Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Annual Report and Financial Statements 2007 - Tesco PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

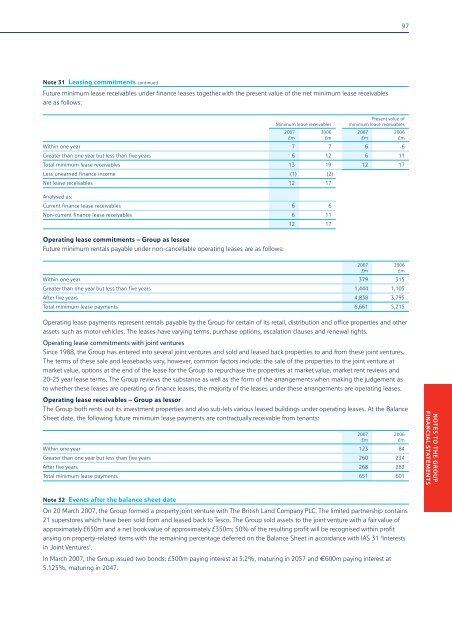

Note 31 Leasing commitments continued<br />

Future minimum lease receivables under finance leases together with the present value of the net minimum lease receivables<br />

are as follows:<br />

Present value of<br />

Minimum lease receivables minimum lease receivables<br />

<strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

£m £m £m £m<br />

Within one year 7 7 6 6<br />

Greater than one year but less than five years 6 12 6 11<br />

Total minimum lease receivables 13 19 12 17<br />

Less unearned finance income (1) (2)<br />

Net lease receivables 12 17<br />

Analysed as:<br />

Current finance lease receivables 6 6<br />

Non-current finance lease receivables 6 11<br />

Operating lease commitments – Group as lessee<br />

Future minimum rentals payable under non-cancellable operating leases are as follows:<br />

12 17<br />

<strong>2007</strong> 2006<br />

£m £m<br />

Within one year 379 315<br />

Greater than one year but less than five years 1,444 1,105<br />

After five years 4,838 3,795<br />

Total minimum lease payments 6,661 5,215<br />

Operating lease payments represent rentals payable by the Group for certain of its retail, distribution <strong>and</strong> office properties <strong>and</strong> other<br />

assets such as motor vehicles. The leases have varying terms, purchase options, escalation clauses <strong>and</strong> renewal rights.<br />

Operating lease commitments with joint ventures<br />

Since 1988, the Group has entered into several joint ventures <strong>and</strong> sold <strong>and</strong> leased back properties to <strong>and</strong> from these joint ventures.<br />

The terms of these sale <strong>and</strong> leasebacks vary, however, common factors include: the sale of the properties to the joint venture at<br />

market value, options at the end of the lease for the Group to repurchase the properties at market value, market rent reviews <strong>and</strong><br />

20-25 year lease terms. The Group reviews the substance as well as the form of the arrangements when making the judgement as<br />

to whether these leases are operating or finance leases; the majority of the leases under these arrangements are operating leases.<br />

Operating lease receivables – Group as lessor<br />

The Group both rents out its investment properties <strong>and</strong> also sub-lets various leased buildings under operating leases. At the Balance<br />

Sheet date, the following future minimum lease payments are contractually receivable from tenants:<br />

<strong>2007</strong> 2006<br />

£m £m<br />

Within one year 123 84<br />

Greater than one year but less than five years 260 234<br />

After five years 268 283<br />

Total minimum lease payments 651 601<br />

Note 32 Events after the balance sheet date<br />

On 20 March <strong>2007</strong>, the Group formed a property joint venture with The British L<strong>and</strong> Company <strong>PLC</strong>. The limited partnership contains<br />

21 superstores which have been sold from <strong>and</strong> leased back to <strong>Tesco</strong>. The Group sold assets to the joint venture with a fair value of<br />

approximately £650m <strong>and</strong> a net bookvalue of approximately £350m; 50% of the resulting profit will be recognised within profit<br />

arising on property-related items with the remaining percentage deferred on the Balance Sheet in accordance with IAS 31 ‘Interests<br />

in Joint Ventures’.<br />

In March <strong>2007</strong>, the Group issued two bonds: £500m paying interest at 5.2%, maturing in 2057 <strong>and</strong> €600m paying interest at<br />

5.125%, maturing in 2047.<br />

97<br />

NOTES TO THE GROUP<br />

FINANCIAL STATEMENTS