From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

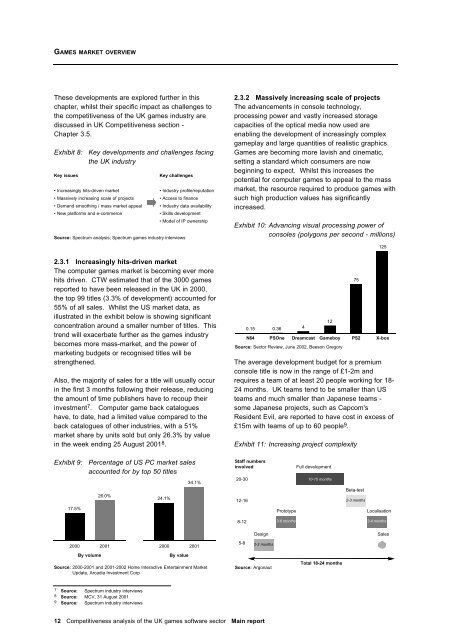

GAMES MARKET OVERVIEW<br />

These developments are explored further in this<br />

chapter, whilst their specific impact as challenges <strong>to</strong><br />

the competitiveness of the UK games industry are<br />

discussed in UK Competitiveness section -<br />

Chapter 3.5.<br />

Exhibit 8: Key developments and challenges facing<br />

the UK industry<br />

Key issues<br />

• Increasingly hits-driven market<br />

• Massively increasing scale of projects<br />

• Demand smoothing / mass market appeal<br />

• New platforms and e-commerce<br />

Source: Spectrum analysis; Spectrum games industry interviews<br />

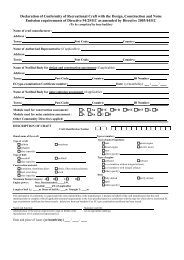

2.3.1 Increasingly hits-driven market<br />

The computer games market is becoming ever more<br />

hits driven. CTW estimated that of the 3000 games<br />

reported <strong>to</strong> have been released in the UK in 2000,<br />

the <strong>to</strong>p 99 titles (3.3% of development) accounted for<br />

55% of all sales. Whilst the US market data, as<br />

illustrated in the exhibit below is showing significant<br />

concentration around a smaller number of titles. This<br />

trend will exacerbate further as the games industry<br />

becomes more mass-market, and the power of<br />

marketing budgets or recognised titles will be<br />

strengthened.<br />

Also, the majority of sales for a title will usually occur<br />

in the first 3 months following their release, reducing<br />

the amount of time publishers have <strong>to</strong> recoup their<br />

investment 7 . Computer game back catalogues<br />

have, <strong>to</strong> date, had a limited value compared <strong>to</strong> the<br />

back catalogues of other industries, with a 51%<br />

market share by units sold but only 26.3% by value<br />

in the week ending 25 August 2001 8 .<br />

Exhibit 9: Percentage of US PC market sales<br />

accounted for by <strong>to</strong>p 50 titles<br />

17.5%<br />

2000<br />

26.0%<br />

24.1%<br />

34.1%<br />

2001 2000 2001<br />

By volume By value<br />

Source: 2000-2001 and 2001-2002 <strong>Home</strong> Interactive Entertainment Market<br />

Update, Arcadia Investment Corp<br />

7 Source: Spectrum industry interviews<br />

8 Source: MCV, 31 August 2001<br />

9 Source: Spectrum industry interviews<br />

Key challenges<br />

• Industry profile/reputation<br />

• Access <strong>to</strong> finance<br />

• Industry data availability<br />

• Skills development<br />

• Model of IP ownership<br />

12 Competitiveness analysis of the UK games software sec<strong>to</strong>r Main report<br />

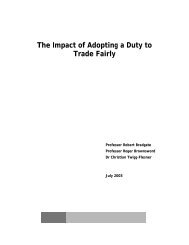

2.3.2 Massively increasing scale of projects<br />

The advancements in console technology,<br />

processing power and vastly increased s<strong>to</strong>rage<br />

capacities of the optical media now used are<br />

enabling the development of increasingly complex<br />

gameplay and large quantities of realistic graphics.<br />

Games are becoming more lavish and cinematic,<br />

setting a standard which consumers are now<br />

beginning <strong>to</strong> expect. Whilst this increases the<br />

potential for computer games <strong>to</strong> appeal <strong>to</strong> the mass<br />

market, the resource required <strong>to</strong> produce games with<br />

such high production values has significantly<br />

increased.<br />

Exhibit 10: Advancing visual processing power of<br />

consoles (polygons per second - millions)<br />

The average development budget for a premium<br />

console title is now in the range of £1-2m and<br />

requires a team of at least 20 people working for 18-<br />

24 months. UK teams tend <strong>to</strong> be smaller than US<br />

teams and much smaller than Japanese teams -<br />

some Japanese projects, such as Capcom's<br />

Resident Evil, are reported <strong>to</strong> have cost in excess of<br />

£15m with teams of up <strong>to</strong> 60 people 9 .<br />

Exhibit 11: Increasing project complexity<br />

20-30<br />

12-16<br />

8-12<br />

5-8<br />

0.15 0.36 4<br />

N64<br />

Staff numbers<br />

involved Full development<br />

Source: Argonaut<br />

Pro<strong>to</strong>type<br />

3-6 months<br />

10-15 months<br />

Total 18-24 months<br />

Beta-test<br />

2-3 monthss<br />

Localisation<br />

3-4 months<br />

Design Sales<br />

2-3 months<br />

PSOne<br />

Source: Sec<strong>to</strong>r Review, June 2002, Beeson Gregory<br />

12<br />

75<br />

125<br />

Dreamcast Gameboy PS2 X-box