406d06a2ba_0c840376de

406d06a2ba_0c840376de

406d06a2ba_0c840376de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

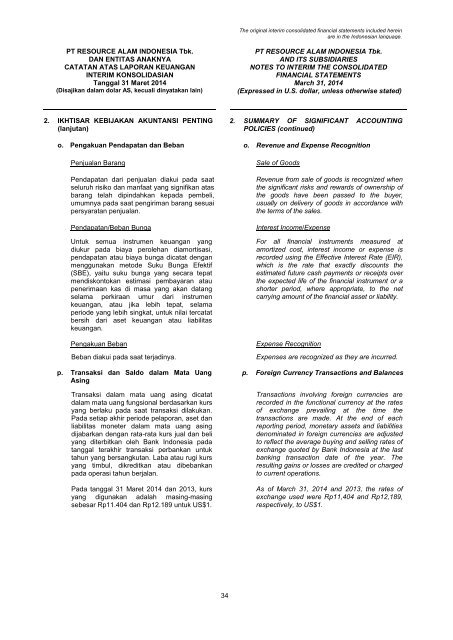

The original interim consolidated financial statements included hereinare in the Indonesian language.PT RESOURCE ALAM INDONESIA Tbk.DAN ENTITAS ANAKNYACATATAN ATAS LAPORAN KEUANGANINTERIM KONSOLIDASIANTanggal 31 Maret 2014(Disajikan dalam dolar AS, kecuali dinyatakan lain)PT RESOURCE ALAM INDONESIA Tbk.AND ITS SUBSIDIARIESNOTES TO INTERIM THE CONSOLIDATEDFINANCIAL STATEMENTSMarch 31, 2014(Expressed in U.S. dollar, unless otherwise stated)2. IKHTISAR KEBIJAKAN AKUNTANSI PENTING(lanjutan)2. SUMMARY OF SIGNIFICANT ACCOUNTINGPOLICIES (continued)o. Pengakuan Pendapatan dan Beban o. Revenue and Expense RecognitionPenjualan BarangPendapatan dari penjualan diakui pada saatseluruh risiko dan manfaat yang signifikan atasbarang telah dipindahkan kepada pembeli,umumnya pada saat pengiriman barang sesuaipersyaratan penjualan.Pendapatan/Beban BungaUntuk semua instrumen keuangan yangdiukur pada biaya perolehan diamortisasi,pendapatan atau biaya bunga dicatat denganmenggunakan metode Suku Bunga Efektif(SBE), yaitu suku bunga yang secara tepatmendiskontokan estimasi pembayaran ataupenerimaan kas di masa yang akan datangselama perkiraan umur dari instrumenkeuangan, atau jika lebih tepat, selamaperiode yang lebih singkat, untuk nilai tercatatbersih dari aset keuangan atau liabilitaskeuangan.Pengakuan BebanBeban diakui pada saat terjadinya.p. Transaksi dan Saldo dalam Mata UangAsingTransaksi dalam mata uang asing dicatatdalam mata uang fungsional berdasarkan kursyang berlaku pada saat transaksi dilakukan.Pada setiap akhir periode pelaporan, aset danliabilitas moneter dalam mata uang asingdijabarkan dengan rata-rata kurs jual dan beliyang diterbitkan oleh Bank Indonesia padatanggal terakhir transaksi perbankan untuktahun yang bersangkutan. Laba atau rugi kursyang timbul, dikreditkan atau dibebankanpada operasi tahun berjalan.Pada tanggal 31 Maret 2014 dan 2013, kursyang digunakan adalah masing-masingsebesar Rp11.404 dan Rp12.189 untuk US$1.Sale of GoodsRevenue from sale of goods is recognized whenthe significant risks and rewards of ownership ofthe goods have been passed to the buyer,usually on delivery of goods in accordance withthe terms of the sales.Interest Income/ExpenseFor all financial instruments measured atamortized cost, interest income or expense isrecorded using the Effective Interest Rate (EIR),which is the rate that exactly discounts theestimated future cash payments or receipts overthe expected life of the financial instrument or ashorter period, where appropriate, to the netcarrying amount of the financial asset or liability.Expense RecognitionExpenses are recognized as they are incurred.p. Foreign Currency Transactions and BalancesTransactions involving foreign currencies arerecorded in the functional currency at the ratesof exchange prevailing at the time thetransactions are made. At the end of eachreporting period, monetary assets and liabilitiesdenominated in foreign currencies are adjustedto reflect the average buying and selling rates ofexchange quoted by Bank Indonesia at the lastbanking transaction date of the year. Theresulting gains or losses are credited or chargedto current operations.As of March 31, 2014 and 2013, the rates ofexchange used were Rp11,404 and Rp12,189,respectively, to US$1.34