Journal of Technical Analysis - Market Technicians Association

Journal of Technical Analysis - Market Technicians Association

Journal of Technical Analysis - Market Technicians Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

What is the impact <strong>of</strong> waiting for both cloud and Chikou Span filter, and to exit trades aggressively on adverse conditions?<br />

This is the only method where filters were used on trade exit. The result is a clear decline in losses. Both the duration <strong>of</strong> losing trades and the amount <strong>of</strong> losses is<br />

reduced. Both the average loss and the maximum drawdown are the smallest among the methods tested in this study. This makes this method particularly attractive.<br />

The total pr<strong>of</strong>it is not the highest, but in light <strong>of</strong> the risk reduction and capital preservation is quite acceptable at $55,289 and compares to the highest pr<strong>of</strong>it in this<br />

test (see table 1), $89,342 and the lowest pr<strong>of</strong>it at $15,010.<br />

II-C<br />

Trade entry on Kijun Sen/Tanken Sen crossover, adding the position relative to the cloud as filter. (above the cloud for buy, under the cloud for sell) Exit on<br />

reverse Kijun Sen/Tenkan Sen crossover, with no other condition. This signal is named “tk 3” in this paper. (see figure 10)<br />

What is the impact <strong>of</strong> delaying the entry until the cloud confirms the outlook?<br />

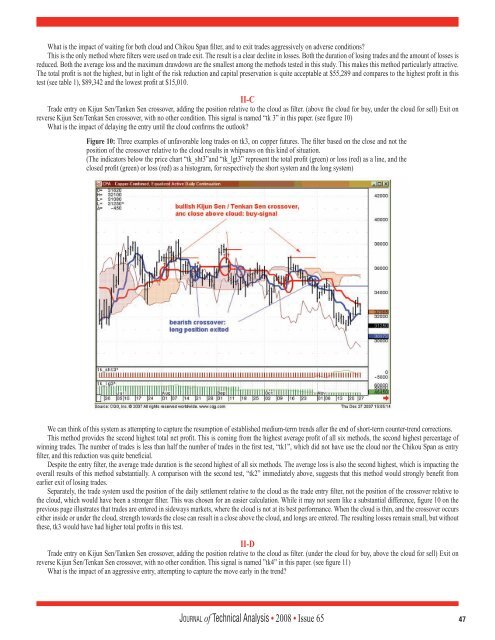

Figure 10: Three examples <strong>of</strong> unfavorable long trades on tk3, on copper futures. The filter based on the close and not the<br />

position <strong>of</strong> the crossover relative to the cloud results in whipsaws on this kind <strong>of</strong> situation.<br />

(The indicators below the price chart “tk_sht3”and “tk_lgt3” represent the total pr<strong>of</strong>it (green) or loss (red) as a line, and the<br />

closed pr<strong>of</strong>it (green) or loss (red) as a histogram, for respectively the short system and the long system)<br />

We can think <strong>of</strong> this system as attempting to capture the resumption <strong>of</strong> established medium-term trends after the end <strong>of</strong> short-term counter-trend corrections.<br />

This method provides the second highest total net pr<strong>of</strong>it. This is coming from the highest average pr<strong>of</strong>it <strong>of</strong> all six methods, the second highest percentage <strong>of</strong><br />

winning trades. The number <strong>of</strong> trades is less than half the number <strong>of</strong> trades in the first test, “tk1”, which did not have use the cloud nor the Chikou Span as entry<br />

filter, and this reduction was quite beneficial.<br />

Despite the entry filter, the average trade duration is the second highest <strong>of</strong> all six methods. The average loss is also the second highest, which is impacting the<br />

overall results <strong>of</strong> this method substantially. A comparison with the second test, “tk2” immediately above, suggests that this method would strongly benefit from<br />

earlier exit <strong>of</strong> losing trades.<br />

Separately, the trade system used the position <strong>of</strong> the daily settlement relative to the cloud as the trade entry filter, not the position <strong>of</strong> the crossover relative to<br />

the cloud, which would have been a stronger filter. This was chosen for an easier calculation. While it may not seem like a substantial difference, figure 10 on the<br />

previous page illustrates that trades are entered in sideways markets, where the cloud is not at its best performance. When the cloud is thin, and the crossover occurs<br />

either inside or under the cloud, strength towards the close can result in a close above the cloud, and longs are entered. The resulting losses remain small, but without<br />

these, tk3 would have had higher total pr<strong>of</strong>its in this test.<br />

II-D<br />

Trade entry on Kijun Sen/Tanken Sen crossover, adding the position relative to the cloud as filter. (under the cloud for buy, above the cloud for sell) Exit on<br />

reverse Kijun Sen/Tenkan Sen crossover, with no other condition. This signal is named ”tk4” in this paper. (see figure 11)<br />

What is the impact <strong>of</strong> an aggressive entry, attempting to capture the move early in the trend?<br />

Jo u r n a l <strong>of</strong> <strong>Technical</strong> <strong>Analysis</strong> • 2008 • Issue 65 47