ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Appendix D<br />

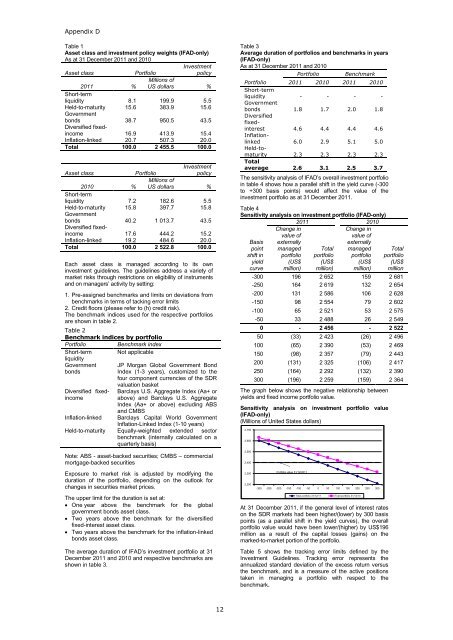

Table 1<br />

Asset class and investment policy weights (<strong>IFAD</strong>-only)<br />

As at 31 December <strong>2011</strong> and 2010<br />

Investment<br />

Asset class Portfolio<br />

Millions of<br />

policy<br />

<strong>2011</strong><br />

Short-term<br />

% US dollars %<br />

liquidity 8.1 199.9 5.5<br />

Held-to-maturity<br />

Government<br />

15.6 383.9 15.6<br />

bonds<br />

Diversified fixed-<br />

38.7 950.5 43.5<br />

income 16.9 413.9 15.4<br />

Inflation-linked 20.7 507.3 20.0<br />

Total 100.0 2 455.5 100.0<br />

Asset class Portfolio<br />

Millions of<br />

Investment<br />

policy<br />

2010<br />

Short-term<br />

% US dollars %<br />

liquidity 7.2 182.6 5.5<br />

Held-to-maturity<br />

Government<br />

15.8 397.7 15.8<br />

bonds<br />

Diversified fixed-<br />

40.2 1 013.7 43.5<br />

income 17.6 444.2 15.2<br />

Inflation-linked 19.2 484.6 20.0<br />

Total 100.0 2 522.8 100.0<br />

Each asset class is managed according to its own<br />

investment guidelines. The guidelines address a variety of<br />

market risks through restrictions on eligibility of instruments<br />

and on managers’ activity by setting:<br />

1. Pre-assigned benchmarks and limits on deviations from<br />

benchmarks in terms of tacking error limits<br />

2. Credit floors (please refer to (h) credit risk).<br />

The benchmark indices used for the respective portfolios<br />

are shown in table 2.<br />

Table 2<br />

Benchmark indices by portfolio<br />

Portfolio Benchmark index<br />

Short-term Not applicable<br />

liquidity<br />

Government<br />

bonds<br />

Diversified fixedincome<br />

JP Morgan Global Government Bond<br />

Index (1-3 years), customized to the<br />

four component currencies of the SDR<br />

valuation basket<br />

Barclays U.S. Aggregate Index (Aa+ or<br />

above) and Barclays U.S. Aggregate<br />

Index (Aa+ or above) excluding ABS<br />

and CMBS<br />

Inflation-linked Barclays Capital World Government<br />

Inflation-Linked Index (1-10 years)<br />

Held-to-maturity Equally-weighted extended sector<br />

benchmark (internally calculated on a<br />

quarterly basis)<br />

Note: ABS - asset-backed securities; CMBS – commercial<br />

mortgage-backed securities<br />

Exposure to market risk is adjusted by modifying the<br />

duration of the portfolio, depending on the outlook for<br />

changes in securities market prices.<br />

The upper limit for the duration is set at:<br />

One year above the benchmark for the global<br />

government bonds asset class.<br />

Two years above the benchmark for the diversified<br />

fixed-interest asset class.<br />

Two years above the benchmark for the inflation-linked<br />

bonds asset class.<br />

The average duration of <strong>IFAD</strong>’s investment portfolio at 31<br />

December <strong>2011</strong> and 2010 and respective benchmarks are<br />

shown in table 3.<br />

12<br />

Table 3<br />

Average duration of portfolios and benchmarks in years<br />

(<strong>IFAD</strong>-only)<br />

As at 31 December <strong>2011</strong> and 2010<br />

Portfolio Benchmark<br />

Portfolio <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Short-term<br />

liquidity - - - -<br />

Government<br />

bonds 1.8 1.7 2.0 1.8<br />

Diversified<br />

fixedinterest<br />

4.6 4.4 4.4 4.6<br />

Inflationlinked<br />

6.0 2.9 5.1 5.0<br />

Held-tomaturity<br />

2.3 2.3 2.3 2.3<br />

Total<br />

average 2.6 3.1 2.5 3.7<br />

The sensitivity analysis of <strong>IFAD</strong>’s overall investment portfolio<br />

in table 4 shows how a parallel shift in the yield curve (-300<br />

to +300 basis points) would affect the value of the<br />

investment portfolio as at 31 December <strong>2011</strong>.<br />

Table 4<br />

Sensitivity analysis on investment portfolio (<strong>IFAD</strong>-only)<br />

<strong>2011</strong> 2010<br />

Basis<br />

point<br />

shift in<br />

yield<br />

curve<br />

Change in<br />

value of<br />

externally<br />

managed<br />

portfolio<br />

(US$<br />

million)<br />

Total<br />

portfolio<br />

(US$<br />

million)<br />

Change in<br />

value of<br />

externally<br />

managed<br />

portfolio<br />

(US$<br />

million)<br />

Total<br />

portfolio<br />

(US$<br />

million<br />

-300 196 2 652 159 2 681<br />

-250 164 2 619 132 2 654<br />

-200 131 2 586 106 2 628<br />

-150 98 2 554 79 2 602<br />

-100 65 2 521 53 2 575<br />

-50 33 2 488 26 2 549<br />

0 - 2 456 - 2 522<br />

50 (33) 2 423 (26) 2 496<br />

100 (65) 2 390 (53) 2 469<br />

150 (98) 2 357 (79) 2 443<br />

200 (131) 2 325 (106) 2 417<br />

250 (164) 2 292 (132) 2 390<br />

300 (196) 2 259 (159) 2 364<br />

The graph below shows the negative relationship between<br />

yields and fixed income portfolio value.<br />

Sensitivity analysis on investment portfolio value<br />

(<strong>IFAD</strong>-only)<br />

(Millions of United States dollars)<br />

2,750<br />

2,650<br />

2,550<br />

2,450<br />

2,350<br />

2,250<br />

Portfolio value 31/12/<strong>2011</strong><br />

-300 -250 -200 -150 -100 -50 0 50 100 150 200 250 300<br />

Total portfolio 31/12/11 Total portfolio 31/12/10<br />

At 31 December <strong>2011</strong>, if the general level of interest rates<br />

on the SDR markets had been higher/(lower) by 300 basis<br />

points (as a parallel shift in the yield curves), the overall<br />

portfolio value would have been lower/(higher) by US$196<br />

million as a result of the capital losses (gains) on the<br />

marked-to-market portion of the portfolio.<br />

Table 5 shows the tracking error limits defined by the<br />

Investment Guidelines. Tracking error represents the<br />

annualized standard deviation of the excess return versus<br />

the benchmark, and is a measure of the active positions<br />

taken in managing a portfolio with respect to the<br />

benchmark.