Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

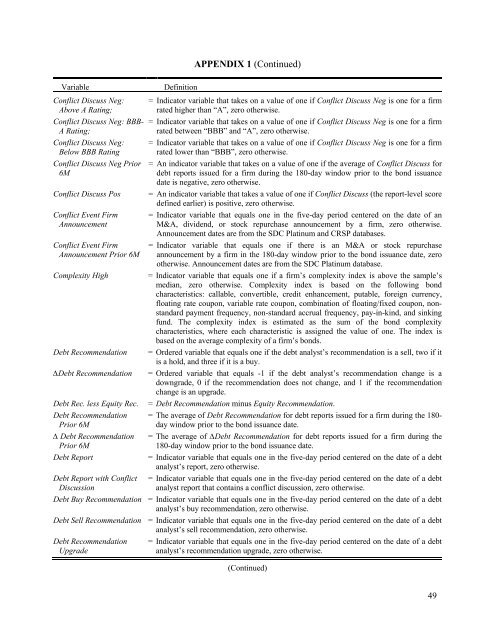

Variable Definition<br />

Conflict Discuss Neg:<br />

Above A Rating;<br />

Conflict Discuss Neg: BBB-<br />

A Rating;<br />

Conflict Discuss Neg:<br />

Below BBB Rating<br />

Conflict Discuss Neg Prior<br />

6M<br />

APPENDIX 1 (Continued)<br />

= Indicator variable that takes on a value <strong>of</strong> one if Conflict Discuss Neg is one for a firm<br />

rated higher than “A”, zero otherwise.<br />

= Indicator variable that takes on a value <strong>of</strong> one if Conflict Discuss Neg is one for a firm<br />

rated between “BBB” and “A”, zero otherwise.<br />

= Indicator variable that takes on a value <strong>of</strong> one if Conflict Discuss Neg is one for a firm<br />

rated lower than “BBB”, zero otherwise.<br />

= An indicator variable that takes on a value <strong>of</strong> one if the average <strong>of</strong> Conflict Discuss for<br />

debt reports issued for a firm during the 180-day window prior to the bond issuance<br />

date is negative, zero otherwise.<br />

Conflict Discuss Pos = An indicator variable that takes a value <strong>of</strong> one if Conflict Discuss (the report-level score<br />

defined earlier) is positive, zero otherwise.<br />

Conflict Event Firm<br />

Announcement<br />

Conflict Event Firm<br />

Announcement Prior 6M<br />

= Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> an<br />

M&A, dividend, or stock repurchase announcement by a firm, zero otherwise.<br />

Announcement dates are from the SDC Platinum and CRSP databases.<br />

= Indicator variable that equals one if there is an M&A or stock repurchase<br />

announcement by a firm in the 180-day window prior to the bond issuance date, zero<br />

otherwise. Announcement dates are from the SDC Platinum database.<br />

Complexity High = Indicator variable that equals one if a firm’s complexity index is above the sample’s<br />

median, zero otherwise. Complexity index is based on the following bond<br />

characteristics: callable, convertible, credit enhancement, putable, foreign currency,<br />

floating rate coupon, variable rate coupon, combination <strong>of</strong> floating/fixed coupon, nonstandard<br />

payment frequency, non-standard accrual frequency, pay-in-kind, and sinking<br />

fund. The complexity index is estimated as the sum <strong>of</strong> the bond complexity<br />

characteristics, where each characteristic is assigned the value <strong>of</strong> one. The index is<br />

based on the average complexity <strong>of</strong> a firm’s bonds.<br />

<strong>Debt</strong> Recommendation = Ordered variable that equals one if the debt analyst’s recommendation is a sell, two if it<br />

is a hold, and three if it is a buy.<br />

∆<strong>Debt</strong> Recommendation = Ordered variable that equals -1 if the debt analyst’s recommendation change is a<br />

downgrade, 0 if the recommendation does not change, and 1 if the recommendation<br />

change is an upgrade.<br />

<strong>Debt</strong> Rec. less <strong>Equity</strong> Rec. = <strong>Debt</strong> Recommendation minus <strong>Equity</strong> Recommendation.<br />

<strong>Debt</strong> Recommendation<br />

Prior 6M<br />

∆ <strong>Debt</strong> Recommendation<br />

Prior 6M<br />

= The average <strong>of</strong> <strong>Debt</strong> Recommendation for debt reports issued for a firm during the 180day<br />

window prior to the bond issuance date.<br />

= The average <strong>of</strong> ∆<strong>Debt</strong> Recommendation for debt reports issued for a firm during the<br />

180-day window prior to the bond issuance date.<br />

<strong>Debt</strong> Report = Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> a debt<br />

analyst’s report, zero otherwise.<br />

<strong>Debt</strong> Report with Conflict<br />

Discussion<br />

= Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> a debt<br />

analyst report that contains a conflict discussion, zero otherwise.<br />

<strong>Debt</strong> Buy Recommendation = Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> a debt<br />

analyst’s buy recommendation, zero otherwise.<br />

<strong>Debt</strong> Sell Recommendation = Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> a debt<br />

analyst’s sell recommendation, zero otherwise.<br />

<strong>Debt</strong> Recommendation<br />

Upgrade<br />

= Indicator variable that equals one in the five-day period centered on the date <strong>of</strong> a debt<br />

analyst’s recommendation upgrade, zero otherwise.<br />

(Continued)<br />

49