From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

From Exuberant Youth to Sustainable Maturity - DTI Home

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

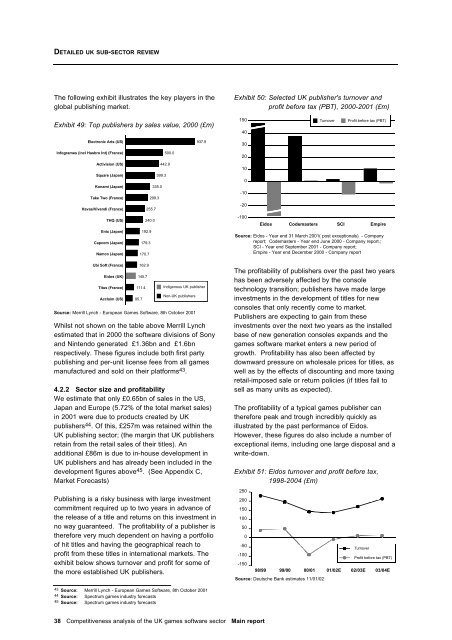

DETAILED UK SUB-SECTOR REVIEW<br />

The following exhibit illustrates the key players in the<br />

global publishing market.<br />

Exhibit 49: Top publishers by sales value, 2000 (£m)<br />

Electronic Arts (US)<br />

Infogrames (incl Hasbro Int) (France)<br />

Activision (US)<br />

Square (Japan)<br />

Konami (Japan)<br />

Take Two (France)<br />

Havas/Vivendi (France)<br />

THQ (US)<br />

Enix (Japan)<br />

Capcom (Japan)<br />

Namco (Japan)<br />

Ubi Soft (France)<br />

Eidos (UK)<br />

Titus (France)<br />

Acclaim (US)<br />

500.0<br />

442.9<br />

399.3<br />

335.0<br />

299.3<br />

255.7<br />

240.0<br />

192.9<br />

179.3<br />

170.7<br />

162.9<br />

145.7<br />

111.4<br />

Indigenous UK publisher<br />

Source: Merrill Lynch - European Games Software, 8th Oc<strong>to</strong>ber 2001<br />

937.9<br />

Whilst not shown on the table above Merrill Lynch<br />

estimated that in 2000 the software divisions of Sony<br />

and Nintendo generated £1.36bn and £1.6bn<br />

respectively. These figures include both first party<br />

publishing and per-unit license fees from all games<br />

manufactured and sold on their platforms 43 .<br />

4.2.2 Sec<strong>to</strong>r size and profitability<br />

We estimate that only £0.65bn of sales in the US,<br />

Japan and Europe (5.72% of the <strong>to</strong>tal market sales)<br />

in 2001 were due <strong>to</strong> products created by UK<br />

publishers 44 . Of this, £257m was retained within the<br />

UK publishing sec<strong>to</strong>r; (the margin that UK publishers<br />

retain from the retail sales of their titles). An<br />

additional £86m is due <strong>to</strong> in-house development in<br />

UK publishers and has already been included in the<br />

development figures above 45 . (See Appendix C,<br />

Market Forecasts)<br />

95.7<br />

Non-UK publishers<br />

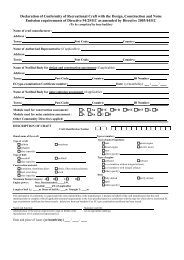

Publishing is a risky business with large investment<br />

commitment required up <strong>to</strong> two years in advance of<br />

the release of a title and returns on this investment in<br />

no way guaranteed. The profitability of a publisher is<br />

therefore very much dependent on having a portfolio<br />

of hit titles and having the geographical reach <strong>to</strong><br />

profit from these titles in international markets. The<br />

exhibit below shows turnover and profit for some of<br />

the more established UK publishers.<br />

43 Source: Merrill Lynch - European Games Software, 8th Oc<strong>to</strong>ber 2001<br />

44 Source: Spectrum games industry forecasts<br />

45 Source: Spectrum games industry forecasts<br />

38 Competitiveness analysis of the UK games software sec<strong>to</strong>r Main report<br />

Exhibit 50: Selected UK publisher's turnover and<br />

profit before tax (PBT), 2000-2001 (£m)<br />

150<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-100<br />

Turnover Profit before tax (PBT)<br />

Eidos Codemasters SCI Empire<br />

Source: Eidos - Year end 31 March 2001( post exceptionals) - Company<br />

report; Codemasters - Year end June 2000 - Company report.;<br />

SCI - Year end September 2001 - Company report;<br />

Empire - Year end December 2000 - Company report<br />

The profitability of publishers over the past two years<br />

has been adversely affected by the console<br />

technology transition; publishers have made large<br />

investments in the development of titles for new<br />

consoles that only recently come <strong>to</strong> market.<br />

Publishers are expecting <strong>to</strong> gain from these<br />

investments over the next two years as the installed<br />

base of new generation consoles expands and the<br />

games software market enters a new period of<br />

growth. Profitability has also been affected by<br />

downward pressure on wholesale prices for titles, as<br />

well as by the effects of discounting and more taxing<br />

retail-imposed sale or return policies (if titles fail <strong>to</strong><br />

sell as many units as expected).<br />

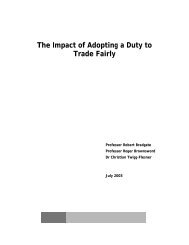

The profitability of a typical games publisher can<br />

therefore peak and trough incredibly quickly as<br />

illustrated by the past performance of Eidos.<br />

However, these figures do also include a number of<br />

exceptional items, including one large disposal and a<br />

write-down.<br />

Exhibit 51: Eidos turnover and profit before tax,<br />

1998-2004 (£m)<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

-100<br />

-150<br />

98/99 99/00 00/01 01/02E 02/03E 03/04E<br />

Source: Deutsche Bank estimates 11/01/02<br />

Turnover<br />

Profit before tax (PBT)