2024-02 SUSTAINABLE BUS

In this issue, all the figures on the European e-bus market 2023 (hint: over 40 of the new city buses were electric!), a reporting on #battery manufacturing plans underway in Hungary and their impact on the European #electricbus landscape, a focus on powertrain values and strategies in the realm of e-mobility. Plus, a piece on the challenges faced by #BEV bus adoption in Germany (yes, it's also a matter of TCO).

In this issue, all the figures on the European e-bus market 2023 (hint: over 40 of the new city buses were electric!), a reporting on #battery manufacturing plans underway in Hungary and their impact on the European #electricbus landscape, a focus on powertrain values and strategies in the realm of e-mobility.

Plus, a piece on the challenges faced by #BEV bus adoption in Germany (yes, it's also a matter of TCO).

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

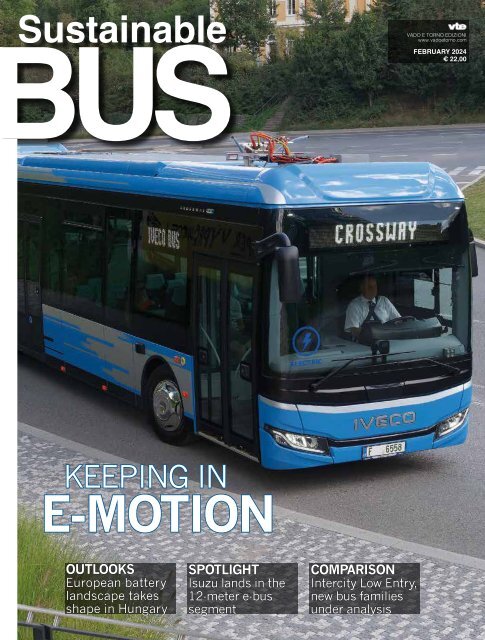

Sustainable<br />

US<br />

VADO E TORNO EDIZIONI<br />

www.vadoetorno.com<br />

FEBRUARY <strong>2<strong>02</strong>4</strong><br />

€ 22,00<br />

KEEPING IN<br />

E-MOTION<br />

OUTLOOKS<br />

European battery<br />

landscape takes<br />

shape in Hungary<br />

SPOTLIGHT<br />

Isuzu lands in the<br />

12-meter e-bus<br />

segment<br />

COMPARISON<br />

Intercity Low Entry,<br />

new bus families<br />

under analysis

Sustainable<br />

<strong>BUS</strong><br />

CONTENTS<br />

<strong>SUSTAINABLE</strong>-<strong>BUS</strong>.COM FEBRUARY <strong>2<strong>02</strong>4</strong><br />

4<br />

POST-IT<br />

Sustainable Bus Tour <strong>2<strong>02</strong>4</strong>:<br />

conferences in Milan and Strasbourg<br />

6<br />

TECHNO<br />

BorgWarner got license<br />

to produce blade battery<br />

10<br />

40<br />

8<br />

10<br />

INFRASTRUCTURE<br />

Genoa will have a flash-charged<br />

line in operation by end 2<strong>02</strong>5<br />

OUTLOOKS<br />

2<strong>02</strong>3 European e-bus market<br />

exceeded 6,000 registrations<br />

14<br />

Trends in e-bus powertrains:<br />

pricing, competition, move to in-house<br />

18<br />

Hungary is becoming EU battery<br />

hotspot: projects and goals<br />

24<br />

Public transport in Germany is switching<br />

to zero-emissions, but support is needed<br />

28<br />

COMPARISON<br />

Iveco Crossway / Setra MultiClass, a look<br />

at newly-updated intercity bus families<br />

18<br />

36<br />

40<br />

IN THE SPOTLIGHT<br />

Isuzu Citivolt 12.<br />

Here it comes the 12-meter BEV!<br />

Next Modular Vehicles NX23.<br />

A startup aims to change mobility<br />

44<br />

PORTFOLIO<br />

All the zero-emission buses<br />

on the European market<br />

MAGAZINE<br />

SUBSCRIPTION<br />

€80<br />

4 ISSUES<br />

36<br />

Starting this year, Sustainable<br />

Bus magazine offers printed<br />

issue subscriptions, adding<br />

a new option alongside<br />

distribution at trade events<br />

and free online access.<br />

Wherever you are located,<br />

you can now subscribe to<br />

receive paper issues directly<br />

to your home or office.<br />

FOR INFO<br />

3

POST-IT<br />

EUROPEAN MAIN PUBLIC TRANSPORT EXPOS IN <strong>2<strong>02</strong>4</strong><br />

The magnificent 11<br />

WHERE TO FIND A COPY OF <strong>SUSTAINABLE</strong> <strong>BUS</strong> MAGAZINE?<br />

The world of public transport and bus technology is poised for an<br />

exciting year ahead, with a lineup of European trade<br />

shows and exhibitions offering a glimpse into the future<br />

of mobility. You'll be able to pick up a copy of Sustainable<br />

Bus magazine in all of those!<br />

First up is the Mobility Move in Berlin, Germany, formerly<br />

known as ElekBu, from March 5 to 7. Backed by the<br />

VDV, highlights the topics of e-mobility and autonomous<br />

driving. In late April <strong>BUS</strong>2<strong>BUS</strong> goes live in Berlin again.<br />

Next, the spotlight shifts to Milan, Italy, for the second<br />

edition of Next Mobility Exhibition from May 8 to 10.<br />

Karlsruhe, Germany, hosts then UITP's IT-TRANS, putting<br />

IT technologies for public transport in the spotlight (as well<br />

as AI, payment, ticketing, cybersecurity). Busworld Turkey<br />

is then back to Istanbul for its 10th edition in late May. In<br />

September, Hannover, Germany, hosts IAA Transportation<br />

from the 17th to the 22nd, featuring for the first time a<br />

dedicated bus theme park within the leading platform for truck<br />

and logistics.<br />

Later that month, Berlin (again!) is home to InnoTrans from<br />

the 24th to the 27th, the world’s leading trade fair for public<br />

transport technology (where buses are playing an increasing<br />

role). Let's move to October. Euro Mobility Expo will be for<br />

the first time held in Strasbourg. Madrid, Spain, hosts FIAA<br />

from October 22 to 25, back to pre Covid dimension (two halls).<br />

In November, Birmingham, UK, set the stage for Euro Bus<br />

Expo, the nation’s premier event for bus and coach operators<br />

since Bus & Coach UK has been permanently cancelled. Finally, Lyon,<br />

France, hosts Autocar Expo from December 3 to 6, showcasing the<br />

latest innovations in buses, coaches, and sustainable mobility solutions,<br />

with a focus on the French market, the largest in EU. <strong>2<strong>02</strong>4</strong> promises to<br />

be an exciting year for the public transport and bus technology industry,<br />

offering valuable opportunities for industry professionals to gather, share<br />

knowledge, and witness the evolution of mobility.<br />

<strong>SUSTAINABLE</strong> <strong>BUS</strong> TOUR<br />

The Sustainable Bus Tour<br />

<strong>2<strong>02</strong>4</strong> will transition to in-person<br />

conferences within Next Mobility<br />

Exhibition in Milan (May) and the<br />

Euro Mobility Expo in Strasbourg<br />

(October). The May conference<br />

will focus on “Balance shifts in<br />

public transport: operators and<br />

industry in the energy transition<br />

era,” addressing topics such as<br />

internationalization and evolving<br />

business models. Macro trends<br />

like electrification and on-demand<br />

transportation are reshaping<br />

business models, prompting<br />

operators to embrace innovation<br />

and flexibility. Meanwhile, industry<br />

players are grappling with<br />

investments and the challenge of<br />

profitability.<br />

The October conference will<br />

delve into the journey towards a<br />

fully zero-emission European city<br />

bus market by 2035, discussing<br />

technological advancements,<br />

market uptake, and financing<br />

models. Questions indeed arise<br />

about supply chain localization,<br />

production scalability, financing,<br />

and battery recycling.<br />

ElekBu this year becomes Mobility Move<br />

THE CHINESE MARKET<br />

China remains the global powerhouse in the EV<br />

market. Recent data from consulting Interact<br />

Analysis show that Geely led both the truck and<br />

bus markets in China in 2<strong>02</strong>3 with sales figures<br />

surging to nearly 75,000 electrified vehicles (a<br />

3-fold increase compared to its closest competitor<br />

Chery Group). Tightening the focus on new<br />

energy buses, the leadership of Geely, Chery and<br />

Chang’an Auto is largely due to sales of smallsized<br />

electric buses (below 7-meter). Foton placed<br />

fourth with 15K units, King Long sold nearly 9,000<br />

e-buses and Yutong placed only 9th with 5.2K<br />

buses. Looking at large-sized buses only (above<br />

10-meter), King Long, Foton and Yutong have<br />

been covering the first positions. The total size of<br />

the Chinese new energy bus market is showed<br />

to be around 160,000 units in 2<strong>02</strong>3. BYD doesn’t<br />

appear in the top 10, as it registered only 1,441<br />

buses in 2<strong>02</strong>3, down by 42% YoY, as Interact<br />

Analysis reports.<br />

Charging<br />

forward<br />

to make zero-emission<br />

transportation work<br />

We make power<br />

last longer.<br />

Our battery technology<br />

makes cleaner power safe<br />

and scalable.<br />

4

TECNHO<br />

TECNHO<br />

A DRIVERLESS PILOT IN THE HEART OF BERLIN<br />

First autonomous steps<br />

BEINTELLI PROJECT SET TO GO LIVE IN SPRING<br />

BATTERY AND TRANSIT <strong>BUS</strong>INESS HAVE BEEN SPLIT<br />

Proterra’s fragmentation<br />

VOLVO GROUP TOOK OVER BATTERY <strong>BUS</strong>INESS<br />

MAN Truck & Bus is collaborating with the Technical<br />

University of Berlin and IAV GmbH to introduce an intelligent<br />

transport system with autonomous vehicles in the heart of Berlin<br />

by spring <strong>2<strong>02</strong>4</strong>. The project, named “BeIntelli,” aims to create a<br />

comprehensive and intelligent traffic solution that incorporates<br />

cutting-edge technologies and autonomous driving capabilities.<br />

The BeIntelli project relies on an interdisciplinary effort,<br />

combining expertise from both academia and industry.<br />

A designated urban test field, stretching from the iconic<br />

Brandenburg Gate across Ernst-Reuter-Platz to the Memorial<br />

Church, serves as a digitalized route for testing and<br />

implementing advanced transportation systems.<br />

The urban test field is equipped with state-of-the-art sensor<br />

technology, including 49 sensors monitoring traffic and the<br />

surrounding area, with 3D lidar radar sensors playing a pivotal<br />

role. This extensive sensor network creates a fully digitalized<br />

route, providing a platform for testing and showcasing the<br />

capabilities of an intelligent transport system.<br />

A key feature of the BeIntelli project is the deployment of<br />

an autonomous MAN electric bus fitted with an Automated<br />

Driving System (ADS) developed by the Technical University of<br />

Berlin. The project aims to lay the groundwork for seamlessly<br />

integrating ADS hardware and software into MAN’s future<br />

autonomous vehicle fleet: the company, according to Head<br />

of Product Strategy Bus Michael Roth, envisions having<br />

autonomous buses ready for series production in regular service<br />

by the end of the decade (in mid-2<strong>02</strong>2 a cooperation with Intelowned<br />

Mobileye was announced).<br />

The autonomous bus, referred to as the “explanatory bus”, is<br />

not only equipped with advanced sensors and communication<br />

components but also features screens within the bus to<br />

visually explain driving skills and technologies to passengers.<br />

This interactive approach enhances public understanding of<br />

autonomous driving systems and their capabilities.<br />

BORGWARNER’S BLADE<br />

BorgWarner has signed an<br />

agreement with BYD subsidiary<br />

FinDreams. BorgWarner will be<br />

in charge of manufacturing LFP<br />

battery packs for commercial<br />

vehicles utilizing blade cells<br />

in Europe, the Americas, and<br />

select regions of Asia Pacific.<br />

The duration of the agreement<br />

is 8 years. Blade battery will be<br />

used also in the bus business,<br />

as the Chinese<br />

giant presented<br />

at Busworld<br />

Europe 2<strong>02</strong>3<br />

a e-bus platform utilizing that<br />

technology.<br />

BorgWarner’s battery capabilities<br />

build back on the purchase<br />

of German battery module<br />

producer Akasol (supplier of<br />

Daimler Buses, among others)<br />

in 2<strong>02</strong>1. Within this deal,<br />

BorgWarner will also receive<br />

a license to use FinDreams’<br />

intellectual property related to its<br />

battery pack<br />

design and<br />

manufacturing<br />

process.<br />

MAN autonomous concept bus ready for use<br />

in Berlin is a Lion’s City E equipped with an<br />

Automated Driving System developed by the<br />

Technical University of Berlin.<br />

Battery diagnostics<br />

Enel X has select the German tech company<br />

Volytica for dedicated battery diagnostics for<br />

electric buses. The collaboration between the<br />

two companies will begin with the deployment<br />

of Latin America’s largest electric bus fleet,<br />

that of Mexico City, using an innovative battery<br />

diagnostic system for real-time monitoring.<br />

The partnership will not only improve battery<br />

performance and fleet efficiency, but also aims<br />

to implement predictive<br />

maintenance measures<br />

and possibly extend<br />

the life cycle of the<br />

batteries themselves. It<br />

also includes the study<br />

of potential second-life<br />

applications, such as<br />

reusing the batteries<br />

for renewable energy<br />

projects or integrating them into power grid<br />

stabilization systems. Volytica has also been<br />

selected by Bridgestone Mobility Solutions<br />

and Webfleet as one of the 12 partners for the<br />

launch of their comprehensive EV Services<br />

Platform. In total, the new platform brings<br />

together various industry leaders, each<br />

contributing unique services to optimize electric<br />

vehicle (EV) operations.<br />

On the 1st February <strong>2<strong>02</strong>4</strong> Volvo announced it has completed<br />

th acquisition of battery business from Proterra. The intention<br />

was announced in November 2<strong>02</strong>3, when Volvo Group had been<br />

selected as the highest bidder in an auction for the business and<br />

assets of the Proterra Powered unit.<br />

Volvo states in a press note that it “intends to run Proterra as a<br />

going concern and deliver to selected customers”.<br />

In August 2<strong>02</strong>3 Proterra filed for Chapter 11 bankruptcy<br />

protection. Phoenix Motorcars‘s bid has win the tender to<br />

acquire Proterra Transit business line.<br />

Volvo acquisition of Proterra battery business, which was<br />

made at a purchase price of USD 210M before adjustment for<br />

inventory level at closing, includes a development center for<br />

battery modules and packs in California and an assembly factory<br />

in Greer, South Carolina. Proterra stated in a Linkedin post: “We<br />

proudly bring more than 400 of our Proterra teammates to carry<br />

the same innovative spirit that has helped transform commercial<br />

vehicle electrification through our industry-leading battery<br />

technology. As a standalone, independent business operating as<br />

Proterra within Volvo Group, our mission remains steadfastly<br />

committed to building innovative battery technology to power a<br />

better, more sustainable world”. It’s worth noticing an apparent<br />

contradiction between Proterra stressing their business remaining<br />

“independent” and Volvo’s statement about the intention to<br />

deliver “to selected customers”.<br />

Concerning the other branch of Proterra’s activities, the bus<br />

manufacturing, Phoenix Motor and the Californian company<br />

have entered into an Asset Purchase Agreement in November 13<br />

2<strong>02</strong>3. Under the Purchase Agreement, Phoenix Motor stated, “the<br />

total cash consideration to be paid by Phoenix for the Proterra<br />

Transit business assets will be $10 million, consisting of $3.5<br />

million for the Proterra Transit operating company and $6.5<br />

million for the Proterra battery lease assets. In addition, Phoenix<br />

will pay certain cure payments and assume other liabilities,<br />

primarily warranties”.<br />

SINO-LITHUANIAN<br />

The Altas Novus City V7, electric novelty in the<br />

Lithuanian manufacturer’s portfolio, has been<br />

on a European roadshow in February, travelling<br />

through Trentino Alto-Adige region (Italy),<br />

Germany, Switzerland and Denmark. Following<br />

its presentation at Busworld in October 2<strong>02</strong>3, the<br />

European commercialization of the 7.5-metre<br />

electric vehicle branded by Altas (in collaboration<br />

with the Chinese Zhongtong) has begun. The<br />

vehicle, now in demo version, will be available to the<br />

European market in its definitive ‘shape’ from late<br />

summer <strong>2<strong>02</strong>4</strong>. The heart of this bus is the electric<br />

motor supplied by Dana TM4, with peak power of<br />

200 kW. The vehicle is powered by four LFP battery<br />

modules totalling 140 kWh, supplied by CATL.<br />

9-TON CAPABLE<br />

e-Bus front independent axle is the latest add in<br />

the product portfolio of BRIST, a supplier of axles,<br />

suspensions and gearboxes with lot of activities<br />

going on in the electric BRT, mini and midi bus<br />

sphere (Hyundai, Alexander Dennis, Karsan,<br />

Anadolu Isuzu, Arrival and CRRC). In late 2<strong>02</strong>3<br />

they launched a new front independent axle<br />

representing a 9 ton (20,000 lbs)-capable variant of<br />

the BRIST-made IFS, which is based on patented<br />

T-joint carrier geometry and has capacity for 8.2<br />

ton. Its core values, speaking of IFS, consist in<br />

the compact design in vertical direction, with low<br />

spring position<br />

and a maximum<br />

steering angle of<br />

56°. The company<br />

claims that this<br />

components<br />

is 7% lighter<br />

than the best<br />

competitor.<br />

6<br />

7

INFRASTRUCTURE<br />

A REAL FIRST FOR ITALY<br />

Flash-charged Genoa<br />

HITACHI FLASH-CHARGING TECHNOLOGY, HESS E-<strong>BUS</strong>ES<br />

Genoa will be the first city in Italy to have an urban line with<br />

a flash charging system in place before the end of 2<strong>02</strong>5. Hitachi<br />

Energy Grid-eMotion charging technologies will indeed support the<br />

electrification of the new bus line of the city of Genoa.<br />

Hitachi Energy announced in late 2<strong>02</strong>3 it has won an order from<br />

Colas Rail Italia, a leader in railway infrastructure, to supply its<br />

Grid-eMotion charging system to the Val Bisagno line, one of four<br />

new Bus Rapid Transit (BRT) lines to be implemented in the city.<br />

Genoa City Council has plan to fully electrify its public<br />

transport by 2<strong>02</strong>5 through the deployment of electric buses and<br />

trolleybuses. More than 70 percent of the new bus lanes will be<br />

reserved and protected.<br />

The Grid-eMotion Flash, the ultrafast charging technology already<br />

adopted for instance in Geneva (TOSA system), will be charging<br />

the buses in just five minutes at the terminals containing Terminal<br />

Feeding Stations. The tenders for the vehicles have been awarded to<br />

Solaris for the trollybuses (as many as 112) and Hess for the e-buses<br />

that are set to be flash-charged thanks to Hitachi technology.<br />

De Lijn future depots<br />

De Lijn‘s board of directors has given ‘green light’<br />

for a new order for charging infrastructure for its<br />

depots. This consists in a framework agreement for<br />

up to 1,600 charging stations to be sourced from two<br />

suppliers, SPIE-Ekoenergetyka and ABB.<br />

The conversion of the depots plays a crucial role<br />

in the greening of De Lijn’s bus fleet. De Lijn will<br />

purchase some 320 to 490 charging points in the first<br />

phase, representing an investment of €15.3 million<br />

for 490 charging points. The framework agreement<br />

allows De Lijn to order a maximum of 1,600 charging<br />

points from two suppliers, SPIE-Ekoenergetyka and<br />

ABB, over a period of up to eight years. In a first<br />

partial order, De Lijn expects to order 320 to 490<br />

charge points divided between the two suppliers.<br />

Concerning Northern Europe, Ekoenergetyka has<br />

selected in January <strong>2<strong>02</strong>4</strong> GodEnergi for distributing<br />

and servicing its products.<br />

8<br />

BORROWING CHARGERS<br />

First Bus announced a collaboration<br />

with the UK’s largest broadband<br />

network provider, Openreach, granting<br />

them access to its rapid EV charging<br />

infrastructure at bus depots nationwide.<br />

The initial phase of the partnership will<br />

witness up to 30 Openreach Electric<br />

Vehicles from its fleet charging at First<br />

Bus depots in Glasgow, Aberdeen,<br />

and Leicester while buses are in<br />

service. This enables Openreach<br />

engineers to cover more ground,<br />

reduce their environmental impact,<br />

and dedicate more time to the needs<br />

of their customers.<br />

Currently, Openreach has more than<br />

3,000 electric vehicles in its fleet – but it<br />

is aiming to convert all its diesel fleet to<br />

zero emissions by 2031 and stands as<br />

a founding member of EV100, a global<br />

initiative uniting companies dedicated<br />

to accelerating the transition to electric<br />

vehicles this decade.<br />

First Bus has the ambition of reaching<br />

a zero-emission bus fleet by 2035.<br />

Openreach joins the<br />

ranks of DPD and Police<br />

Scotland, plugging into<br />

this shared infrastructure<br />

initiative from one of the<br />

UK’s largest bus operators.<br />

The Crossway Low Entry ELEC marks a new step forward towards<br />

an even more sustainable mobility.<br />

12 m and 13 m long versions, available in Class I and Class II<br />

Central electric motor 290 kW output for a maximum torque of 3000 Nm<br />

NMC Lithium battery pack assembled by FPT Industrial<br />

Various charging interfaces, including optional pantograph bottom-up or rails for top-down

OUTLOOKS<br />

42 percent of city buses<br />

were zero-emission (BEV<br />

and hydrogen), growing<br />

3-fold compared to 15<br />

percent in 2<strong>02</strong>0. And<br />

2<strong>02</strong>3 was also a recordbreaking<br />

year for fuel cell<br />

bus deliveries, as many as<br />

207, growing 111 percent<br />

on 2<strong>02</strong>2 and 32 percent on<br />

former record-year 2<strong>02</strong>1.<br />

In 2<strong>02</strong>3, 13,466 buses featuring<br />

alternative drivelines<br />

were registered. This<br />

represents a substantial 41<br />

percent increase compared<br />

to the previous year,<br />

primarily fueled by the<br />

growing volume of electric<br />

and hybrid buses.<br />

THE SLOW GROWTH<br />

OF HYDROGEN <strong>BUS</strong>ES<br />

The year 2<strong>02</strong>3 saw a notable increase<br />

in the adoption of hydrogen-powered<br />

buses in Europe, with<br />

a total of 207 registrations—more<br />

than double the previous year’s<br />

count of 99 in 2<strong>02</strong>2, and surpassing<br />

the previous record of 158 set<br />

in 2<strong>02</strong>1. Solaris led the pack with<br />

77 registrations, followed by Van<br />

Hool and Caetano with 34 each. Behind:<br />

Alexander Dennis (20 units),<br />

the Polish Neso Bus with 20 vehicles<br />

delivered as well, Wrightbus<br />

with 15 H2 buses and, finally, the<br />

first 7 eCitaro fuel cell registered in<br />

the region.<br />

A fleet of 577 hydrogen buses (considering<br />

only those delivered from<br />

2012 on) was operational as of<br />

January 1st <strong>2<strong>02</strong>4</strong>. Solaris claimed<br />

the top position with 181 buses,<br />

followed by Van Hool with 140, and<br />

Wrightbus with 97.<br />

10<br />

ELECTRIC <strong>BUS</strong> MARKET 2<strong>02</strong>3. AND THE WINNER IS...<br />

IT’S RAINING EV<br />

Plot twist in the European e-bus market. MAN<br />

took the lead last year growing over 3-fold. Over<br />

6,000 battery-electric buses were registered,<br />

growing 53 percent on 2<strong>02</strong>2<br />

In recent years, the European bus<br />

market has undergone a paradigm<br />

transformation, and it’s not a figure<br />

of speech. Who would have<br />

thought, just a few years ago, that almost<br />

one out of two urban buses sold in<br />

Europe could be powered by batteries?<br />

But this is precisely what has already<br />

happened, and figures from consulting<br />

Chatrou CME Solutions on alternative<br />

drive bus registrations are a testament<br />

of such development.<br />

Absolute volume of battery-electric bus<br />

registrations grew from 4,152 in 2<strong>02</strong>2<br />

to 6,354 in 2<strong>02</strong>3 in EU27, UK, Iceland,<br />

Norway, and Switzerland: a 53 percent<br />

growth. 42 percent of city buses were zero-emission<br />

(BEV and hydrogen), growing<br />

3-fold compared to 15 percent in<br />

2<strong>02</strong>0. And 2<strong>02</strong>3 was also a record-breaking<br />

year for fuel cell bus deliveries<br />

(as many as 207, growing 111 percent<br />

on 2<strong>02</strong>2 and 32 percent on former record-year<br />

2<strong>02</strong>1. More info in the box).<br />

In 2<strong>02</strong>3, 13,466 buses featuring alternative<br />

drivelines were registered. This<br />

represents a substantial 41 percent increase<br />

compared to the previous year,<br />

primarily fueled by the growing volume<br />

of electric and hybrid buses.<br />

Three alternative buses every four<br />

Every four city buses registered in Europe,<br />

three are now ‘alternatively’-fueled<br />

(it was 62 percent in 2<strong>02</strong>2 and 52<br />

in 2<strong>02</strong>0).<br />

The shortlist of market leaders in the<br />

e-bus segment has just witness a plot<br />

twist, with MAN taking the lead of the<br />

PLOT TWIST ON THE PODIUM<br />

2<strong>02</strong>3** 2<strong>02</strong>2** 2<strong>02</strong>1** 2<strong>02</strong>0* 2019* Trend volumes Market Market Trend market<br />

2<strong>02</strong>3/2<strong>02</strong>2 % share 2<strong>02</strong>3 % share 2<strong>02</strong>2 % share 2<strong>02</strong>3/2<strong>02</strong>2 %<br />

MAN 785 230 134 25 0 241,3 12,4 5,5 6,9<br />

Solaris 725 342 390 416 145 112,0 11,4 8,2 3,2<br />

Yutong 483 479 303 164 105 0,8 7,6 11,5 -3,9<br />

Wrightbus 469 112 *** *** *** 318,8 7,4 2,7 4,7<br />

BYD - ADL 448 465 375 190 79 -3,7 7 11,2 -4,2<br />

Mercedes 446 405 333 99 126 10,1 7 9,8 -2,8<br />

BYD 358 322 257 424 236 11,2 5,6 7,8 -2,2<br />

Iveco Bus / Heuliez Bus 356 347 274 114 83 2,6 5,6 8,4 -2,8<br />

Volvo Buses 345 232 211 217 135 48,7 5,4 5,6 -0,2<br />

Zhongtong 249 *** *** *** *** - 3,9 *** -<br />

Zonson 232 *** *** *** *** - 3,7 *** -<br />

Irizar 211 110 201 24 127 91,8 3,3 2,6 0,7<br />

Ebusco 193 78 132 109 1<strong>02</strong> 147,4 3 1,9 1,1<br />

Karsan 187 135 36 23 *** 38,5 2,9 3,3 -0,4<br />

Golden Dragon 136 133 53 *** *** 2,3 2,1 3,2 -1,1<br />

VDL 108 344 178 127 386 -68,6 1,7 8,3 -6,6<br />

* Registrations in Estonia, Latvia, Lithuania, Czech Republic, Slovakia, Hungary, Croatia, Romania and Slovenia are not counted<br />

** Registrations EU27+UK+ICE+NO+CH<br />

*** Figure not available<br />

Based on Chatrou - CME Solutions data on battery-electric bus registrations (excluding trolley buses) above 8 ton.<br />

market thanks to 785 Lion’s City E registered<br />

in the continent, over three times<br />

the 2<strong>02</strong>2’s figure of 230. The Lion is<br />

followed by Solaris (725, doubling the<br />

previous year), Yutong (483) and the<br />

other surprise: Wrightbus (469 units,<br />

thanks to a striking +318 percent).<br />

However, looking at the ‘pie’ of zero<br />

emission bus providers and thus including<br />

fuel cell powered vehicles, Solaris<br />

keeps the lead with 8<strong>02</strong> vehicles.<br />

Looking at the wider 12-years period<br />

surveyed by Chatrou CME Solutions,<br />

as many as 19,000 e-buses have been<br />

registered, with Polish Solaris still at<br />

11

OUTLOOKS<br />

Looking at the 12-years<br />

period surveyed by Chatrou<br />

CME Solutions, 19,000<br />

e-buses have been registered,<br />

with Solaris at the<br />

helm of the market with<br />

2,188 vehicles and a share<br />

of 11.5 percent. BYD follows<br />

with 1,768 registrations,<br />

then BYD-ADL with 1,716.<br />

HYBRID’HUNGER (AS<br />

LONG AS THEY’RE MILD)<br />

A notable development involved<br />

hybrid bus registrations, that increased<br />

from 2,018 in 2<strong>02</strong>2 to<br />

4,<strong>02</strong>2. In the meanwhile, plug-in<br />

and full hybrid bus projects were<br />

largely abandoned.<br />

Such an increase is due to mild<br />

hybrid tractions, widely chosen as<br />

a funded alternative to combustion<br />

engine buses. On the other<br />

hand, gas-powered buses are facing<br />

though times in the Class 1<br />

segment. Their absolute volume<br />

dropped from 3,274 in 2<strong>02</strong>2 to<br />

2,883 in 2<strong>02</strong>3 (-12 percent), but<br />

CNG share in the interurban segment<br />

is still growing from 978 in<br />

2<strong>02</strong>2 to 1,187 in 2<strong>02</strong>3.<br />

EUROPEAN LANDSCAPE<br />

2<strong>02</strong>3 2<strong>02</strong>2 2<strong>02</strong>1 2<strong>02</strong>0 Trend e-bus<br />

registrations<br />

2<strong>02</strong>3/2<strong>02</strong>2 %<br />

UK 1,206 685 540 288 76.1<br />

Germany 753 581 555 350 29.6<br />

Norway 493 216 86 210 128.2<br />

Spain 491 136 127 42 261.0<br />

France 416 549 512 133 -24.2<br />

Italy 400 121 178 97 230.6<br />

Romania 368 161 65 0 128.6<br />

Portugal 364 52 31 8 600<br />

Poland 336 149 215 196 125.5<br />

Sweden 296 256 189 206 15.6<br />

Denmark 200 381 217 1 -47.5<br />

Belgium 172 42 19 12 309.5<br />

Netherlands 167 95 152 445 75.8<br />

Switzerland 145 81 37 7 79.0<br />

Finland 104 279 190 25 -62.7<br />

Based on Chatrou - CME Solutions data on battery-electric bus registrations (excluding trolley<br />

buses) above 8 ton.<br />

the helm of the market with 2,188 electric<br />

buses and a share of 11.5 percent.<br />

BYD follows with 1,768 registrations,<br />

then BYD-Alexander Dennis with a total<br />

of 1,716 buses.<br />

The UK is still leading the pie of coun-<br />

tries where most of the e-buses are<br />

deployed, with 1,206 electric buses<br />

registered in 2<strong>02</strong>3 (it means one out<br />

of five e-buses registered in Europe)<br />

and 3,041 delivered within 2012 and<br />

2<strong>02</strong>3. Germany is second with 753<br />

units (2,562 in the last 12 years), followed<br />

by the small Norwegian market,<br />

where 493 e-buses were registered in<br />

2<strong>02</strong>3. And it’s worth mentioning also<br />

the fourth country in the list: Spain had<br />

491 e-buses enrolled last year.<br />

Available in 2 or 3 doors version<br />

231 kWh Energy for up to 300 km Range<br />

HYDRON<br />

Fuel Cell Range Extender<br />

Hy4Drive System for up to 400 km Range<br />

12

OUTLOOKS<br />

Growth in electric bus<br />

sales leads to a subsequent<br />

increase in component<br />

sales. Europe, defined<br />

as the EU 27 plus the UK,<br />

had forecast component<br />

powertrain sales of $0.73<br />

billion in 2<strong>02</strong>3 (preliminary<br />

figures), with $1.03 billion<br />

forecast for 2<strong>02</strong>6 and $1.38<br />

billion for 2030. The fastest<br />

growth period is from 2<strong>02</strong>3<br />

to 2<strong>02</strong>5 as electric buses<br />

start to become the preferred<br />

choice (rather than<br />

diesel) in some countries<br />

in Europe.<br />

POWERTRAIN <strong>BUS</strong> REVENUE TO HIT $1BN IN EUROPE<br />

THE VALUE OF<br />

POWERTRAINS<br />

E-bus powertrain revenue are set to grow fast<br />

until 2<strong>02</strong>5. The princing issue and the move<br />

towards in-house production may upset the<br />

apple cart, according to Interact Anaysis<br />

The revenue from powertrain components<br />

is forecast to reach a billion<br />

US dollars in 2<strong>02</strong>6 in Europe<br />

(and a billion euros in 2<strong>02</strong>7 at the<br />

present exchange rates), according to Interact<br />

Analysis’ latest research. This is for<br />

BEV buses only, which dominate, and excludes<br />

a smaller amount of business in electrified<br />

hybrid and hydrogen buses.<br />

The fastest growth period is from 2<strong>02</strong>3 to<br />

2<strong>02</strong>5 as electric buses start to become the<br />

preferred choice (rather than diesel) in some<br />

countries in Europe. In countries with strong<br />

government support, battery electric buses<br />

have reached a point where they can be very<br />

successful, as product availability, low running<br />

cost and clean air targets should combine<br />

to see a lot of sales. Some places, such<br />

as the Netherlands and much of Scandinavia,<br />

already see battery electric as the default<br />

choice for a bus and we expect that this will<br />

steadily become the case in other countries<br />

over the next few years, including France,<br />

Germany and the UK.<br />

Electrification spreading in Europe<br />

It is not just Western Europe that is seeing<br />

bus electrification though. Eastern Europe is<br />

not necessarily slower and has seen some<br />

very significant deals, so understanding<br />

where growth will be faster and where it will<br />

be slower is arguably a case of analyzing<br />

country by country and city by city rather<br />

than looking at regions within Europe.<br />

From 2<strong>02</strong>6 we forecast slower growth for<br />

electric buses as some cities and countries<br />

will already have a high percentage of new<br />

buses electrified by 2<strong>02</strong>6.<br />

This growth in electric bus sales leads to a<br />

subsequent increase in component sales.<br />

Europe, defined as the EU 27 plus the UK,<br />

had forecast component powertrain sales of<br />

$0.73 billion in 2<strong>02</strong>3 (preliminary figures),<br />

with $1.03 billion forecast for 2<strong>02</strong>6 and<br />

$1.38 billion for 2030.<br />

Europe to stay behind China<br />

China already has a >$3 billion annual powertrain<br />

component market for buses (referring<br />

here to components sold for buses registered<br />

within China, not sales of Chinese<br />

buses or components to Europe). This is due<br />

to a much higher percentage of new buses<br />

being electric, so Europe will still be well behind<br />

China, even in 2<strong>02</strong>6. However, electric<br />

buses in Europe are becoming more common<br />

than in many other parts of the world.<br />

Of the total bus sales per year in Europe (40-<br />

50,000), we expect over 14,000 to be electric<br />

in 2030. This is mainly due to low adoption<br />

of electrification for rural and intercity buses.<br />

Urban buses will predominantly be battery<br />

electric by 2030, in line with negotiations<br />

at EU level (not yet concluded at the time<br />

of printing this magazine issue) for full zero<br />

emission city bus market in 2035 with intermediate<br />

target of 90% in 2030.<br />

China also has much lower component<br />

pricing than Europe. If Chinese companies<br />

manage to make inroads into the<br />

European market for completed battery<br />

packs (rather than just cells), motors and<br />

other products, prices could fall. In the<br />

long term, Chinese companies may be<br />

capable of winning a high share.<br />

However, at the moment, the political environment,<br />

the time to setup operations, and<br />

the fact some companies are not yet well<br />

Interact Analysis is a<br />

market research firm with<br />

a specific department for<br />

truck, bus and off-highway<br />

electrification. Here on<br />

Sustainable Bus Magazine<br />

we host a contribution<br />

from the research analyst<br />

Jamie Fox.<br />

known, means that in the next few years<br />

the share of Chinese companies will remain<br />

low for many products. However, the price<br />

gap is very large – as more people come<br />

to understand that Chinese products can<br />

be half price rather than 10% less – these<br />

products may eventually start to command<br />

attention. However, of course these are<br />

prices for sales within China. As Chinese<br />

companies have to pay for overseas sales<br />

and marketing, travel to Europe, shipping<br />

and the costs of complying with European<br />

regulations the price advantage does reduce<br />

substantially, but even so, Chinese products<br />

are likely to remain significantly less expensive<br />

than those from most other countries<br />

including from within Europe.<br />

Leading battery pack providers for on-road<br />

vehicles (including trucks and sales outside<br />

Europe) ranked in Interact Analysis’ 'Electrified<br />

truck and bus components – 2<strong>02</strong>3'<br />

report include BorgWarner (Akasol), BMZ,<br />

BYD, CATL, Forsee Power, Northvolt,<br />

SAFT and Xalt Energy. These companies<br />

have expanded their offerings, however the<br />

market is quite diverse and there are many<br />

smaller suppliers in-play with no single<br />

dominant company.<br />

For other components, ZF has excelled for<br />

several years with its portal axle products,<br />

although it currently faces strong competition<br />

in buses from central drive designs.<br />

Bosch is another company well placed to<br />

address the market for powertrain components<br />

in electric vehicles in on-road vehicles.<br />

There is also still time for new entrants<br />

to disrupt the market or for existing players<br />

to carve out a strong niche.<br />

A in-house trend?<br />

In addition, there are also some companies<br />

that produce components in-house<br />

(i.e. vehicle manufacturers that produce<br />

their own components). Interact Analysis<br />

forecast’s this trend to grow, with inverters,<br />

battery packs and PDUs being some<br />

of the components that are increasingly<br />

being planned for in-house production<br />

14<br />

15

outlooks<br />

Revenue ($B)<br />

DOUBLING REVENUES<br />

2,5<br />

2<br />

1,5<br />

1<br />

0,5<br />

0<br />

2019<br />

E-bus powertrain revenue<br />

Source: Interact Analysis<br />

in the future. In the 2030s, it’s possible<br />

that the in-house share of production is<br />

a similar share of the market to external<br />

purchasers, as OEMs look to replace lost<br />

revenue from diesel business and minimize<br />

job losses as electric vehicles have<br />

fewer moving parts and may require less<br />

maintenance. Once this is factored in, it’s<br />

not clear whether growth for components<br />

suppliers will continue after 2030.<br />

The move to in-house component production<br />

is more likely to happen at bigger companies<br />

where sales are high, such as bus<br />

OEMs that also have other divisions selling<br />

other types of vehicles, or the largest industry<br />

players. Smaller firms will purchase<br />

SPLITTING THE PRICE OF A BEV <strong>BUS</strong><br />

Battery BMS, Thermal<br />

16%<br />

Battery Pack<br />

71%<br />

2<strong>02</strong>1 2<strong>02</strong>3 2<strong>02</strong>5 2<strong>02</strong>7 2<strong>02</strong>9 2031 2033 2035<br />

Share of battery electric bus 2<strong>02</strong>6 powertrain revenue<br />

Source: Interact Analysis<br />

most products externally, although they<br />

may still buy cells and package them rather<br />

than buying a complete battery pack.<br />

The heavy role of battery<br />

The powertrain revenue is dominated by<br />

the battery pack – 71% of the forecast 2<strong>02</strong>6<br />

revenue, or as much as 87% if we include<br />

the battery BMS and battery thermal in the<br />

total. This is a higher share than is often the<br />

case: for trucks and off-road machinery the<br />

battery pack's related value is lower.<br />

Why is this? There are two main reasons.<br />

Firstly, buses need to have a long<br />

range so they can repeat the same route<br />

over and again, with either one or pref-<br />

Motor, Inverter, DC-DC,<br />

Transmission, Onboard Charger, PDU<br />

13%<br />

erably no charges during the day. This<br />

means that 200 miles is a typical needed<br />

range, with 400kWh being a common<br />

battery size in Europe. The battery size<br />

chosen for a bus also has to factor in a<br />

large cooling and/or heating demand for<br />

the passengers. The large battery, which<br />

often has to last well over 500,000 km,<br />

is what leads to the high value.<br />

Secondly, the power required for buses<br />

is not as high as some trucks or off-highway<br />

machinery as they often operate at<br />

In the 2030s, it’s possible<br />

that the in-house share<br />

of production is a similar<br />

share of the market to external<br />

purchasers, as OEMs<br />

look to replace lost revenue<br />

from diesel business and<br />

minimize job losses as<br />

electric vehicles have fewer<br />

moving parts and may<br />

require less maintenance.<br />

Components prices have peaked?<br />

Component prices, including battery<br />

packs, motors and inverters rose<br />

from 2<strong>02</strong>0 to 2<strong>02</strong>2/2<strong>02</strong>3 due to<br />

an increase in raw materials<br />

cost and supply chain<br />

difficulties that affected<br />

prices. However, raw materials<br />

costs and the supply<br />

chain returned to normality<br />

within 2<strong>02</strong>3 and we<br />

expect to see prices decline<br />

again in <strong>2<strong>02</strong>4</strong>, as would<br />

be expected in a growing,<br />

innovative market like this<br />

one. However, the unit growth<br />

in electric vehicles will be faster than<br />

price declines, so revenue of compolow<br />

speeds in cities and don’t need to<br />

climb over mountainous areas. Therefore,<br />

the value of motors and inverters<br />

is more modest than in the case of trucks<br />

and off-road vehicles.<br />

So, at first glance, buses are perhaps a<br />

better opportunity for battery manufacturers<br />

rather than for other components such<br />

as motors and inverters. However, a high<br />

profit margin is more difficult to achieve in<br />

the highly competitive battery pack market,<br />

whereas some other components have<br />

fewer suppliers and are more of an opportunity<br />

for manufacturers to carve out a<br />

strong position. This may be achieved<br />

through some technological innovation,<br />

or just having a well-run company<br />

with strong product development<br />

and good marketing.<br />

The powertrain revenue is<br />

dominated by the battery<br />

pack – 71% of the forecast<br />

2<strong>02</strong>6 revenue, or as much<br />

as 87% if we include BMS<br />

and battery thermal in the<br />

total. This is a higher share<br />

than is often the case: for<br />

trucks and off-road machinery<br />

the battery pack's<br />

related value is lower.<br />

The power required for<br />

buses is not as high as<br />

some trucks or off-highway<br />

machinery as they often<br />

operate at low speeds in<br />

cities. Therefore, the value<br />

of motors and inverters is<br />

more modest than in the<br />

case of trucks and off-road<br />

vehicles.<br />

nents is still forecast to increase. Some<br />

companies are trying to avoid cutting<br />

prices as the difficult environment of<br />

2<strong>02</strong>2 made it hard to make a profit and<br />

the hope is to return to profitability by<br />

maintaining prices at the same level in<br />

<strong>2<strong>02</strong>4</strong>. However, we believe that holding<br />

prices steady will be difficult as competitive<br />

pressures will likely return in<br />

<strong>2<strong>02</strong>4</strong>.<br />

Jamie Fox (Interact Analysis)<br />

16<br />

17

OUTLOOKS<br />

18<br />

BATTERY PRODUCTION PLANS IN HUNGARY. INVESTMENTS AND STRATEGIES<br />

INTO EUROPEAN<br />

BATTERY HEAVEN<br />

Hungary emerges as a key hub for EV battery<br />

production, attracting manufacturers and<br />

suppliers. Government aims to achieve 250<br />

GWh/year capacity (today it’s 87 GWh/year)<br />

Hungary - the future paradise for<br />

EV battery manufacturers?<br />

Over the last years, many of the<br />

leader EV traction battery manufacturers<br />

and their suppliers chose Hungary<br />

as the location of their newly established<br />

manufacturing plants. This is in line with<br />

the goal of the Hungarian government to<br />

become one of the main battery producer<br />

countries not only in Europe, but also at<br />

global level. We provide an insight into the<br />

background of the events and an overview<br />

about the companies involved.<br />

As we all know by now, the future of the automotive<br />

industry - including buses - is green<br />

and electric, but Europe, the former frontrun-<br />

Hungary economy minister<br />

Márton Nagy stated that the<br />

government has plans to<br />

build up an annual battery<br />

production capacity of 250<br />

GWh in the next few years,<br />

which, according to him,<br />

would cover 35 percent of<br />

the European needs and<br />

would put the country to<br />

the fourth place worldwide<br />

(after China, US, Germany).<br />

By November 2<strong>02</strong>3, battery<br />

production capacity in<br />

Hungary reportedly already<br />

reached 87 GWh/year.<br />

HUNGARIAN BATTERY LANDSCAPE TAKING SHAPE<br />

Name Origin Total annual Location of Starting year Main Use of the brand’s<br />

production output Hungarian plant(s) of operation customers products in e-buses<br />

BYD China t.b.a. Fót t.b.a. BYD BYD (with own<br />

and custom bodywork)<br />

CATL China 100 GWh Debrecen 2<strong>02</strong>5 BMW, Daimler, Yutong, Higer,<br />

Tesla, Toyota,<br />

King Long, Solaris,<br />

Volkswagen, Volvo etc. CaetanoBus, Ikarus etc.<br />

EVE Power China 28 GWh Debrecen 2<strong>02</strong>6 BMW<br />

Samsung SDI South Korea 40 GWh+ Göd 2017 BMW, Hyundai, Mercedes-Benz, Van Hool,<br />

Stellantis, Volkswagen Gillig, IIA, Otokar,Credobus etc.<br />

SK Innovation South Korea 47,3 GWh* Komárom, Iváncsa 2019 Daimler, Volkswagen<br />

Sunwoda China t.b.a. Nyíregyháza 2<strong>02</strong>5 t.b.a.<br />

*possibility to be increased to 53,5 GWh<br />

EV battery cell, module and pack manufacturers in Hungary<br />

ner of the industrial revolution, now seems<br />

to struggle to take part in the global transition.<br />

One of the key products of the future<br />

are traction batteries, essential components<br />

of any electric - or even fuel cell powered -<br />

vehicles. While the center of battery R&D<br />

is typically located in the Far East, Europe<br />

is trying to stay competitive by hosting local<br />

factories of the industry leading companies.<br />

Within the European Union, Hungary puts a<br />

particularly high stake on EV battery plants,<br />

in the hope that it will find itself among the<br />

leading countries of an emerging industry<br />

within a few years.<br />

A way to remain part of the game<br />

Commitment to green mobility is not the<br />

only motivation for attracting large battery<br />

manufacturers to the small Central European<br />

country. As automotive industry gradually<br />

turns to more sustainable - practically electric<br />

- drivelines, fear of change (and the loss<br />

of the combustion engine market) also increases<br />

in Hungary, whose economy is currently<br />

highly dependent on automotive industry.<br />

Today, according the the estimations of the<br />

government, the conventional automotive<br />

sector is responsible for nearly 20 percent<br />

of the country’s total GDP, which comes<br />

not only from the large OEMs present at the<br />

country - namely Suzuki, Audi, Mercedes-<br />

Benz, Stellantis (Opel), with a new BMW<br />

assembly plant being under construction -,<br />

but also the many local and multinational<br />

industry suppliers settled in Hungary during<br />

the last decades. However, producing traction<br />

batteries in large amounts seems to be a<br />

good card to remain part of the game in the<br />

future as well.<br />

For the above reasons, the establishment of<br />

factories related to the EV battery industry<br />

(including supplier products) enjoys huge<br />

financial and political support from the Hungarian<br />

government - a reason often mentioned<br />

by the battery manufacturers themselves<br />

when they are asked about their reasons why<br />

choosing Hungary as the location of their<br />

newest plants. The central position of the<br />

country within the region, the local big car<br />

factories and the relative proximity of others<br />

in the neighbouring countries - such as Slovakia,<br />

Romania or even the Czech Republic<br />

- also contributes in making Hungary a considerable<br />

place for such investments.<br />

The full EV supply chain<br />

In almost every month in 2<strong>02</strong>3, the Hungarian<br />

media could report on the announcement<br />

of the establishment of a new plant related to<br />

the EV battery industry. Márton Nagy, national<br />

economy minister of Hungary stated at a<br />

press event in September that the government<br />

has plans to build up an annual battery production<br />

capacity of 250 GWh in the next few<br />

years, which, according to him, would cover<br />

35 percent of the European needs and would<br />

put the country to the fourth place worldwide,<br />

right after China, the United States and<br />

Germany. Indeed, by November 2<strong>02</strong>3, battery<br />

production capacity in Hungary reportedly<br />

already reached 87 GWh/year, not including<br />

the newest SK Innovation plant, which is<br />

expected to begin production soon and to<br />

provide an additional output of 30 GWh/year<br />

alone when operating on full throttle.<br />

It is also worth mentioning that not only battery<br />

cell and module producers, but also all<br />

participants of the whole supply chain, such<br />

as electrolyte, anode, cathode, aluminum/<br />

copper foil, separator foil and battery part<br />

manufacturers, as well as industrial waste<br />

recycling firms are welcomed by the Hungarian<br />

government, which is well demonstrated<br />

by the various recent local investments of<br />

these companies. Moreover, there are even<br />

plans for local lithium extraction, by exploiting<br />

geothermic deposits.<br />

A hotspot of Eastern investments<br />

EV battery cell and module manufacturers<br />

currently present at Hungary come from the<br />

Far East - namely South Korea, Japan, and,<br />

first of all, China. The supplier segment is<br />

also dominated by these countries, for whom<br />

setting up a local production base in a relatively<br />

cheap but well-located EU-member<br />

state provides an entrance to the European<br />

market. Some political concerns raise at European<br />

level, especially in case of China.<br />

And where are all these batteries going, can<br />

we see them in e-buses? Well, although the<br />

products of some of these manufacturers,<br />

such as Samsung SDI or CATL can be found<br />

in electric buses too and some of the locally<br />

produced cells would be suitable for use in<br />

19

OUTLOOKS<br />

LOW-VOLTAGE BATTERY MANUFACTURERS<br />

Apart from the industry-flagship traction batteries, producers of low-voltage<br />

starter batteries also enjoy considerable support from the Hungarian<br />

government. Japanese battery manufacturer GS Yuasa opened its first<br />

European factory in Miskolc, northeastern Hungary, in 2019, where 12V<br />

automotive lithium-ion batteries are produced.<br />

The initial production capacity of<br />

500,000 units/year is planned to be increased<br />

soon, but the company’s future<br />

vision also include installation of lithium-ion<br />

cell manufacturing process in the<br />

plant. Jász-Plasztik - which is an exception<br />

in a context dominated by Far Eastern<br />

companies, since it is a Hungarian-owned<br />

firm - also received state financial support<br />

in recent years to increase its production<br />

capacity.<br />

electric or fuel cell powered buses as well, at<br />

the moment most customers of the battery industry<br />

products produced in Hungary are coming<br />

from the passenger car business. Some<br />

of the OEMs representing the main customer<br />

market also operate in Hungary, while the<br />

local Hungarian bus industry - which is currently<br />

a shadow of its former glory, although<br />

some developments have been done the<br />

last years - plays a negligible role for now.<br />

The only exception is BYD, which operates<br />

(among others) a bus assembly plant in Hungary<br />

and uses its own batteries.<br />

In below, we provide a slight overview about<br />

the EV battery producer companies which<br />

already operate manufacturing plants in<br />

Hungary or announced to do so in the near<br />

future. We also take a look at their products<br />

and manufacturing capacity.<br />

BYD<br />

An internationally well-known and respected<br />

Chinese company, BYD has special connections<br />

in Hungary. Its already mentioned bus<br />

assembly plant in Komárom started operations<br />

in 2017, and now is the only foreignowned<br />

bus factory in a country which has a<br />

huge heritage in bus and coach manufacturing.<br />

BYD is also the current leader of the<br />

local e-bus market, but buses will not be the<br />

only vehicles that roll off Hungarian production<br />

lines. On December 22, 2<strong>02</strong>3 it was officially<br />

confirmed that BYD will build up its<br />

first European electric passenger car assembly<br />

plant in the city of Szeged, in the southeastern<br />

corner of Hungary. Last but not least,<br />

BYD’s battery business branch also plans to<br />

establish a manufacturing unit in the country,<br />

namely at Fót, in the northeastern agglomeration<br />

of Budapest.<br />

It is important to note that unlike the previously<br />

mentioned EV battery makers, BYD<br />

would not manufacture battery cells in Hungary,<br />

but would establish an assembly plant<br />

for battery packs, without the use of harmful<br />

chemicals. When officially announcing<br />

the new plant’s arrival in June 2<strong>02</strong>3, Péter<br />

Szijjártó, minister of foreign affairs and trade<br />

of Hungary stated that the total value of the<br />

investment is 10 billion HUF (nearly 27 million<br />

euros), with a financial support of 1 billion<br />

HUF from the Hungarian government.<br />

The initial plans include a workforce of<br />

100 people. The battery modules and packs<br />

would be assembled from cells based on Li-<br />

FePO4 chemistry, which themselves would<br />

come to Fót from other BYD facilities. The<br />

Hungarian-assembled batteries are intended<br />

for use in various electric vehicles, including<br />

e-buses. However, neither the exact vehicle<br />

types, nor the factory’s planned production<br />

output has been confirmed yet.<br />

CATL<br />

The largest EV battery maker of the world for<br />

six consecutive years by now (according to<br />

the 2<strong>02</strong>2 report of the SNE Research market<br />

SK Innovation<br />

Another major player from South Korea,<br />

battery industry giant SK Innovation operesearch<br />

and consultant company from South<br />

Korea), CATL is a well known supplier of<br />

many electric cars and buses worldwide. The<br />

Chinese industry giant is also considered to<br />

be one of the most important company in the<br />

Hungarian economy in the future. Although<br />

not operating yet, it is already decided and<br />

officially announced that CATL will establish<br />

a huge battery cell manufacturing plant<br />

in Debrecen, the second most populous city<br />

of Hungary. This will be the second battery<br />

manufacturing base of the company outside<br />

China, after commissioning the first such<br />

unit in Erfurt, Thuringia, Germany.<br />

The project, which is the biggest greenfield<br />

investment to date in Hungary with its total<br />

value of 7.34 billion euros, enjoys great support<br />

from the Hungarian government, in order<br />

to create an estimated 9,000 jobs locally.<br />

According to the available industry news,<br />

CATL’s Debrecen plant will produce NMC<br />

cells in prismatic and cylindrical format. Production<br />

output in the first phase will be an<br />

impressive 40 GWh/year, with plans already<br />

announced to increase it to even 100 GWh/<br />

BYD plant is the only<br />

foreign-owned bus factory<br />

in Hungary. The group<br />

has plans to establish an<br />

assembly facility for battery<br />

packs. CATL will establish a<br />

battery cell manufacturing<br />

plant in Debrecen, the<br />

second most populous city<br />

of Hungary. This will be the<br />

2nd battery manufacturing<br />

base of the company<br />

outside China, after the one<br />

in Erfurt, Germany.<br />

year in the near future. Trial production is<br />

planned to start at the beginning of 2<strong>02</strong>5.<br />

Modules and cells produced at the Debrecen<br />

factory will appear in electric models of approximately<br />

30 different car manufacturers,<br />

including BMW, Daimler, Volkswagen, Toyota,<br />

Volvo and Tesla. CATL traction batteries<br />

are also widely used by e-bus manufacturers,<br />

among others the world’s largest<br />

bus and coach manufacturer Yutong and the<br />

Hungarian brand Ikarus.<br />

EVE Power<br />

In May 2<strong>02</strong>3, another major battery industry<br />

investment was officially announced on the<br />

Hungarian media: EVE Power, another powerful<br />

Chinese participant of the EV battery<br />

industry, will establish its first European production<br />

plant in Debrecen. It will supply 6thgeneration<br />

cylindrical lithium-ion battery<br />

cells, most probably in a 4695 format, for the<br />

future BMW battery module assembly plant<br />

located also in the same city, with a massive<br />

production capacity of 28 GWh/year. The total<br />

value of the investment exceeds 1 billion<br />

euros (from which 37.5 million euros come<br />

from the Hungarian government as financial<br />

support). The factory is expected to start operating<br />

in 2<strong>02</strong>6, with a workforce of more than<br />

1000 people.<br />

Samsung SDI<br />

Samsung SDI, one of the leading EV battery<br />

cell producers worldwide, can be considered<br />

as a pioneer of the traction battery industry<br />

in Hungary, as it started to construct its first<br />

traction battery plant in the country as early<br />

as 2016, located at Göd (sometimes written<br />

as „Goed” in the international media), a town<br />

about 25 kilometers north of Budapest. In<br />

fact, it was a brownfield investment by converting<br />

Samsung’s own former cathode ray<br />

tube factory, which was closed two years before,<br />

due to the market loss of the technology.<br />

The new battery plant’s inauguration ceremony<br />

was held in 2017, quickly followed by<br />

a further expansion investment of 1.2 billion<br />

euros in the same year. As a result, the second<br />

unit was completed in 2019 and reached full<br />

production capacity (more than 6 million<br />

cells/month) by January 2<strong>02</strong>2. By now the<br />

total manufacturing output increased to 40<br />

GWh/year. Prismatic battery cells produced<br />

here are are used in electric cars of BMW,<br />

Volkswagen and Stellantis. The Hungarian<br />

plant will also supply sixth-generation P6<br />

prismatic NCA cells for Hyundai Motor’s<br />

electric vehicles dedicated for the European<br />

market, starting from 2<strong>02</strong>6.<br />

In January 2<strong>02</strong>3, there were reports that<br />

Samsung SDI would expand its operations in<br />

Hungary with a new production plant, with<br />

a similar output as the previous two. According<br />

to the rumours, this facility would produce<br />

46120-type cylindrical cells, to be used<br />

exclusively in BMW cars - more precisely,<br />

the planned new manufacturing unit is expected<br />

to supply the also recently-announced<br />

BMW battery module assembly plant in Debrecen,<br />

Hungary.<br />

From an e-bus perspective, Samsung SDI<br />

cells are used in the traction battery packs of<br />

Akasol, which itself is a supplier of Mercedes-Benz,<br />

Van Hool and Industria Italiana<br />

Autobus. The current Hungarian market leader<br />

Credobus will also use these packs in<br />

its all-new zero emission bus family, scheduled<br />

to be introduced in <strong>2<strong>02</strong>4</strong>. Also, battery<br />

technology of Samsung SDI is used in Webasto<br />

batteries, which can be found for instance<br />

in Otokar e-buses.<br />

20<br />

21

OUTLOOKS<br />

THE CHAIN OF EV<br />

BATTERIES<br />

Not only the main cell and battery<br />

manufacturers, but also many<br />

supplier companies are already<br />

present in Hungary with manufacturing<br />

capacities, producing<br />

vital components of EV batteries.<br />

Just to list a few: cathode material<br />

(EcoPro, Huayou Cobalt, Toyo<br />

Ink), electrolyte (Soulbrain), separator<br />

film (LG Toray, Semcorp,<br />

W-Scope), aluminium and copper<br />

foil (Lotte Aluminium and Volta<br />

Energy Solutions/Doosan, respectively),<br />

housing (NICE LMS,<br />

Sangsin) and various other battery<br />

parts (Bumchun Precision,<br />

HALMS, INZI Controls, Mektec,<br />

Sang-A Frontec, Shenzen Kedali,<br />

Shinheung SEC), while recycling<br />

industry is represented by companies<br />

like Dongwha Electrolyte,<br />

JWH and SungEel Hitech.<br />

rates three plants in Hungary by now. Two<br />

of them are located in Komárom - the same<br />

northwestern Hungarian town which is the<br />

home of BYD’s now-only European bus assembly<br />

plant -, while the newest, third unit<br />

recently started operation at Iváncsa, with<br />

an almost twice higher production output<br />

than the former two combined.<br />

The original Komárom plant - which was<br />

the first European plant of the company,<br />

operating since the end of 2019 - produces<br />

third-generation pouch battery cells, with a<br />

manufacturing capacity of 7.5 GWh/year,<br />

on a total of five assembly lines. Capacity<br />

was increased by a further 9.8 GWh with<br />

the commission of the second manufacturing<br />

unit in 2<strong>02</strong>2, which has a capability<br />

to be scaled up to even 16 GWh/year.<br />

The number of employees, originally<br />

475, was also boosted by another 1,000.<br />

These two plants mainly supply battery<br />

cells for the electric vehicles of Daimler<br />

and Volkswagen.<br />

The company’s newest, third factory in<br />

Hungary will operate at Iváncsa, a small<br />

town 51 kilometers southwest of Budapest.<br />

Just in order to perceive the dimensions<br />

and the importance of this project,<br />

at the time of its official announcement<br />

in early 2<strong>02</strong>1, it was considered to be not<br />

only the largest green field investment in<br />

the history of Hungary up to that point<br />

(value: 1.9 billion euros), but also the largest<br />

EV battery plant in Europe.<br />

Although the factory buildings are ready<br />

and production is expected to start soon, various<br />

works are still remaining around the<br />

plant, such as the construction of road and<br />

industrial railway connections, and the set<br />

up of service infrastructure. When operating<br />

at full capacity (expected from mid-<strong>2<strong>02</strong>4</strong>,<br />

although the plant’s full completion is only<br />

scheduled for 2<strong>02</strong>8), the facility will provide<br />

an annual production output of 30 GWh,<br />

with a workforce of 2,500 people. SK Innovation<br />

has ambitious plans to increase<br />

its global annual production output to 125<br />

GWh by 2<strong>02</strong>5 and to 500 GWh by 2030, in<br />

which they assign a large role to their Hungarian<br />

manufacturing capacities, along with<br />

their facilities in South Korea, China and<br />

the United States.<br />

SK Innovation’s Hungarian plants were<br />

also involved in some safety issues: in<br />

June 2<strong>02</strong>3, dozens of workers experien-<br />

ced sickness during the construction of the<br />

Iváncsa plant after inhaling an unknown<br />

chemical. This incident was also widely reported<br />

in the local media.<br />

Sunwoda<br />

At the end of July Sunwoda also officially<br />

announced that it would build a new battery<br />

plant in Hungary. The Chinese company’s<br />

first European manufacturing facility will<br />

be established in Nyíregyháza, a city in<br />

the northeastern region of the country, with<br />

an initial investment of 245 million euros.<br />

However, in medium to long term this may<br />

increase to even nearly 1.5 billion euros,<br />

creating more than 1,000 jobs locally. The<br />

size of the planned production capacity and<br />

the type of battery cells to be produced have<br />

not yet been announced. Construction of the<br />

factory will start in <strong>2<strong>02</strong>4</strong>, with production is<br />

expected to begin at the end of 2<strong>02</strong>5.<br />

Sunwoda is considered among the top 10<br />

EV battery manufacturers worldwide based<br />

on market share, and is a supplier of<br />

Volkswagen, the Renault-Nissan group and<br />

Dongfeng, among others. However, customers<br />

of the products to be manufactured in<br />

Hungary have not yet been named, it was<br />

only communicated that the new plant will<br />

work for the “international market”.<br />

To sum up, the building up of the new industry<br />

(made not only of battery manufacturer<br />

but also of low-voltage modules providers<br />

and suppliers, as mentioned in the boxes) is<br />

well on its way in Hungary. The number of<br />

the settled companies is expected to increase<br />

even more in the near future, for example<br />

there are rumors about the possible arrival<br />

of Hangke Technology, another EV battery<br />

industry player from China.<br />

Gellért Patthy, Magyarbusz [Info]<br />

Sustainable mobility of the future<br />

FOR A<br />

BETTER<br />

LIFE.<br />

22<br />

www.irizar-emobility.com

OUTLOOKS<br />

A PWC STUDY LOOKS AT THE TCO OF ZERO EMISSION <strong>BUS</strong>ES<br />

THE COSTS OF E-MOBILITY<br />

THE AUTHORS<br />

Maximilian Rohs is Director<br />

Infrastructure & Mobility at<br />

PwC Germany<br />

(maximilian.rohs@pwc.com).<br />

Felix Krewerth is Senior<br />

Associate Infrastructure &<br />

Mobility at PwC Germany<br />

(felix.krewerth@pwc.com).<br />

Where now for Germany’s zero<br />

emission bus market? Can the decade<br />

of the e-bus be sustained? Financial<br />

support is crucial for hitting targets.<br />

Focus on TCO, procurement’s methods,<br />

standardization<br />

Around 2,900 buses affected<br />

by the Clean Vehicles<br />

Directive are procured each<br />

year in Germany. In the<br />

first period of the directive,<br />

which runs until the end<br />

of 2<strong>02</strong>5, at least 22.5% of<br />

these buses (approx. 650<br />

buses per year) must be<br />

zero-emissions. This figure<br />

will rise to 32.5% from 2<strong>02</strong>6<br />

onwards, or around 950<br />

zero-emissions buses per<br />

year. German operators<br />

have demonstrated that<br />

they can achieve these<br />

procurement targets if the<br />

conditions are right: 2<strong>02</strong>3<br />

saw over 770 zero-emissions<br />

buses enter service in<br />

Germany.<br />

For many German bus operators,<br />

the changeover to a zero-emissions<br />

fleet is in full swing. Many others<br />

have ambitious plans ready to go.<br />

But as with most things, this transition has<br />

a price: decarbonising bus fleets requires<br />

heavy investment. The Federal Ministry for<br />

Digital and Transport (Bundesministerium<br />

für Digitales und Verkehr, or BMDV) re-<br />

cently extended its comprehensive funding<br />

programme for zero-emissions buses, but<br />

has now had to cancel this programme following<br />

the high-profile ruling by the Federal<br />

Constitutional Court on 15 November 2<strong>02</strong>3<br />

concerning the German Federal Government’s<br />

Climate and Transformation Fund<br />

(Klima- und Transfomationsfonds, or KTF).<br />

The Federal Government had financed the<br />

KTF by transferring €60 billion of borrowing<br />

– authorised during the Covid-19 pandemic<br />

– into a Federal Special Fund for use<br />

over subsequent financial years, an action<br />

which the court declared unconstitutional.<br />

With this source of funding now having<br />

dried up, does this mean that operators in<br />

Germany will have to reconsider their plans<br />

for electric bus fleets?<br />

Federal subsidies’s role<br />

With the BMDV programme now having<br />

been withdrawn, continuing the changeover<br />

to electric buses is set to be a major economic<br />

challenge for the sector. The first three<br />

rounds of funding were massively oversubscribed,<br />

and analysing total cost of ownership<br />

(TCO) data explains why: despite<br />

electric buses being cheaper to operate than<br />

traditional types, these savings do not fully<br />

offset their much higher procurement costs –<br />

particularly in the case of battery buses.<br />

Based on PwC’s cost model, our TCO analysis<br />

factors in all costs that are directly associated<br />

with a bus and putting it into service,<br />

using an example which compares the<br />

capital costs (CAPEX) and operating costs<br />

(OPEX) of non-articulated diesel and battery-electric<br />

buses. All expected costs were<br />

aggregated and then divided by the bus’s<br />

service life (12 years) at the point of entry<br />

into service (<strong>2<strong>02</strong>4</strong>). The operating cost analysis<br />

included dynamic diesel and electricity<br />

prices – for example, it factored in the increases<br />

in carbon taxation which are expected<br />

to occur in Germany. The values shown<br />

in the diagram below are averages over the<br />

bus’s service life.<br />

Comparing the TCO clearly shows where the<br />

additional costs lie for battery buses: namely,<br />

in the capital costs of the buses and the<br />

necessary infrastructure. Based on current<br />

information, including more than 1,000 price<br />

points for battery buses, the average procurement<br />

price of a non-articulated battery-electric<br />