Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

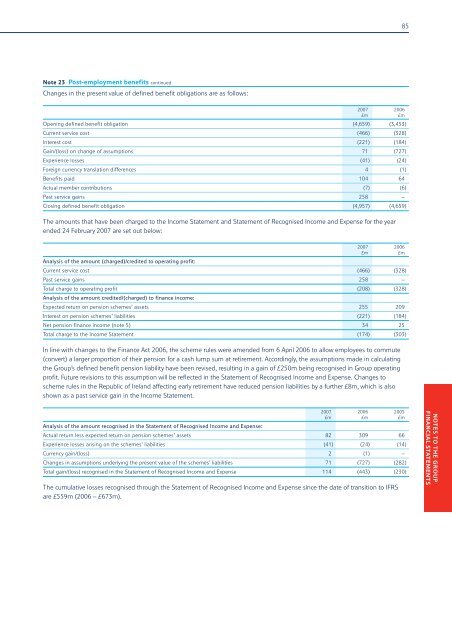

Note 23 Post-employment benefits continued<br />

Changes in the present value of defined benefit obligations are as follows:<br />

<strong>2007</strong> 2006<br />

£m £m<br />

Opening defined benefit obligation (4,659) (3,453)<br />

Current service cost (466) (328)<br />

Interest cost (221) (184)<br />

Gain/(loss) on change of assumptions 71 (727)<br />

Experience losses (41) (24)<br />

Foreign currency translation differences 4 (1)<br />

Benefits paid 104 64<br />

Actual member contributions (7) (6)<br />

Past service gains 258 –<br />

Closing defined benefit obligation (4,957) (4,659)<br />

The amounts that have been charged to the Income Statement <strong>and</strong> Statement of Recognised Income <strong>and</strong> Expense for the year<br />

ended 24 February <strong>2007</strong> are set out below:<br />

Analysis of the amount (charged)/credited to operating profit:<br />

<strong>2007</strong> 2006<br />

£m £m<br />

Current service cost (466) (328)<br />

Past service gains 258 –<br />

Total charge to operating profit (208) (328)<br />

Analysis of the amount credited/(charged) to finance income:<br />

Expected return on pension schemes’ assets 255 209<br />

Interest on pension schemes’ liabilities (221) (184)<br />

Net pension finance income (note 5) 34 25<br />

Total charge to the Income Statement (174) (303)<br />

In line with changes to the Finance Act 2006, the scheme rules were amended from 6 April 2006 to allow employees to commute<br />

(convert) a larger proportion of their pension for a cash lump sum at retirement. Accordingly, the assumptions made in calculating<br />

the Group’s defined benefit pension liability have been revised, resulting in a gain of £250m being recognised in Group operating<br />

profit. Future revisions to this assumption will be reflected in the Statement of Recognised Income <strong>and</strong> Expense. Changes to<br />

scheme rules in the Republic of Irel<strong>and</strong> affecting early retirement have reduced pension liabilities by a further £8m, which is also<br />

shown as a past service gain in the Income Statement.<br />

Analysis of the amount recognised in the Statement of Recognised Income <strong>and</strong> Expense:<br />

<strong>2007</strong> 2006 2005<br />

£m £m £m<br />

Actual return less expected return on pension schemes’ assets 82 309 66<br />

Experience losses arising on the schemes’ liabilities (41) (24) (14)<br />

Currency gain/(loss) 2 (1) –<br />

Changes in assumptions underlying the present value of the schemes’ liabilities 71 (727) (282)<br />

Total gain/(loss) recognised in the Statement of Recognised Income <strong>and</strong> Expense 114 (443) (230)<br />

The cumulative losses recognised through the Statement of Recognised Income <strong>and</strong> Expense since the date of transition to IFRS<br />

are £559m (2006 – £673m).<br />

85<br />

NOTES TO THE GROUP<br />

FINANCIAL STATEMENTS