Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SOLAR SYSTEMS DIVISION<br />

Sales revenues in the Solar Systems division totaled EUR<br />

8.2 million in <strong>2012</strong> (previous year: EUR 26.3 million). The<br />

division thus contributed 8% of total sales revenues for the<br />

<strong>PVA</strong> <strong>TePla</strong> Group. As in the other divisions, sales revenues<br />

in <strong>2012</strong> result primarily from orders received in 2011; in the<br />

Solar Systems division, these orders were for delivery of<br />

crystal growing systems. There is significant overcapacity<br />

in the global photovoltaic market. Worldwide production<br />

capacity for PV modules is nearly 60 gigawatt. That means<br />

the capacity to produce PV modules in <strong>2012</strong> was nearly<br />

twice as high as the expected market volume. A significant<br />

decline in prices was therefore unavoidable. Despite<br />

these difficulties, the worldwide photovoltaic market in<br />

<strong>2012</strong> grew by about 15% in volume to around 30 GW. The<br />

collapse in prices was a significant contributing factor to<br />

the growth in the market, particularly in countries such as<br />

the US. Photovoltaic markets are growing <strong>and</strong> diversifying.<br />

This also leads to new opportunities in markets that were<br />

not the focus of attention until now. In particular, the Solar<br />

Systems division sees good sales opportunities for its<br />

products in the short term in markets that want to exp<strong>and</strong><br />

their own solar production due to economic policy reasons.<br />

Nevertheless, it must also be stated that 2013 will be a<br />

difficult year for the division.<br />

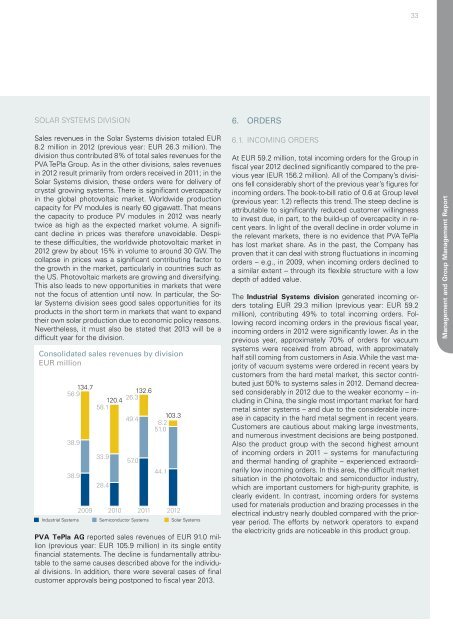

<strong>Consolidated</strong> sales revenues by division<br />

EUR million<br />

134.7<br />

56.9<br />

120.4<br />

58.1<br />

132.6<br />

26.3<br />

49.4<br />

103.3<br />

8.2<br />

51.0<br />

38.9<br />

38.9<br />

33.9<br />

28.4<br />

57.0<br />

44.1<br />

2009 2010 2011 <strong>2012</strong><br />

Industrial Systems Semiconductor Systems Solar Systems<br />

<strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> reported sales revenues of EUR 91.0 million<br />

(previous year: EUR 105.9 million) in its single entity<br />

financial statements. The decline is fundamentally attributable<br />

to the same causes described above for the individual<br />

divisions. In addition, there were several cases of final<br />

customer approvals being postponed to fiscal year 2013.<br />

6. ORDERS<br />

6.1. INCOMING ORDERS<br />

33<br />

At EUR 59.2 million, total incoming orders for the Group in<br />

fiscal year <strong>2012</strong> declined significantly compared to the previous<br />

year (EUR 156.2 million). All of the Company’s divisions<br />

fell considerably short of the previous year’s figures for<br />

incoming orders. The book-to-bill ratio of 0.6 at Group level<br />

(previous year: 1.2) reflects this trend. The steep decline is<br />

attributable to significantly reduced customer willingness<br />

to invest due, in part, to the build-up of overcapacity in recent<br />

years. In light of the overall decline in order volume in<br />

the relevant markets, there is no evidence that <strong>PVA</strong> <strong>TePla</strong><br />

has lost market share. As in the past, the Company has<br />

proven that it can deal with strong fluctuations in incoming<br />

orders – e.g., in 2009, when incoming orders declined to<br />

a similar extent – through its flexible structure with a low<br />

depth of added value.<br />

The Industrial Systems division generated incoming orders<br />

totaling EUR 29.3 million (previous year: EUR 59.2<br />

million), contributing 49% to total incoming orders. Following<br />

record incoming orders in the previous fiscal year,<br />

incoming orders in <strong>2012</strong> were significantly lower. As in the<br />

previous year, approximately 70% of orders for vacuum<br />

systems were received from abroad, with approximately<br />

half still coming from customers in Asia. While the vast majority<br />

of vacuum systems were ordered in recent years by<br />

customers from the hard metal market, this sector contributed<br />

just 50% to systems sales in <strong>2012</strong>. Dem<strong>and</strong> decreased<br />

considerably in <strong>2012</strong> due to the weaker economy – including<br />

in China, the single most important market for hard<br />

metal sinter systems – <strong>and</strong> due to the considerable increase<br />

in capacity in the hard metal segment in recent years.<br />

Customers are cautious about making large investments,<br />

<strong>and</strong> numerous investment decisions are being postponed.<br />

Also the product group with the second highest amount<br />

of incoming orders in 2011 – systems for manufacturing<br />

<strong>and</strong> thermal h<strong>and</strong>ing of graphite – experienced extraordinarily<br />

low incoming orders. In this area, the difficult market<br />

situation in the photovoltaic <strong>and</strong> semiconductor industry,<br />

which are important customers for high-purity graphite, is<br />

clearly evident. In contrast, incoming orders for systems<br />

used for materials production <strong>and</strong> brazing processes in the<br />

electrical industry nearly doubled compared with the prioryear<br />

period. The efforts by network operators to exp<strong>and</strong><br />

the electricity grids are noticeable in this product group.<br />

Management <strong>and</strong> Group Management <strong>Report</strong>