Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

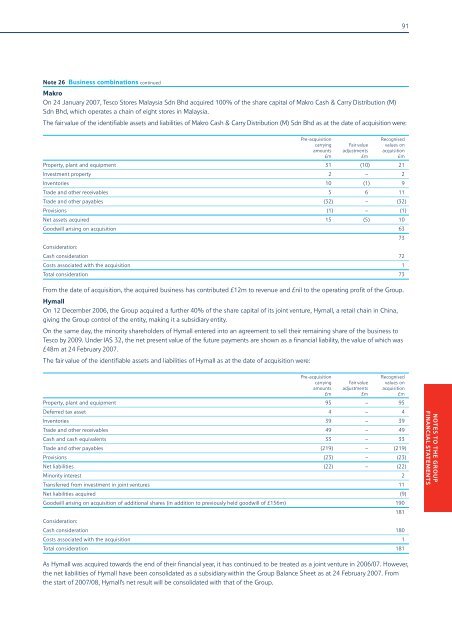

Note 26 Business combinations continued<br />

Makro<br />

On 24 January <strong>2007</strong>, <strong>Tesco</strong> Stores Malaysia Sdn Bhd acquired 100% of the share capital of Makro Cash & Carry Distribution (M)<br />

Sdn Bhd, which operates a chain of eight stores in Malaysia.<br />

The fair value of the identifiable assets <strong>and</strong> liabilities of Makro Cash & Carry Distribution (M) Sdn Bhd as at the date of acquisition were:<br />

Pre-acquisition Recognised<br />

carrying Fair value values on<br />

amounts adjustments acquisition<br />

£m £m £m<br />

Property, plant <strong>and</strong> equipment 31 (10) 21<br />

Investment property 2 – 2<br />

Inventories 10 (1) 9<br />

Trade <strong>and</strong> other receivables 5 6 11<br />

Trade <strong>and</strong> other payables (32) – (32)<br />

Provisions (1) – (1)<br />

Net assets acquired 15 (5) 10<br />

Goodwill arising on acquisition 63<br />

Consideration:<br />

Cash consideration 72<br />

Costs associated with the acquisition 1<br />

Total consideration 73<br />

From the date of acquisition, the acquired business has contributed £12m to revenue <strong>and</strong> £nil to the operating profit of the Group.<br />

Hymall<br />

On 12 December 2006, the Group acquired a further 40% of the share capital of its joint venture, Hymall, a retail chain in China,<br />

giving the Group control of the entity, making it a subsidiary entity.<br />

On the same day, the minority shareholders of Hymall entered into an agreement to sell their remaining share of the business to<br />

<strong>Tesco</strong> by 2009. Under IAS 32, the net present value of the future payments are shown as a financial liability, the value of which was<br />

£48m at 24 February <strong>2007</strong>.<br />

The fair value of the identifiable assets <strong>and</strong> liabilities of Hymall as at the date of acquisition were:<br />

73<br />

Pre-acquisition Recognised<br />

carrying Fair value values on<br />

amounts adjustments acquisition<br />

£m £m £m<br />

Property, plant <strong>and</strong> equipment 95 – 95<br />

Deferred tax asset 4 – 4<br />

Inventories 39 – 39<br />

Trade <strong>and</strong> other receivables 49 – 49<br />

Cash <strong>and</strong> cash equivalents 33 – 33<br />

Trade <strong>and</strong> other payables (219) – (219)<br />

Provisions (23) – (23)<br />

Net liabilities (22) – (22)<br />

Minority interest 2<br />

Transferred from investment in joint ventures 11<br />

Net liabilities acquired (9)<br />

Goodwill arising on acquisition of additional shares (in addition to previously held goodwill of £156m) 190<br />

Consideration:<br />

Cash consideration 180<br />

Costs associated with the acquisition 1<br />

Total consideration 181<br />

As Hymall was acquired towards the end of their financial year, it has continued to be treated as a joint venture in 2006/07. However,<br />

the net liabilities of Hymall have been consolidated as a subsidiary within the Group Balance Sheet as at 24 February <strong>2007</strong>. From<br />

the start of <strong>2007</strong>/08, Hymall’s net result will be consolidated with that of the Group.<br />

181<br />

91<br />

NOTES TO THE GROUP<br />

FINANCIAL STATEMENTS