Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cost of materials<br />

in EUR <strong>2012</strong> 2011<br />

Cost of raw materials, operating<br />

supplies <strong>and</strong> goods 50,677,404.02 61,351,944.61<br />

Cost of purchased services 6,419,857.81 5,850,240.59<br />

Personnel expenses<br />

in EUR <strong>2012</strong> 2011<br />

a) Wages <strong>and</strong> salaries<br />

b) Social security, pensions <strong>and</strong><br />

19,744,368.09 19,587,670.97<br />

other benefits 3,853,292.85 3,292,138.19<br />

of which relating to pensions 389,832.82 116,180.22<br />

Other operating income <strong>and</strong> expenses<br />

In fiscal year <strong>2012</strong>, there are currency exchange rate gains<br />

in the amount of EUR 297,918.61 contained in other operating<br />

income. There are currency exchange rate losses totaling<br />

EUR 239,217.23 in other operating expenses.<br />

Income <strong>and</strong> expense accrued in other<br />

accounting periods<br />

In the reporting year, other operating income included EUR<br />

2,325 thous<strong>and</strong> in prior-period income. These primarily relate<br />

to reversing provisions.<br />

105<br />

Prior-period expenses in the amount of EUR 252 thous<strong>and</strong><br />

are contained in other operating expenses.<br />

Prior-period expenses <strong>and</strong> income resulting from previous<br />

years’ tax payments, totaling EUR 59 thous<strong>and</strong> <strong>and</strong> EUR<br />

235 thous<strong>and</strong> respectively, were recorded in income taxes.<br />

Accumulation <strong>and</strong> discounting of interests for provisions<br />

Interest <strong>and</strong> similar expenses amounting to EUR 430,074.43<br />

thous<strong>and</strong> relate to expenses associated with the discounting<br />

of provisions.<br />

Extraordinary income <strong>and</strong> expenses<br />

There were no extraordinary income <strong>and</strong> expenses in fiscal<br />

year <strong>2012</strong>.<br />

C. SUPPLEMENTARY INFORMATION<br />

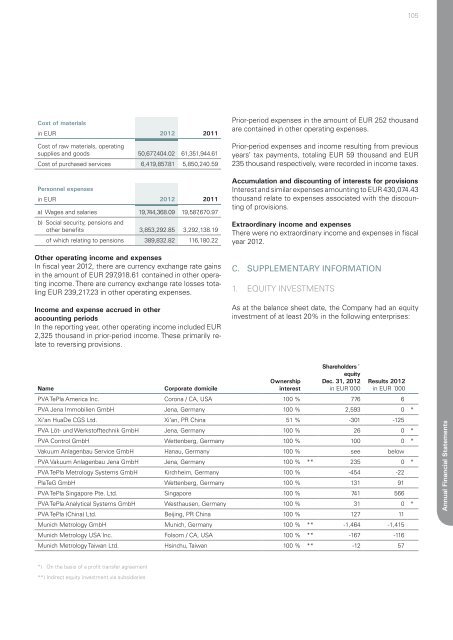

1. EQUITY INVESTMENTS<br />

As at the balance sheet date, the Company had an equity<br />

investment of at least 20% in the following enterprises:<br />

Ownership<br />

Shareholders´<br />

equity<br />

Dec. 31, <strong>2012</strong> Results <strong>2012</strong><br />

Name Corporate domicile<br />

interest in EUR´000 in EUR ´000<br />

<strong>PVA</strong> <strong>TePla</strong> America Inc. Corona / CA, USA 100 % 776 6<br />

<strong>PVA</strong> Jena Immobilien GmbH Jena, Germany 100 % 2,593 0 *<br />

Xi‘an HuaDe CGS Ltd. Xi‘an, PR China 51 % -301 -125<br />

<strong>PVA</strong> Löt- und Werkstofftechnik GmbH Jena, Germany 100 % 26 0 *<br />

<strong>PVA</strong> Control GmbH Wettenberg, Germany 100 % 100 0 *<br />

Vakuum Anlagenbau Service GmbH Hanau, Germany 100 % see below<br />

<strong>PVA</strong> Vakuum Anlagenbau Jena GmbH Jena, Germany 100 % ** 235 0 *<br />

<strong>PVA</strong> <strong>TePla</strong> Metrology Systems GmbH Kirchheim, Germany 100 % -454 -22<br />

PlaTeG GmbH Wettenberg, Germany 100 % 131 91<br />

<strong>PVA</strong> <strong>TePla</strong> Singapore Pte. Ltd. Singapore 100 % 741 566<br />

<strong>PVA</strong> <strong>TePla</strong> Analytical Systems GmbH Westhausen, Germany 100 % 31 0 *<br />

<strong>PVA</strong> <strong>TePla</strong> (China) Ltd. Beijing, PR China 100 % 127 11<br />

Munich Metrology GmbH Munich, Germany 100 % ** -1,464 -1,415<br />

Munich Metrology USA Inc. Folsom / CA, USA 100 % ** -167 -116<br />

Munich Metrology Taiwan Ltd. Hsinchu, Taiwan 100 % ** -12 57<br />

*) On the basis of a profit transfer agreement<br />

**) Indirect equity investment via subsidiaries<br />

<strong>Annual</strong> Financial Statements