the outstanding estimated claimfor tax refund to “Prepaid Taxes” since theyare expected to be recovered within lessthan twelve months (Note 41).b. Taksiran tagihan pajak terdiri dari: b. Estimated claims for tax refund consist of:31 Maret / 31 Desember /March 31, December 31,2014 2013Pajak penghasilan badanCorporate income tax2014 (5.218) - 20142013 3.239.890 3.239.890 20132012 15.377 15.377 20122011 - - 2011Pajak pertambahan nilai 113.646 113.646 Value added taxTotal 3.363.695 3.368.913 Totalc. Utang pajak terdiri dari: c. Taxes payable consist of:31 Maret / 31 Desember /March 31, December 31,2014 2013Pajak penghasilanIncome taxesPasal 4(2) - 1.934 Article 4(2)Pasal 15 640 - Article 15Pasal 21 11.571 173.801 Article 21Pasal 23 181.692 211.139 Article 23Pasal 25 399.738 806.267 Article 25Pajak pertambahan nilai - - Value added taxesTotal 593.641 1.193.141 Total68