2024-02 SUSTAINABLE BUS

In this issue, all the figures on the European e-bus market 2023 (hint: over 40 of the new city buses were electric!), a reporting on #battery manufacturing plans underway in Hungary and their impact on the European #electricbus landscape, a focus on powertrain values and strategies in the realm of e-mobility. Plus, a piece on the challenges faced by #BEV bus adoption in Germany (yes, it's also a matter of TCO).

In this issue, all the figures on the European e-bus market 2023 (hint: over 40 of the new city buses were electric!), a reporting on #battery manufacturing plans underway in Hungary and their impact on the European #electricbus landscape, a focus on powertrain values and strategies in the realm of e-mobility.

Plus, a piece on the challenges faced by #BEV bus adoption in Germany (yes, it's also a matter of TCO).

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OUTLOOKS<br />

Growth in electric bus<br />

sales leads to a subsequent<br />

increase in component<br />

sales. Europe, defined<br />

as the EU 27 plus the UK,<br />

had forecast component<br />

powertrain sales of $0.73<br />

billion in 2<strong>02</strong>3 (preliminary<br />

figures), with $1.03 billion<br />

forecast for 2<strong>02</strong>6 and $1.38<br />

billion for 2030. The fastest<br />

growth period is from 2<strong>02</strong>3<br />

to 2<strong>02</strong>5 as electric buses<br />

start to become the preferred<br />

choice (rather than<br />

diesel) in some countries<br />

in Europe.<br />

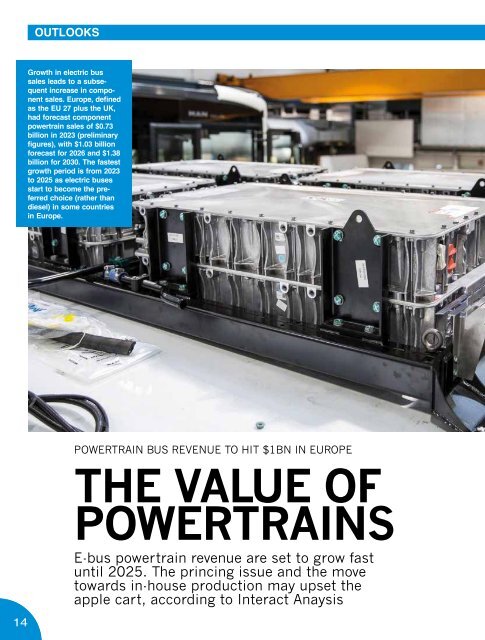

POWERTRAIN <strong>BUS</strong> REVENUE TO HIT $1BN IN EUROPE<br />

THE VALUE OF<br />

POWERTRAINS<br />

E-bus powertrain revenue are set to grow fast<br />

until 2<strong>02</strong>5. The princing issue and the move<br />

towards in-house production may upset the<br />

apple cart, according to Interact Anaysis<br />

The revenue from powertrain components<br />

is forecast to reach a billion<br />

US dollars in 2<strong>02</strong>6 in Europe<br />

(and a billion euros in 2<strong>02</strong>7 at the<br />

present exchange rates), according to Interact<br />

Analysis’ latest research. This is for<br />

BEV buses only, which dominate, and excludes<br />

a smaller amount of business in electrified<br />

hybrid and hydrogen buses.<br />

The fastest growth period is from 2<strong>02</strong>3 to<br />

2<strong>02</strong>5 as electric buses start to become the<br />

preferred choice (rather than diesel) in some<br />

countries in Europe. In countries with strong<br />

government support, battery electric buses<br />

have reached a point where they can be very<br />

successful, as product availability, low running<br />

cost and clean air targets should combine<br />

to see a lot of sales. Some places, such<br />

as the Netherlands and much of Scandinavia,<br />

already see battery electric as the default<br />

choice for a bus and we expect that this will<br />

steadily become the case in other countries<br />

over the next few years, including France,<br />

Germany and the UK.<br />

Electrification spreading in Europe<br />

It is not just Western Europe that is seeing<br />

bus electrification though. Eastern Europe is<br />

not necessarily slower and has seen some<br />

very significant deals, so understanding<br />

where growth will be faster and where it will<br />

be slower is arguably a case of analyzing<br />

country by country and city by city rather<br />

than looking at regions within Europe.<br />

From 2<strong>02</strong>6 we forecast slower growth for<br />

electric buses as some cities and countries<br />

will already have a high percentage of new<br />

buses electrified by 2<strong>02</strong>6.<br />

This growth in electric bus sales leads to a<br />

subsequent increase in component sales.<br />

Europe, defined as the EU 27 plus the UK,<br />

had forecast component powertrain sales of<br />

$0.73 billion in 2<strong>02</strong>3 (preliminary figures),<br />

with $1.03 billion forecast for 2<strong>02</strong>6 and<br />

$1.38 billion for 2030.<br />

Europe to stay behind China<br />

China already has a >$3 billion annual powertrain<br />

component market for buses (referring<br />

here to components sold for buses registered<br />

within China, not sales of Chinese<br />

buses or components to Europe). This is due<br />

to a much higher percentage of new buses<br />

being electric, so Europe will still be well behind<br />

China, even in 2<strong>02</strong>6. However, electric<br />

buses in Europe are becoming more common<br />

than in many other parts of the world.<br />

Of the total bus sales per year in Europe (40-<br />

50,000), we expect over 14,000 to be electric<br />

in 2030. This is mainly due to low adoption<br />

of electrification for rural and intercity buses.<br />

Urban buses will predominantly be battery<br />

electric by 2030, in line with negotiations<br />

at EU level (not yet concluded at the time<br />

of printing this magazine issue) for full zero<br />

emission city bus market in 2035 with intermediate<br />

target of 90% in 2030.<br />

China also has much lower component<br />

pricing than Europe. If Chinese companies<br />

manage to make inroads into the<br />

European market for completed battery<br />

packs (rather than just cells), motors and<br />

other products, prices could fall. In the<br />

long term, Chinese companies may be<br />

capable of winning a high share.<br />

However, at the moment, the political environment,<br />

the time to setup operations, and<br />

the fact some companies are not yet well<br />

Interact Analysis is a<br />

market research firm with<br />

a specific department for<br />

truck, bus and off-highway<br />

electrification. Here on<br />

Sustainable Bus Magazine<br />

we host a contribution<br />

from the research analyst<br />

Jamie Fox.<br />

known, means that in the next few years<br />

the share of Chinese companies will remain<br />

low for many products. However, the price<br />

gap is very large – as more people come<br />

to understand that Chinese products can<br />

be half price rather than 10% less – these<br />

products may eventually start to command<br />

attention. However, of course these are<br />

prices for sales within China. As Chinese<br />

companies have to pay for overseas sales<br />

and marketing, travel to Europe, shipping<br />

and the costs of complying with European<br />

regulations the price advantage does reduce<br />

substantially, but even so, Chinese products<br />

are likely to remain significantly less expensive<br />

than those from most other countries<br />

including from within Europe.<br />

Leading battery pack providers for on-road<br />

vehicles (including trucks and sales outside<br />

Europe) ranked in Interact Analysis’ 'Electrified<br />

truck and bus components – 2<strong>02</strong>3'<br />

report include BorgWarner (Akasol), BMZ,<br />

BYD, CATL, Forsee Power, Northvolt,<br />

SAFT and Xalt Energy. These companies<br />

have expanded their offerings, however the<br />

market is quite diverse and there are many<br />

smaller suppliers in-play with no single<br />

dominant company.<br />

For other components, ZF has excelled for<br />

several years with its portal axle products,<br />

although it currently faces strong competition<br />

in buses from central drive designs.<br />

Bosch is another company well placed to<br />

address the market for powertrain components<br />

in electric vehicles in on-road vehicles.<br />

There is also still time for new entrants<br />

to disrupt the market or for existing players<br />

to carve out a strong niche.<br />

A in-house trend?<br />

In addition, there are also some companies<br />

that produce components in-house<br />

(i.e. vehicle manufacturers that produce<br />

their own components). Interact Analysis<br />

forecast’s this trend to grow, with inverters,<br />

battery packs and PDUs being some<br />

of the components that are increasingly<br />

being planned for in-house production<br />

14<br />

15