Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78 <strong>Tesco</strong> <strong>PLC</strong> <strong>Annual</strong> report <strong>and</strong> financial statements <strong>2007</strong> Find out more at www.tesco.com/corporate<br />

Notes to the financial statements continued<br />

Note 20 <strong>Financial</strong> instruments continued<br />

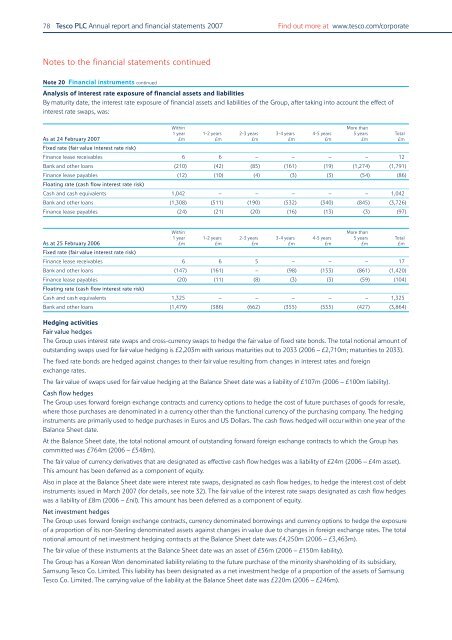

Analysis of interest rate exposure of financial assets <strong>and</strong> liabilities<br />

By maturity date, the interest rate exposure of financial assets <strong>and</strong> liabilities of the Group, after taking into account the effect of<br />

interest rate swaps, was:<br />

Within More than<br />

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total<br />

As at 24 February <strong>2007</strong> £m £m £m £m £m £m £m<br />

Fixed rate (fair value interest rate risk)<br />

Finance lease receivables 6 6 – – – – 12<br />

Bank <strong>and</strong> other loans (210) (42) (85) (161) (19) (1,274) (1,791)<br />

Finance lease payables (12) (10) (4) (3) (3) (54) (86)<br />

Floating rate (cash flow interest rate risk)<br />

Cash <strong>and</strong> cash equivalents 1,042 – – – – – 1,042<br />

Bank <strong>and</strong> other loans (1,308) (511) (190) (532) (340) (845) (3,726)<br />

Finance lease payables (24) (21) (20) (16) (13) (3) (97)<br />

Within More than<br />

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total<br />

As at 25 February 2006 £m £m £m £m £m £m £m<br />

Fixed rate (fair value interest rate risk)<br />

Finance lease receivables 6 6 5 – – – 17<br />

Bank <strong>and</strong> other loans (147) (161) – (98) (153) (861) (1,420)<br />

Finance lease payables (20) (11) (8) (3) (3) (59) (104)<br />

Floating rate (cash flow interest rate risk)<br />

Cash <strong>and</strong> cash equivalents 1,325 – – – – – 1,325<br />

Bank <strong>and</strong> other loans (1,479) (386) (662) (355) (555) (427) (3,864)<br />

Hedging activities<br />

Fair value hedges<br />

The Group uses interest rate swaps <strong>and</strong> cross-currency swaps to hedge the fair value of fixed rate bonds. The total notional amount of<br />

outst<strong>and</strong>ing swaps used for fair value hedging is £2,203m with various maturities out to 2033 (2006 – £2,710m; maturities to 2033).<br />

The fixed rate bonds are hedged against changes to their fair value resulting from changes in interest rates <strong>and</strong> foreign<br />

exchange rates.<br />

The fair value of swaps used for fair value hedging at the Balance Sheet date was a liability of £107m (2006 – £100m liability).<br />

Cash flow hedges<br />

The Group uses forward foreign exchange contracts <strong>and</strong> currency options to hedge the cost of future purchases of goods for resale,<br />

where those purchases are denominated in a currency other than the functional currency of the purchasing company. The hedging<br />

instruments are primarily used to hedge purchases in Euros <strong>and</strong> US Dollars. The cash flows hedged will occur within one year of the<br />

Balance Sheet date.<br />

At the Balance Sheet date, the total notional amount of outst<strong>and</strong>ing forward foreign exchange contracts to which the Group has<br />

committed was £764m (2006 – £548m).<br />

The fair value of currency derivatives that are designated as effective cash flow hedges was a liability of £24m (2006 – £4m asset).<br />

This amount has been deferred as a component of equity.<br />

Also in place at the Balance Sheet date were interest rate swaps, designated as cash flow hedges, to hedge the interest cost of debt<br />

instruments issued in March <strong>2007</strong> (for details, see note 32). The fair value of the interest rate swaps designated as cash flow hedges<br />

was a liability of £8m (2006 – £nil). This amount has been deferred as a component of equity.<br />

Net investment hedges<br />

The Group uses forward foreign exchange contracts, currency denominated borrowings <strong>and</strong> currency options to hedge the exposure<br />

of a proportion of its non-Sterling denominated assets against changes in value due to changes in foreign exchange rates. The total<br />

notional amount of net investment hedging contracts at the Balance Sheet date was £4,250m (2006 – £3,463m).<br />

The fair value of these instruments at the Balance Sheet date was an asset of £56m (2006 – £150m liability).<br />

The Group has a Korean Won denominated liability relating to the future purchase of the minority shareholding of its subsidiary,<br />

Samsung <strong>Tesco</strong> Co. Limited. This liability has been designated as a net investment hedge of a proportion of the assets of Samsung<br />

<strong>Tesco</strong> Co. Limited. The carrying value of the liability at the Balance Sheet date was £220m (2006 – £246m).