Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

Consolidated Annual Report 2012 and Single-Entity ... - PVA TePla AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 <strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

The Semiconductor Systems division likewise posted<br />

a decline in incoming orders in <strong>2012</strong>, coming in at EUR<br />

28.8 million (previous year: EUR 68.1 million), a similar level<br />

of incoming orders as the Industrial Systems division,<br />

<strong>and</strong> representing a 49% share of total incoming orders at<br />

the <strong>PVA</strong> <strong>TePla</strong> Group. During the third <strong>and</strong> fourth quarter of<br />

<strong>2012</strong>, <strong>PVA</strong> <strong>TePla</strong> Danmark, a manufacturer of floatzone systems,<br />

received orders from Korea for crystal growing systems<br />

for the manufacture of high-purity silicon crystals for<br />

high performance electronics <strong>and</strong> analysis purposes. This<br />

area is impacted by the fact that expansion investments<br />

for the manufacture of high-purity polysilicon has come to<br />

a st<strong>and</strong>still due to the weakness in solar markets. In addition,<br />

the considerable decline in the need for materials for<br />

high-performance electronics, which also comes from this<br />

sector, has been an additional factor. As the semiconductor<br />

market contracted in <strong>2012</strong>, the willingness of companies to<br />

invest has declined overall. In contrast, incoming orders in<br />

2011 were characterized by very positive ongoing business<br />

for crystal growing systems. Asia also plays a dominant<br />

role in the Analytical Systems business unit, in which systems<br />

are developed <strong>and</strong> produced for the nondestructive<br />

inspection of materials. Asia’s share of incoming orders<br />

totaled approximately 50%. At the moment, China <strong>and</strong><br />

Singapore are the driving markets in this region, whereas<br />

Korea <strong>and</strong> Taiwan will increasingly become the focus of<br />

attention for this business unit in the future. The need for<br />

systems to analyze defects <strong>and</strong> perform quality control of<br />

chips for smartphones <strong>and</strong> tablets continues to increase.<br />

The Plasma Systems business unit at the locations in Kirchheim<br />

<strong>and</strong> Corona posted the highest incoming orders in<br />

the Semiconductor Systems division. The Asian region is<br />

the largest market for the plasma systems of <strong>PVA</strong> <strong>TePla</strong>.<br />

It is encouraging that the customer base in the back end<br />

packaging segment has exp<strong>and</strong>ed considerably compared<br />

with recent years. A series of new products that were finalized<br />

in <strong>2012</strong> have resulted in good opportunities that will<br />

enable the Company to grow disproportionately when the<br />

next recovery in the semiconductor market occurs.<br />

The Solar Systems division posted incoming orders of just<br />

EUR 1.1 million (previous year: EUR 28.9 million). This division<br />

accounted for a 2% share of total incoming orders.<br />

Significant overcapacity in the solar market <strong>and</strong> sharp declines<br />

in sales prices across the entire supply chain of the<br />

solar industry resulted from the significant investments<br />

to exp<strong>and</strong> capacity, particularly by Chinese providers. The<br />

entire solar market is in upheaval. It is expected that this<br />

consolidation will continue in 2013. Dem<strong>and</strong> for equipment<br />

for the solar industry is expected to remain low in 2013 <strong>and</strong><br />

2014. It is highly likely that a system technology will prevail<br />

that guarantees maximum efficiency <strong>and</strong> optimal cost of<br />

ownership. As <strong>PVA</strong> <strong>TePla</strong> is working intensively to develop<br />

such systems for industrial applications, medium to longterm<br />

market prospects are positive, even given the difficult<br />

photovoltaic market at present.<br />

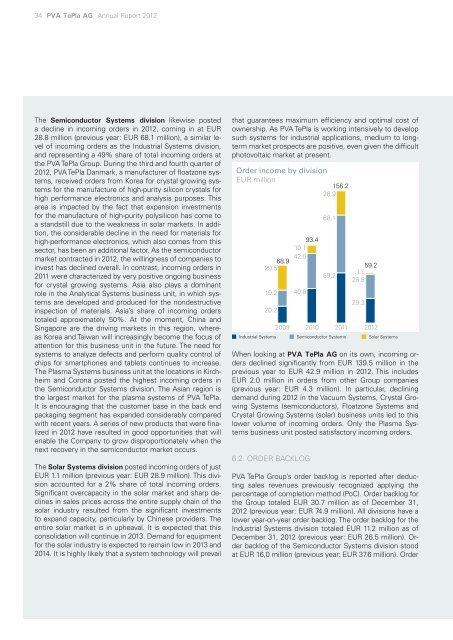

Order income by division<br />

EUR million<br />

156.2<br />

28.9<br />

68.9<br />

29.5<br />

19.2<br />

20.2<br />

93.4<br />

10.1<br />

42.5<br />

40.8<br />

When looking at <strong>PVA</strong> <strong>TePla</strong> <strong>AG</strong> on its own, incoming orders<br />

declined significantly from EUR 139.5 million in the<br />

previous year to EUR 42.9 million in <strong>2012</strong>. This includes<br />

EUR 2.0 million in orders from other Group companies<br />

(previous year: EUR 4.3 million). In particular, declining<br />

dem<strong>and</strong> during <strong>2012</strong> in the Vacuum Systems, Crystal Growing<br />

Systems (semiconductors), Floatzone Systems <strong>and</strong><br />

Crystal Growing Systems (solar) business units led to this<br />

lower volume of incoming orders. Only the Plasma Systems<br />

business unit posted satisfactory incoming orders.<br />

6.2. ORDER BACKLOG<br />

68.1<br />

59.2<br />

59.2<br />

1.1<br />

28.8<br />

29.3<br />

2009 2010 2011 <strong>2012</strong><br />

Industrial Systems Semiconductor Systems Solar Systems<br />

<strong>PVA</strong> <strong>TePla</strong> Group’s order backlog is reported after deducting<br />

sales revenues previously recognized applying the<br />

percentage of completion method (PoC). Order backlog for<br />

the Group totaled EUR 30.7 million as of December 31,<br />

<strong>2012</strong> (previous year: EUR 74.9 million). All divisions have a<br />

lower year-on-year order backlog. The order backlog for the<br />

Industrial Systems division totaled EUR 11.2 million as of<br />

December 31, <strong>2012</strong> (previous year: EUR 26.5 million). Order<br />

backlog of the Semiconductor Systems division stood<br />

at EUR 16,0 million (previous year: EUR 37.6 million). Order