Annual Report 2008 in PDF - GKN

Annual Report 2008 in PDF - GKN

Annual Report 2008 in PDF - GKN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

Bus<strong>in</strong>ess Review cont<strong>in</strong>ued<br />

Earn<strong>in</strong>gs and dividends per share — pence<br />

2004 2005 2006 2007 <strong>2008</strong><br />

■ Earn<strong>in</strong>gs per share on a management basis<br />

■ Dividend per share<br />

2. Growth <strong>in</strong> sales and trad<strong>in</strong>g marg<strong>in</strong>s<br />

We aim to achieve growth <strong>in</strong> sales at both a Group<br />

and divisional level <strong>in</strong> excess of that seen <strong>in</strong> our major<br />

markets both <strong>in</strong> absolute terms and on a like-for-like<br />

basis, i.e. exclud<strong>in</strong>g the effects of currency translation,<br />

acquisitions or divestments.<br />

In <strong>2008</strong> sales of subsidiaries rose by 13% to £4,376<br />

million. Jo<strong>in</strong>t ventures, the sales of which are not<br />

consolidated <strong>in</strong> the f<strong>in</strong>ancial statements, decl<strong>in</strong>ed by 5%<br />

to £241 million. Our total Group sales on a management<br />

basis <strong>in</strong>creased by £495 million to £4,617 million (12%).<br />

Overall underly<strong>in</strong>g sales rema<strong>in</strong>ed flat with growth<br />

<strong>in</strong> both Aerospace and OffHighway, 10% and 17%<br />

respectively, be<strong>in</strong>g offset by decl<strong>in</strong>es <strong>in</strong> Automotive and<br />

Powder Metallurgy.<br />

The Group’s medium term trad<strong>in</strong>g marg<strong>in</strong> targets<br />

are between 8% and 10% for Drivel<strong>in</strong>e and Powder<br />

Metallurgy, between 6% and 10% for Other Automotive,<br />

7% to 10% <strong>in</strong> OffHighway and 10% or higher for the<br />

Aerospace division, giv<strong>in</strong>g an overall Group marg<strong>in</strong><br />

target of between 8% and 10%.<br />

The Group trad<strong>in</strong>g marg<strong>in</strong> for <strong>2008</strong> of 4.8% (2007 –<br />

7.5%) was adversely affected by the sharp deterioration<br />

<strong>in</strong> automotive markets <strong>in</strong> the second half of the year.<br />

OffHighway and Aerospace marg<strong>in</strong>s were with<strong>in</strong> their<br />

target ranges.<br />

Sales* of cont<strong>in</strong>u<strong>in</strong>g bus<strong>in</strong>esses and return on sales<br />

£m<br />

4,800<br />

4,200<br />

3,600<br />

3,000<br />

2,400<br />

1,800<br />

1,200<br />

600<br />

0<br />

2004 2005 2006 2007 <strong>2008</strong><br />

Return on sales % * <strong>in</strong>clud<strong>in</strong>g subsidiaries and jo<strong>in</strong>t ventures<br />

■ Sales<br />

<strong>GKN</strong> plc <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

%<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

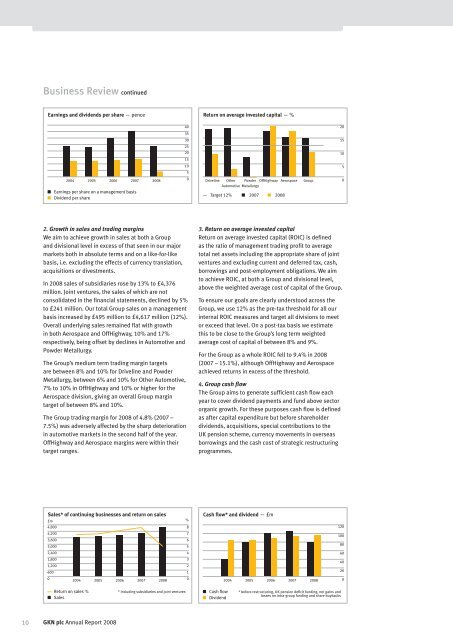

Return on average <strong>in</strong>vested capital — %<br />

Drivel<strong>in</strong>e Other Powder OffHighway Aerospace Group<br />

Automotive Metallurgy<br />

Target 12% ■ 2007 ■ <strong>2008</strong><br />

3. Return on average <strong>in</strong>vested capital<br />

Return on average <strong>in</strong>vested capital (ROIC) is def<strong>in</strong>ed<br />

as the ratio of management trad<strong>in</strong>g profit to average<br />

total net assets <strong>in</strong>clud<strong>in</strong>g the appropriate share of jo<strong>in</strong>t<br />

ventures and exclud<strong>in</strong>g current and deferred tax, cash,<br />

borrow<strong>in</strong>gs and post-employment obligations. We aim<br />

to achieve ROIC, at both a Group and divisional level,<br />

above the weighted average cost of capital of the Group.<br />

To ensure our goals are clearly understood across the<br />

Group, we use 12% as the pre-tax threshold for all our<br />

<strong>in</strong>ternal ROIC measures and target all divisions to meet<br />

or exceed that level. On a post-tax basis we estimate<br />

this to be close to the Group’s long term weighted<br />

average cost of capital of between 8% and 9%.<br />

For the Group as a whole ROIC fell to 9.4% <strong>in</strong> <strong>2008</strong><br />

(2007 – 15.1%), although OffHighway and Aerospace<br />

achieved returns <strong>in</strong> excess of the threshold.<br />

4. Group cash flow<br />

The Group aims to generate sufficient cash flow each<br />

year to cover dividend payments and fund above sector<br />

organic growth. For these purposes cash flow is def<strong>in</strong>ed<br />

as after capital expenditure but before shareholder<br />

dividends, acquisitions, special contributions to the<br />

UK pension scheme, currency movements <strong>in</strong> overseas<br />

borrow<strong>in</strong>gs and the cash cost of strategic restructur<strong>in</strong>g<br />

programmes.<br />

Cash fl ow* and dividend — £m<br />

2004 2005 2006 2007 <strong>2008</strong><br />

■ Cash fl ow * before restructur<strong>in</strong>g, UK pension defi cit fund<strong>in</strong>g, net ga<strong>in</strong>s and<br />

■ Dividend<br />

losses on <strong>in</strong>tra-group fund<strong>in</strong>g and share buybacks<br />

20<br />

15<br />

10<br />

5<br />

0<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0