Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

64 <strong>Tesco</strong> <strong>PLC</strong> <strong>Annual</strong> report <strong>and</strong> financial statements <strong>2007</strong> Find out more at www.tesco.com/corporate<br />

Notes to the financial statements continued<br />

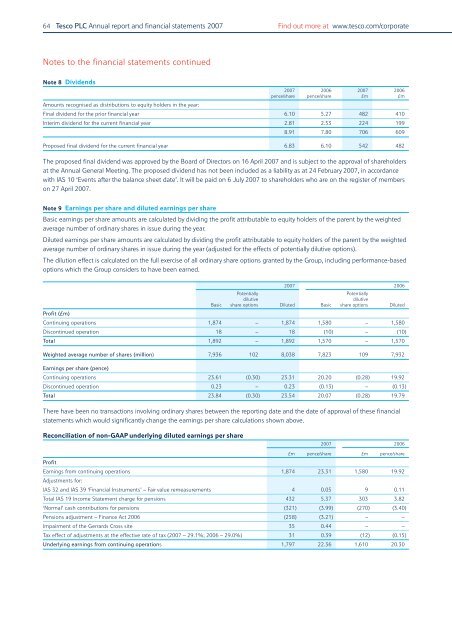

Note 8 Dividends<br />

Amounts recognised as distributions to equity holders in the year:<br />

<strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

pence/share pence/share £m £m<br />

Final dividend for the prior financial year 6.10 5.27 482 410<br />

Interim dividend for the current financial year 2.81 2.53 224 199<br />

8.91 7.80 706 609<br />

Proposed final dividend for the current financial year 6.83 6.10 542 482<br />

The proposed final dividend was approved by the Board of Directors on 16 April <strong>2007</strong> <strong>and</strong> is subject to the approval of shareholders<br />

at the <strong>Annual</strong> General Meeting. The proposed dividend has not been included as a liability as at 24 February <strong>2007</strong>, in accordance<br />

with IAS 10 ‘Events after the balance sheet date’. It will be paid on 6 July <strong>2007</strong> to shareholders who are on the register of members<br />

on 27 April <strong>2007</strong>.<br />

Note 9 Earnings per share <strong>and</strong> diluted earnings per share<br />

Basic earnings per share amounts are calculated by dividing the profit attributable to equity holders of the parent by the weighted<br />

average number of ordinary shares in issue during the year.<br />

Diluted earnings per share amounts are calculated by dividing the profit attributable to equity holders of the parent by the weighted<br />

average number of ordinary shares in issue during the year (adjusted for the effects of potentially dilutive options).<br />

The dilution effect is calculated on the full exercise of all ordinary share options granted by the Group, including performance-based<br />

options which the Group considers to have been earned.<br />

Profit (£m)<br />

<strong>2007</strong> 2006<br />

Potentially Potentially<br />

dilutive dilutive<br />

Basic share options Diluted Basic share options Diluted<br />

Continuing operations 1,874 – 1,874 1,580 – 1,580<br />

Discontinued operation 18 – 18 (10) – (10)<br />

Total 1,892 – 1,892 1,570 – 1,570<br />

Weighted average number of shares (million) 7,936 102 8,038 7,823 109 7,932<br />

Earnings per share (pence)<br />

Continuing operations 23.61 (0.30) 23.31 20.20 (0.28) 19.92<br />

Discontinued operation 0.23 – 0.23 (0.13) – (0.13)<br />

Total 23.84 (0.30) 23.54 20.07 (0.28) 19.79<br />

There have been no transactions involving ordinary shares between the reporting date <strong>and</strong> the date of approval of these financial<br />

statements which would significantly change the earnings per share calculations shown above.<br />

Reconciliation of non-GAAP underlying diluted earnings per share<br />

Profit<br />

<strong>2007</strong> 2006<br />

£m pence/share £m pence/share<br />

Earnings from continuing operations 1,874 23.31 1,580 19.92<br />

Adjustments for:<br />

IAS 32 <strong>and</strong> IAS 39 ‘<strong>Financial</strong> Instruments’ – Fair value remeasurements 4 0.05 9 0.11<br />

Total IAS 19 Income Statement charge for pensions 432 5.37 303 3.82<br />

‘Normal’ cash contributions for pensions (321) (3.99) (270) (3.40)<br />

Pensions adjustment – Finance Act 2006 (258) (3.21) – –<br />

Impairment of the Gerrards Cross site 35 0.44 – –<br />

Tax effect of adjustments at the effective rate of tax (<strong>2007</strong> – 29.1%; 2006 – 29.0%) 31 0.39 (12) (0.15)<br />

Underlying earnings from continuing operations 1,797 22.36 1,610 20.30