ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

ANNUAL REPORT 2011 - IFAD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Appendix D<br />

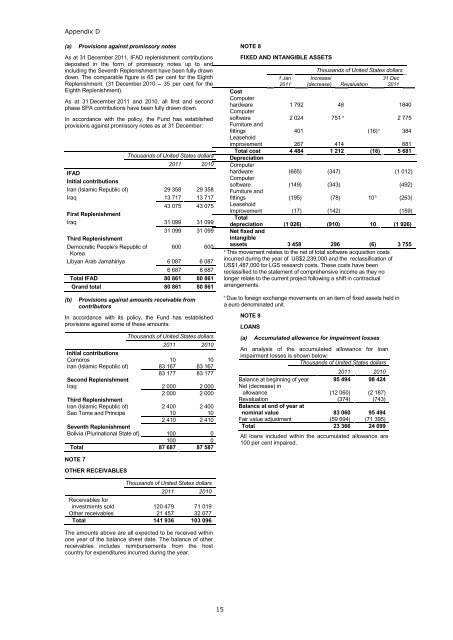

(a) Provisions against promissory notes<br />

As at 31 December <strong>2011</strong>, <strong>IFAD</strong> replenishment contributions<br />

deposited in the form of promissory notes up to and<br />

including the Seventh Replenishment have been fully drawn<br />

down. The comparable figure is 65 per cent for the Eighth<br />

Replenishment. (31 December 2010 – 35 per cent for the<br />

Eighth Replenishment).<br />

As at 31 December <strong>2011</strong> and 2010, all first and second<br />

phase SPA contributions have been fully drawn down.<br />

In accordance with the policy, the Fund has established<br />

provisions against promissory notes as at 31 December:<br />

Thousands of United States dollars<br />

<strong>2011</strong> 2010<br />

<strong>IFAD</strong><br />

Initial contributions<br />

Iran (Islamic Republic of) 29 358 29 358<br />

Iraq 13 717 13 717<br />

43 075 43 075<br />

First Replenishment<br />

Iraq 31 099 31 099<br />

31 099 31 099<br />

Third Replenishment<br />

Democratic People’s Republic of<br />

Korea<br />

600 600<br />

Libyan Arab Jamahiriya 6 087 6 087<br />

6 687 6 687<br />

Total <strong>IFAD</strong> 80 861 80 861<br />

Grand total 80 861 80 861<br />

(b) Provisions against amounts receivable from<br />

contributors<br />

In accordance with its policy, the Fund has established<br />

provisions against some of these amounts:<br />

Thousands of United States dollars<br />

<strong>2011</strong> 2010<br />

Initial contributions<br />

Comoros 10 10<br />

Iran (Islamic Republic of) 83 167 83 167<br />

Second Replenishment<br />

83 177 83 177<br />

Iraq 2 000 2 000<br />

Third Replenishment<br />

2 000 2 000<br />

Iran (Islamic Republic of) 2 400 2 400<br />

Sao Tome and Principe 10 10<br />

Seventh Replenishment<br />

2 410 2 410<br />

Bolivia (Plurinational State of) 100 0<br />

100 0<br />

Total 87 687 87 587<br />

NOTE 7<br />

OTHER RECEIVABLES<br />

Thousands of United States dollars<br />

<strong>2011</strong> 2010<br />

Receivables for<br />

investments sold 120 479 71 019<br />

Other receivables 21 457 32 077<br />

Total 141 936 103 096<br />

The amounts above are all expected to be received within<br />

one year of the balance sheet date. The balance of other<br />

receivables includes reimbursements from the host<br />

country for expenditures incurred during the year.<br />

15<br />

NOTE 8<br />

FIXED AND INTANGIBLE ASSETS<br />

1 Jan<br />

<strong>2011</strong><br />

Thousands of United States dollars<br />

Increase/<br />

(decrease)<br />

Cost<br />

Computer<br />

hardware<br />

Computer<br />

1 792 48<br />

software 2 024 751 a<br />

Furniture and<br />

fittings<br />

Leasehold<br />

401<br />

improvement 267 414<br />

Revaluation<br />

31 Dec<br />

<strong>2011</strong><br />

1840<br />

2 775<br />

(16) b 384<br />

Total cost<br />

Depreciation<br />

Computer<br />

4 484 1 212 (16) 5 681<br />

hardware<br />

Computer<br />

(665) (347)<br />

(1 012)<br />

software<br />

Furniture and<br />

(149) (343)<br />

(492)<br />

fittings (195) (78) 10 b Leasehold<br />

(263)<br />

improvement<br />

Total<br />

(17) (142)<br />

(159)<br />

depreciation<br />

Net fixed and<br />

intangible<br />

(1 026) (910)<br />

10 (1 926)<br />

assets 3 458 296<br />

(6) 3 755<br />

a This movement relates to the net of total software acquisition costs<br />

incurred during the year of US$2,239,000 and the reclassification of<br />

US$1,487,000 for LGS research costs. These costs have been<br />

reclassified to the statement of comprehensive income as they no<br />

longer relate to the current project following a shift in contractual<br />

arrangements.<br />

b Due to foreign exchange movements on an item of fixed assets held in<br />

a euro denominated unit.<br />

NOTE 9<br />

LOANS<br />

(a) Accumulated allowance for impairment losses<br />

An analysis of the accumulated allowance for loan<br />

impairment losses is shown below:<br />

Thousands of United States dollars<br />

<strong>2011</strong> 2010<br />

Balance at beginning of year 95 494 98 424<br />

Net (decrease) in<br />

allowance (12 060) (2 187)<br />

Revaluation (374) (743)<br />

Balance at end of year at<br />

nominal value 83 060 95 494<br />

Fair value adjustment (59 694) (71 395)<br />

Total 23 366 24 099<br />

All loans included within the accumulated allowance are<br />

100 per cent impaired.<br />

681