2005 Annual Report - SBM Offshore

2005 Annual Report - SBM Offshore

2005 Annual Report - SBM Offshore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Shareholder information<br />

Share listing<br />

The shares of <strong>SBM</strong> <strong>Offshore</strong> N.V. (par value € 1.00) are listed<br />

on the stock exchange of Amsterdam since 11 October 1965,<br />

originally under the name IHC Holland and later as IHC<br />

Caland. The shares are included in the AEX Index of Euronext<br />

Amsterdam since 4 March 2003. On 2 May <strong>2005</strong> the shares<br />

were for the first time listed under the current name <strong>SBM</strong><br />

<strong>Offshore</strong>. Out of the 23 participants in the index at year-end<br />

<strong>2005</strong>, the Company ranked 19th on the basis of market<br />

capitalisation, with a weighting of 0.59%, and 22nd on the<br />

basis of turnover. Options on Company shares have been<br />

traded since 7 July 1993 on the Euronext Amsterdam<br />

Derivative Markets. The revised Articles of Association<br />

adopted by the Extraordinary General Meeting of<br />

Shareholders of 11 February <strong>2005</strong> provided the Company with<br />

the option to dematerialise its shares. This change was<br />

effected on 31 October <strong>2005</strong>, replacing the bearer shares by<br />

a share register.<br />

Share price development<br />

The share price went up during the year <strong>2005</strong> by 46% from<br />

€ 46.74 to € 68.25, thereby outperforming the AEX by<br />

20.5%, compared with an outperformance by 5% in 2004.<br />

In US Dollar terms the increase of the share price in <strong>2005</strong> was<br />

26.7%, from US$ 63.47 to US$ 80.41.<br />

Dividend<br />

As in previous years, the annual dividend will be calculated in<br />

US Dollars, but will be payable in Euros. The conversion into<br />

Euros will be effected on the basis of the exchange rate on 19<br />

May 2006. The same exchange rate will apply in the event a<br />

shareholder elects for a dividend payment in shares of <strong>SBM</strong><br />

<strong>Offshore</strong>. Based on the year-end closing price, the proposed<br />

dividend of US$ 3.30 per share gives a yield of 4.0% per<br />

share (2004: 2.7%). The proposed dividend is based upon the<br />

Company’s usual 50% pay-out ratio, and taking into account<br />

the exceptional net income from the FPSO Serpentina<br />

transaction.<br />

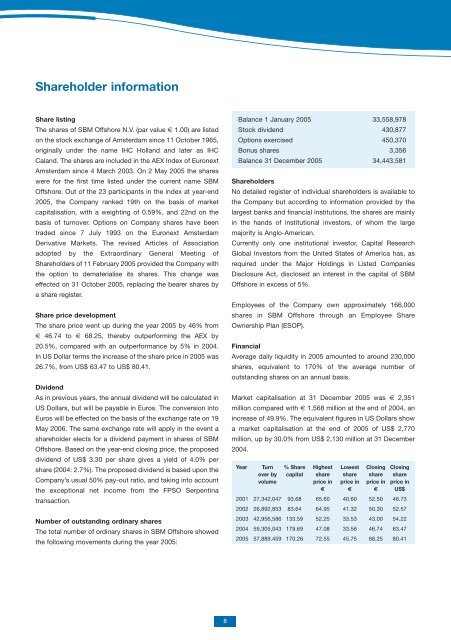

Number of outstanding ordinary shares<br />

The total number of ordinary shares in <strong>SBM</strong> <strong>Offshore</strong> showed<br />

the following movements during the year <strong>2005</strong>:<br />

8<br />

Balance 1 January <strong>2005</strong> 33,558,978<br />

Stock dividend 430,877<br />

Options exercised 450,370<br />

Bonus shares 3,356<br />

Balance 31 December <strong>2005</strong> 34,443,581<br />

Shareholders<br />

No detailed register of individual shareholders is available to<br />

the Company but according to information provided by the<br />

largest banks and financial institutions, the shares are mainly<br />

in the hands of institutional investors, of whom the large<br />

majority is Anglo-American.<br />

Currently only one institutional investor, Capital Research<br />

Global Investors from the United States of America has, as<br />

required under the Major Holdings in Listed Companies<br />

Disclosure Act, disclosed an interest in the capital of <strong>SBM</strong><br />

<strong>Offshore</strong> in excess of 5%.<br />

Employees of the Company own approximately 166,000<br />

shares in <strong>SBM</strong> <strong>Offshore</strong> through an Employee Share<br />

Ownership Plan (ESOP).<br />

Financial<br />

Average daily liquidity in <strong>2005</strong> amounted to around 230,000<br />

shares, equivalent to 170% of the average number of<br />

outstanding shares on an annual basis.<br />

Market capitalisation at 31 December <strong>2005</strong> was € 2,351<br />

million compared with € 1,568 million at the end of 2004, an<br />

increase of 49.9%. The equivalent figures in US Dollars show<br />

a market capitalisation at the end of <strong>2005</strong> of US$ 2,770<br />

million, up by 30.0% from US$ 2,130 million at 31 December<br />

2004.<br />

Year Turn % Share Highest Lowest Closing Closing<br />

over by capital share share share share<br />

volume price in price in price in price in<br />

€ € € US$<br />

2001 27,342,047 93.68 65.60 40.60 52.50 46.73<br />

2002 26,892,853 83.64 64.95 41.32 50.30 52.57<br />

2003 42,956,586 133.59 52.25 33.53 43.00 54.22<br />

2004 59,305,043 179.69 47.08 33.56 46.74 63.47<br />

<strong>2005</strong> 57,889.459 170.26 72.55 45.75 68.25 80.41