Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

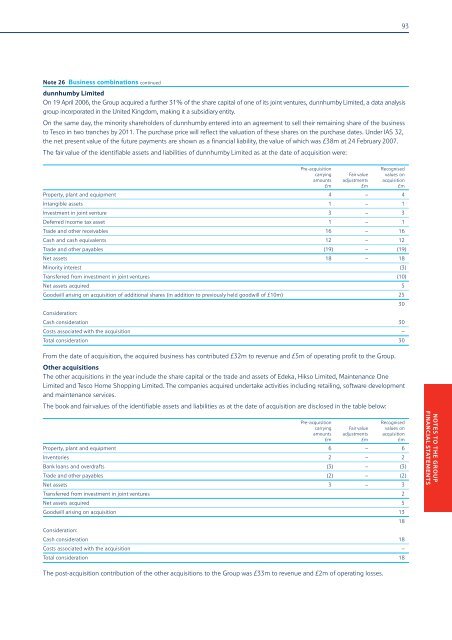

Note 26 Business combinations continued<br />

dunnhumby Limited<br />

On 19 April 2006, the Group acquired a further 31% of the share capital of one of its joint ventures, dunnhumby Limited, a data analysis<br />

group incorporated in the United Kingdom, making it a subsidiary entity.<br />

On the same day, the minority shareholders of dunnhumby entered into an agreement to sell their remaining share of the business<br />

to <strong>Tesco</strong> in two tranches by 2011. The purchase price will reflect the valuation of these shares on the purchase dates. Under IAS 32,<br />

the net present value of the future payments are shown as a financial liability, the value of which was £38m at 24 February <strong>2007</strong>.<br />

The fair value of the identifiable assets <strong>and</strong> liabilities of dunnhumby Limited as at the date of acquisition were:<br />

Pre-acquisition Recognised<br />

carrying Fair value values on<br />

amounts adjustments acquisition<br />

£m £m £m<br />

Property, plant <strong>and</strong> equipment 4 – 4<br />

Intangible assets 1 – 1<br />

Investment in joint venture 3 – 3<br />

Deferred income tax asset 1 – 1<br />

Trade <strong>and</strong> other receivables 16 – 16<br />

Cash <strong>and</strong> cash equivalents 12 – 12<br />

Trade <strong>and</strong> other payables (19) – (19)<br />

Net assets 18 – 18<br />

Minority interest (3)<br />

Transferred from investment in joint ventures (10)<br />

Net assets acquired 5<br />

Goodwill arising on acquisition of additional shares (in addition to previously held goodwill of £10m) 25<br />

Consideration:<br />

Cash consideration 30<br />

Costs associated with the acquisition –<br />

Total consideration 30<br />

From the date of acquisition, the acquired business has contributed £32m to revenue <strong>and</strong> £5m of operating profit to the Group.<br />

Other acquisitions<br />

The other acquisitions in the year include the share capital or the trade <strong>and</strong> assets of Edeka, Hikso Limited, Maintenance One<br />

Limited <strong>and</strong> <strong>Tesco</strong> Home Shopping Limited. The companies acquired undertake activities including retailing, software development<br />

<strong>and</strong> maintenance services.<br />

The book <strong>and</strong> fair values of the identifiable assets <strong>and</strong> liabilities as at the date of acquisition are disclosed in the table below:<br />

30<br />

Pre-acquisition Recognised<br />

carrying Fair value values on<br />

amounts adjustments acquisition<br />

£m £m £m<br />

Property, plant <strong>and</strong> equipment 6 – 6<br />

Inventories 2 – 2<br />

Bank loans <strong>and</strong> overdrafts (3) – (3)<br />

Trade <strong>and</strong> other payables (2) – (2)<br />

Net assets 3 – 3<br />

Transferred from investment in joint ventures 2<br />

Net assets acquired 5<br />

Goodwill arising on acquisition 13<br />

Consideration:<br />

Cash consideration 18<br />

Costs associated with the acquisition –<br />

Total consideration 18<br />

The post-acquisition contribution of the other acquisitions to the Group was £33m to revenue <strong>and</strong> £2m of operating losses.<br />

18<br />

93<br />

NOTES TO THE GROUP<br />

FINANCIAL STATEMENTS