ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financing by subsector<br />

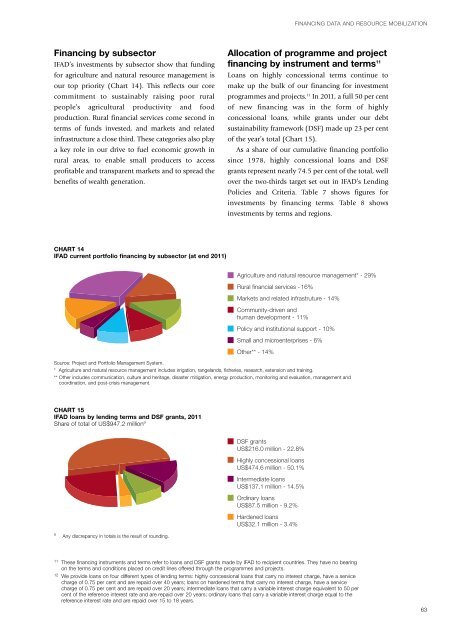

<strong>IFAD</strong>’s investments by subsector show that funding<br />

for agriculture and natural resource management is<br />

our top priority (Chart 14). This reflects our core<br />

commitment to sustainably raising poor rural<br />

people’s agricultural productivity and food<br />

production. Rural financial services come second in<br />

terms of funds invested, and markets and related<br />

infrastructure a close third. These categories also play<br />

a key role in our drive to fuel economic growth in<br />

rural areas, to enable small producers to access<br />

profitable and transparent markets and to spread the<br />

benefits of wealth generation.<br />

CHART 14<br />

<strong>IFAD</strong> current portfolio financing by subsector (at end <strong>2011</strong>)<br />

CHART 15<br />

<strong>IFAD</strong> loans by lending terms and DSF grants, <strong>2011</strong><br />

Share of total of US$947.2 million a<br />

FINANCING DATA AND RESOURCE MOBILIZATION<br />

Allocation of programme and project<br />

financing by instrument and terms11 Loans on highly concessional terms continue to<br />

make up the bulk of our financing for investment<br />

programmes and projects. 12 In <strong>2011</strong>, a full 50 per cent<br />

of new financing was in the form of highly<br />

concessional loans, while grants under our debt<br />

sustainability framework (DSF) made up 23 per cent<br />

of the year’s total (Chart 15).<br />

As a share of our cumulative financing portfolio<br />

since 1978, highly concessional loans and DSF<br />

grants represent nearly 74.5 per cent of the total, well<br />

over the two-thirds target set out in <strong>IFAD</strong>’s Lending<br />

Policies and Criteria. Table 7 shows figures for<br />

investments by financing terms. Table 8 shows<br />

investments by terms and regions.<br />

Agriculture and natural resource management* - 29%<br />

Rural financial services - 16%<br />

Markets and related infrastruture - 14%<br />

Community-driven and<br />

human development - 11%<br />

Policy and institutional support - 10%<br />

Small and microenterprises - 6%<br />

Other** - 14%<br />

Source: Project and Portfolio Management System.<br />

* Agriculture and natural resource management includes irrigation, rangelands, fisheries, research, extension and training.<br />

** Other includes communication, culture and heritage, disaster mitigation, energy production, monitoring and evaluation, management and<br />

coordination, and post-crisis management.<br />

a<br />

Any discrepancy in totals is the result of rounding.<br />

DSF grants<br />

US$216.0 million - 22.8%<br />

Highly concessional loans<br />

US$474.6 million - 50.1%<br />

Intermediate loans<br />

US$137.1 million - 14.5%<br />

Ordinary loans<br />

US$87.5 million - 9.2%<br />

Hardened loans<br />

US$32.1 million - 3.4%<br />

11 These financing instruments and terms refer to loans and DSF grants made by <strong>IFAD</strong> to recipient countries. They have no bearing<br />

on the terms and conditions placed on credit lines offered through the programmes and projects.<br />

12 We provide loans on four different types of lending terms: highly concessional loans that carry no interest charge, have a service<br />

charge of 0.75 per cent and are repaid over 40 years; loans on hardened terms that carry no interest charge, have a service<br />

charge of 0.75 per cent and are repaid over 20 years; intermediate loans that carry a variable interest charge equivalent to 50 per<br />

cent of the reference interest rate and are repaid over 20 years; ordinary loans that carry a variable interest charge equal to the<br />

reference interest rate and are repaid over 15 to 18 years.<br />

63