ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

66<br />

Managing <strong>IFAD</strong>’s liquidity, cash flow<br />

and financial policies<br />

<strong>IFAD</strong> manages investments worth US$2.5 billion for<br />

our regular programme of work, together with<br />

US$0.7 billion on behalf of supplementary<br />

programmes and trust funds, and all related<br />

operational cash flows.<br />

In <strong>2011</strong>, cash flow operations reached record<br />

levels of US$3.9 billion for the regular programme<br />

and US$2.1 billion for supplementary programmes,<br />

registering an overall increase of 33 per cent<br />

compared with 2010. The level of the overall cash<br />

flow increase was driven mainly by a considerable<br />

expansion of supplementary fund activities.<br />

During the year, we completed a comprehensive<br />

review of our investment policy and presented an<br />

Investment Policy Statement to the Executive<br />

Board, setting out the broad framework for<br />

<strong>IFAD</strong>’s investments. As part of the review, a riskbudgeting<br />

approach will be introduced for<br />

investments in 2012 and in-house risk management<br />

will be strengthened through the use of an<br />

enhanced risk management tool.<br />

In preparation for the Consultation on the<br />

Ninth Replenishment of <strong>IFAD</strong>’s Resources<br />

(see page 58), the impact of different programme<br />

levels on our financial resources was analysed<br />

using the asset liability management framework.<br />

We also reviewed the long-term financial approach<br />

to <strong>IFAD</strong>’s sustainability and analysed alternatives<br />

to the Advance Commitment Authority. This is a<br />

facility that allows <strong>IFAD</strong> to use expected future<br />

loan reflows as an additional basis on which to<br />

make new loan and grant commitments. It was first<br />

used at <strong>IFAD</strong> in 2001.<br />

<strong>IFAD</strong> is committed to continuing to make<br />

financial risk management and fiduciary and<br />

transparency issues a priority during the Ninth<br />

Replenishment period 2013-2015.<br />

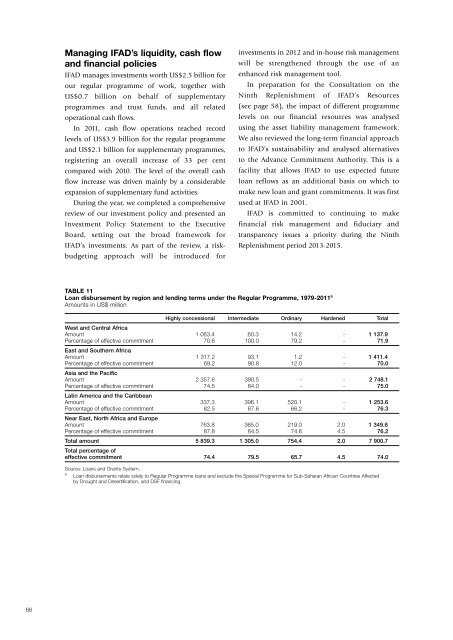

TABLE 11<br />

Loan disbursement by region and lending terms under the Regular Programme, 1979-<strong>2011</strong> a<br />

Amounts in US$ million<br />

Highly concessional Intermediate Ordinary Hardened Total<br />

West and Central Africa<br />

Amount 1 063.4 60.3 14.2 - 1 137.9<br />

Percentage of effective commitment<br />

East and Southern Africa<br />

70.6 100.0 79.2 - 71.9<br />

Amount 1 317.2 93.1 1.2 - 1 411.4<br />

Percentage of effective commitment<br />

Asia and the Pacific<br />

69.2 90.8 12.0 - 70.0<br />

Amount 2 357.6 390.5 - - 2 748.1<br />

Percentage of effective commitment<br />

Latin America and the Caribbean<br />

74.5 84.0 - - 75.0<br />

Amount 337.3 396.1 520.1 - 1 253.6<br />

Percentage of effective commitment<br />

Near East, North Africa and Europe<br />

82.5 87.6 66.2 - 76.3<br />

Amount 763.8 365.0 219.0 2.0 1 349.8<br />

Percentage of effective commitment 87.8 64.5 74.6 4.5 76.2<br />

Total amount<br />

Total percentage of<br />

5 839.3 1 305.0 754.4 2.0 7 900.7<br />

effective commitment 74.4 79.5 65.7 4.5 74.0<br />

Source: Loans and Grants System.<br />

a<br />

Loan disbursements relate solely to Regular Programme loans and exclude the Special Programme for Sub-Saharan African Countries Affected<br />

by Drought and Desertification, and DSF financing.