From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GAMES MARKET OVERVIEW<br />

• Console manufacturer: Manufacturers heavily<br />

subsidise the cost of the console hardware itself<br />

but charge a license fee for each unit of software<br />

sold. The console hardware is thus a loss leader<br />

for selling games. As a result, manufacturers<br />

spend very heavily every five years <strong>to</strong> promote<br />

their new console platforms (e.g. Microsoft has an<br />

estimated $500m budget <strong>to</strong> market the Xbox).<br />

Consequently, manufacturers control access <strong>to</strong><br />

their console platforms very closely through<br />

licensing developers and access <strong>to</strong> development<br />

<strong>to</strong>ols, approval of titles at concept and<br />

manufacturing stage and control of the<br />

manufacturing process.<br />

The console manufacturers also have in-house<br />

development and publishing arms which are able <strong>to</strong><br />

produce high production value games for their own<br />

platforms as flagship titles as license fee payments<br />

do not apply <strong>to</strong> them.<br />

2.2 Global market size<br />

The global leisure software industry has experienced<br />

rapid growth over the last five years and is now<br />

estimated <strong>to</strong> be worth c £13bn. Of this <strong>to</strong>tal, games<br />

software represents the majority of the market,<br />

approximately £10bn (the remainder is accounted for<br />

by educational, children's, reference, utility and home<br />

office software). The US is the largest leisure<br />

software market in the world, accounting for £4.5bn<br />

in 2000, followed by the European (£4.1bn) and<br />

Japanese (£2.4bn) markets.<br />

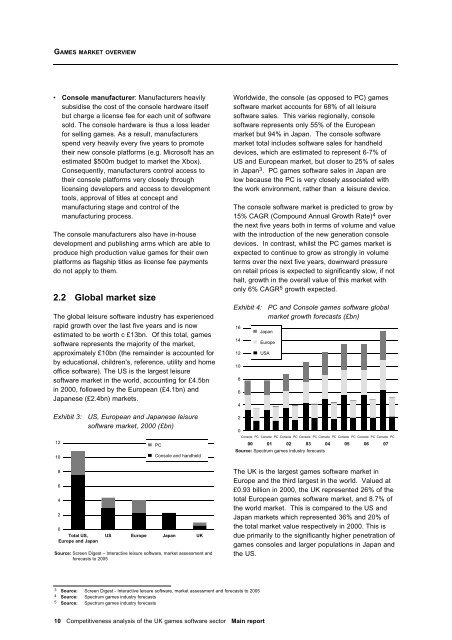

Exhibit 3: US, European and Japanese leisure<br />

software market, 2000 (£bn)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Total US,<br />

Europe and Japan<br />

US Europe Japan UK<br />

Source: Screen Digest – Interactive leisure software, market assessment and<br />

forecasts <strong>to</strong> 2005<br />

3 Source: Screen Digest - Interactive leisure software, market assessment and forecasts <strong>to</strong> 2005<br />

4 Source: Spectrum games industry forecasts<br />

5 Source: Spectrum games industry forecasts<br />

PC<br />

Console and handheld<br />

10 Competitiveness analysis of the UK games software sec<strong>to</strong>r Main report<br />

Worldwide, the console (as opposed <strong>to</strong> PC) games<br />

software market accounts for 68% of all leisure<br />

software sales. This varies regionally, console<br />

software represents only 55% of the European<br />

market but 94% in Japan. The console software<br />

market <strong>to</strong>tal includes software sales for handheld<br />

devices, which are estimated <strong>to</strong> represent 6-7% of<br />

US and European market, but closer <strong>to</strong> 25% of sales<br />

in Japan 3 . PC games software sales in Japan are<br />

low because the PC is very closely associated with<br />

the work environment, rather than a leisure device.<br />

The console software market is predicted <strong>to</strong> grow by<br />

15% CAGR (Compound Annual Growth Rate) 4 over<br />

the next five years both in terms of volume and value<br />

with the introduction of the new generation console<br />

devices. In contrast, whilst the PC games market is<br />

expected <strong>to</strong> continue <strong>to</strong> grow as strongly in volume<br />

terms over the next five years, downward pressure<br />

on retail prices is expected <strong>to</strong> significantly slow, if not<br />

halt, growth in the overall value of this market with<br />

only 6% CAGR 5 growth expected.<br />

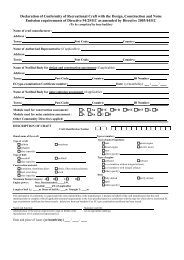

Exhibit 4: PC and Console games software global<br />

market growth forecasts (£bn)<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Console PC Console PC Console PC Console PC Console PC Console PC Console PC Console PC<br />

00<br />

Japan<br />

Europe<br />

USA<br />

01<br />

02<br />

03<br />

Source: Spectrum games industry forecasts<br />

The UK is the largest games software market in<br />

Europe and the third largest in the world. Valued at<br />

£0.93 billion in 2000, the UK represented 26% of the<br />

<strong>to</strong>tal European games software market, and 8.7% of<br />

the world market. This is compared <strong>to</strong> the US and<br />

Japan markets which represented 36% and 20% of<br />

the <strong>to</strong>tal market value respectively in 2000. This is<br />

due primarily <strong>to</strong> the significantly higher penetration of<br />

games consoles and larger populations in Japan and<br />

the US.<br />

04<br />

05<br />

06<br />

07