Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ilities due to the inclusion of the request for collateral for<br />

an additional approved loan with a total volume of EUR 10<br />

million for financing construction in Wettenberg. While this<br />

loan was approved in 2007, it was not utilized in the <strong>2012</strong><br />

fiscal year.<br />

The loan for the financing of investments in machinery for<br />

the subsidiary <strong>PVA</strong> Löt- und Werkstofftechnik GmbH, Jena<br />

is secured through the transfer of ownership of the assets<br />

to be financed. The carrying amount of this collateral was<br />

EUR 1,332 thous<strong>and</strong> on December 31, <strong>2012</strong> (previous<br />

year: EUR 1,564 thous<strong>and</strong>).<br />

The financial liabilities of <strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> are carried at amortized<br />

cost. As in the previous year, our banks were unable<br />

to provide us with the corresponding information, meaning<br />

that we were only able to approximate the actual<br />

market values using the present values of the principal<br />

repayments based on the yield curve at the balance sheet<br />

date plus a risk premium of 1%. This resulted in deviations<br />

between the conditions at the conclusion date <strong>and</strong> the balance<br />

sheet date in the amount of EUR -1,181 thous<strong>and</strong><br />

(previous year: EUR -1,012 thous<strong>and</strong>).<br />

17. RETIREMENT PENSION PROVISIONS<br />

Basic principles<br />

In the area of company pension schemes, a distinction is<br />

made between defined benefit plans <strong>and</strong> defined contribution<br />

plans. In the case of defined benefit plans, the Company<br />

is obliged to pay defined benefits to active <strong>and</strong> former<br />

employees.<br />

In the case of defined contribution plans, the Company<br />

does not enter into any additional obligations other than<br />

making earmarked contributions.<br />

Defined benefit plans<br />

Provisions for pension obligations are recognized on the<br />

basis of pension plans for commitments to pay retirement,<br />

invalidity <strong>and</strong> dependents’ benefits. The amount of benefit<br />

usually depends on the number of years of service <strong>and</strong> the<br />

salary of the respective employee.<br />

Pension commitments in the form of defined benefit plans<br />

are in place for the eligible employees of <strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> <strong>and</strong><br />

71<br />

<strong>PVA</strong> Vakuum Anlagenbau Jena GmbH. The relevant pension<br />

plans were taken over from previous companies in each<br />

case <strong>and</strong> only consist of previous benefit obligations. New<br />

pension obligations are generally no longer entered into.<br />

Obligations are calculated using the projected unit credit<br />

method, under which future obligations are measured on<br />

the basis of the proportionate benefit entitlement acquired<br />

at the balance sheet date. Measurement takes into<br />

account assumptions on trends for the relevant factors affecting<br />

the amount of benefits.<br />

There is no external financing via a pension fund.<br />

In detail, the calculation is based on the following actuarial<br />

premises:<br />

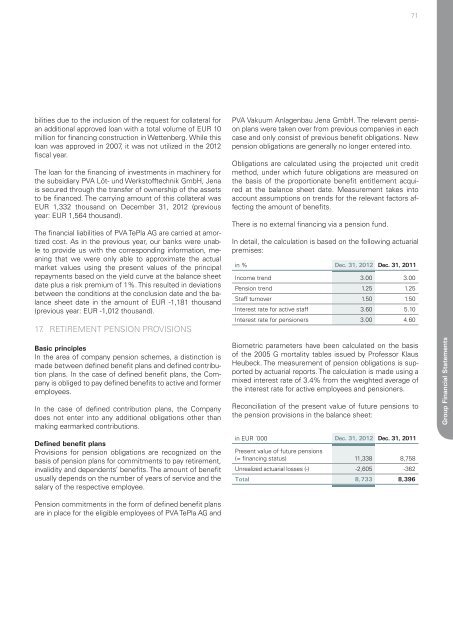

in % Dec. 31, <strong>2012</strong> Dec. 31, 2011<br />

Income trend 3.00 3.00<br />

Pension trend 1.25 1.25<br />

Staff turnover 1.50 1.50<br />

Interest rate for active staff 3.60 5.10<br />

Interest rate for pensioners 3.00 4.60<br />

Biometric parameters have been calculated on the basis<br />

of the 2005 G mortality tables issued by Professor Klaus<br />

Heubeck. The measurement of pension obligations is supported<br />

by actuarial reports. The calculation is made using a<br />

mixed interest rate of 3.4% from the weighted average of<br />

the interest rate for active employees <strong>and</strong> pensioners.<br />

Reconciliation of the present value of future pensions to<br />

the pension provisions in the balance sheet:<br />

in EUR ´000 Dec. 31, <strong>2012</strong> Dec. 31, 2011<br />

Present value of future pensions<br />

(= financing status) 11,338 8,758<br />

Unrealized actuarial losses (-) -2,605 -362<br />

Total 8,733 8,396<br />

Group Financial Statements