Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

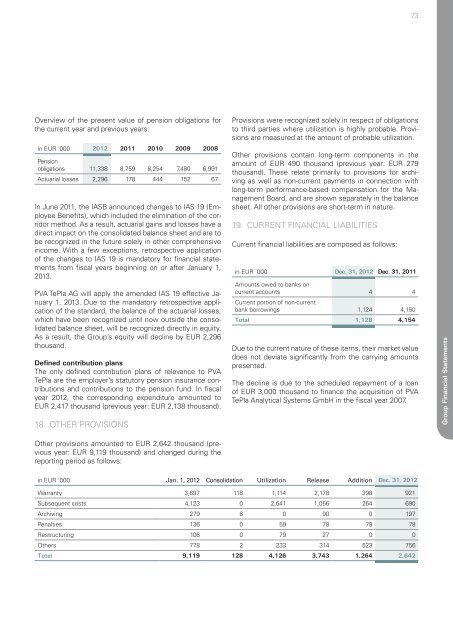

Overview of the present value of pension obligations for<br />

the current year <strong>and</strong> previous years:<br />

in EUR ´000 <strong>2012</strong> 2011 2010 2009 2008<br />

Pension<br />

obligations 11,338 8,759 8,254 7,480 6,991<br />

Actuarial losses 2,296 178 444 152 67<br />

In June 2011, the IASB announced changes to IAS 19 (Employee<br />

Benefits), which included the elimination of the corridor<br />

method. As a result, actuarial gains <strong>and</strong> losses have a<br />

direct impact on the consolidated balance sheet <strong>and</strong> are to<br />

be recognized in the future solely in other comprehensive<br />

income. With a few exceptions, retrospective application<br />

of the changes to IAS 19 is m<strong>and</strong>atory for financial statements<br />

from fiscal years beginning on or after January 1,<br />

2013.<br />

<strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> will apply the amended IAS 19 effective January<br />

1, 2013. Due to the m<strong>and</strong>atory retrospective application<br />

of the st<strong>and</strong>ard, the balance of the actuarial losses,<br />

which have been recognized until now outside the consolidated<br />

balance sheet, will be recognized directly in equity.<br />

As a result, the Group’s equity will decline by EUR 2,296<br />

thous<strong>and</strong>.<br />

Defined contribution plans<br />

The only defined contribution plans of relevance to <strong>PVA</strong><br />

<strong>TePla</strong> are the employer’s statutory pension insurance contributions<br />

<strong>and</strong> contributions to the pension fund. In fiscal<br />

year <strong>2012</strong>, the corresponding expenditure amounted to<br />

EUR 2,417 thous<strong>and</strong> (previous year: EUR 2,138 thous<strong>and</strong>).<br />

18. OTHER PROVISIONS<br />

Other provisions amounted to EUR 2,642 thous<strong>and</strong> (previous<br />

year: EUR 9,119 thous<strong>and</strong>) <strong>and</strong> changed during the<br />

reporting period as follows:<br />

73<br />

Provisions were recognized solely in respect of obligations<br />

to third parties where utilization is highly probable. Provisions<br />

are measured at the amount of probable utilization.<br />

Other provisions contain long-term components in the<br />

amount of EUR 490 thous<strong>and</strong> (previous year: EUR 279<br />

thous<strong>and</strong>). These relate primarily to provisions for archiving<br />

as well as non-current payments in connection with<br />

long-term performance-based compensation for the Management<br />

Board, <strong>and</strong> are shown separately in the balance<br />

sheet. All other provisions are short-term in nature.<br />

19. CURRENT FINANCIAL LIABILITIES<br />

Current financial liabilities are composed as follows:<br />

in EUR ´000 Dec. 31, <strong>2012</strong> Dec. 31, 2011<br />

Amounts owed to banks on<br />

current accounts<br />

Current portion of non-current<br />

4 4<br />

bank borrowings 1,124 4,150<br />

Total 1,128 4,154<br />

Due to the current nature of these items, their market value<br />

does not deviate significantly from the carrying amounts<br />

presented.<br />

The decline is due to the scheduled repayment of a loan<br />

of EUR 3,000 thous<strong>and</strong> to finance the acquisition of <strong>PVA</strong><br />

<strong>TePla</strong> Analytical Systems GmbH in the fiscal year 2007.<br />

in EUR ´000 Jan. 1, <strong>2012</strong> Consolidation Utilization Release Addition Dec. 31, <strong>2012</strong><br />

Warranty 3,697 118 1,114 2,178 398 921<br />

Subsequent costs 4,123 0 2,641 1,056 264 690<br />

Archiving 279 8 0 90 0 197<br />

Penalties 136 0 59 78 79 78<br />

Restructuring 106 0 79 27 0 0<br />

Others 778 2 233 314 523 756<br />

Total 9,119 128 4,126 3,743 1,264 2,642<br />

Group Financial Statements