406d06a2ba_0c840376de

406d06a2ba_0c840376de

406d06a2ba_0c840376de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

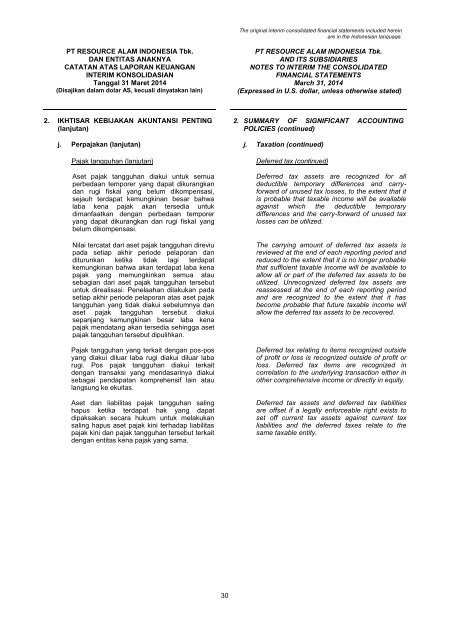

The original interim consolidated financial statements included hereinare in the Indonesian language.PT RESOURCE ALAM INDONESIA Tbk.DAN ENTITAS ANAKNYACATATAN ATAS LAPORAN KEUANGANINTERIM KONSOLIDASIANTanggal 31 Maret 2014(Disajikan dalam dolar AS, kecuali dinyatakan lain)PT RESOURCE ALAM INDONESIA Tbk.AND ITS SUBSIDIARIESNOTES TO INTERIM THE CONSOLIDATEDFINANCIAL STATEMENTSMarch 31, 2014(Expressed in U.S. dollar, unless otherwise stated)2. IKHTISAR KEBIJAKAN AKUNTANSI PENTING(lanjutan)2. SUMMARY OF SIGNIFICANT ACCOUNTINGPOLICIES (continued)j. Perpajakan (lanjutan) j. Taxation (continued)Pajak tangguhan (lanjutan)Aset pajak tangguhan diakui untuk semuaperbedaan temporer yang dapat dikurangkandan rugi fiskal yang belum dikompensasi,sejauh terdapat kemungkinan besar bahwalaba kena pajak akan tersedia untukdimanfaatkan dengan perbedaan temporeryang dapat dikurangkan dan rugi fiskal yangbelum dikompensasi.Nilai tercatat dari aset pajak tangguhan direviupada setiap akhir periode pelaporan danditurunkan ketika tidak lagi terdapatkemungkinan bahwa akan terdapat laba kenapajak yang memungkinkan semua atausebagian dari aset pajak tangguhan tersebutuntuk direalisasi. Penelaahan dilakukan padasetiap akhir periode pelaporan atas aset pajaktangguhan yang tidak diakui sebelumnya danaset pajak tangguhan tersebut diakuisepanjang kemungkinan besar laba kenapajak mendatang akan tersedia sehingga asetpajak tangguhan tersebut dipulihkan.Pajak tangguhan yang terkait dengan pos-posyang diakui diluar laba rugi diakui diluar labarugi. Pos pajak tangguhan diakui terkaitdengan transaksi yang mendasarinya diakuisebagai pendapatan komprehensif lain ataulangsung ke ekuitas.Aset dan liabilitas pajak tangguhan salinghapus ketika terdapat hak yang dapatdipaksakan secara hukum untuk melakukansaling hapus aset pajak kini terhadap liabilitaspajak kini dan pajak tangguhan tersebut terkaitdengan entitas kena pajak yang sama.Deferred tax (continued)Deferred tax assets are recognized for alldeductible temporary differences and carryforwardof unused tax losses, to the extent that itis probable that taxable income will be availableagainst which the deductible temporarydifferences and the carry-forward of unused taxlosses can be utilized.The carrying amount of deferred tax assets isreviewed at the end of each reporting period andreduced to the extent that it is no longer probablethat sufficient taxable income will be available toallow all or part of the deferred tax assets to beutilized. Unrecognized deferred tax assets arereassessed at the end of each reporting periodand are recognized to the extent that it hasbecome probable that future taxable income willallow the deferred tax assets to be recovered.Deferred tax relating to items recognized outsideof profit or loss is recognized outside of profit orloss. Deferred tax items are recognized incorrelation to the underlying transaction either inother comprehensive income or directly in equity.Deferred tax assets and deferred tax liabilitiesare offset if a legally enforceable right exists toset off current tax assets against current taxliabilities and the deferred taxes relate to thesame taxable entity.30