Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

Debt Analysts' Views of Debt-Equity Conflicts of Interest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

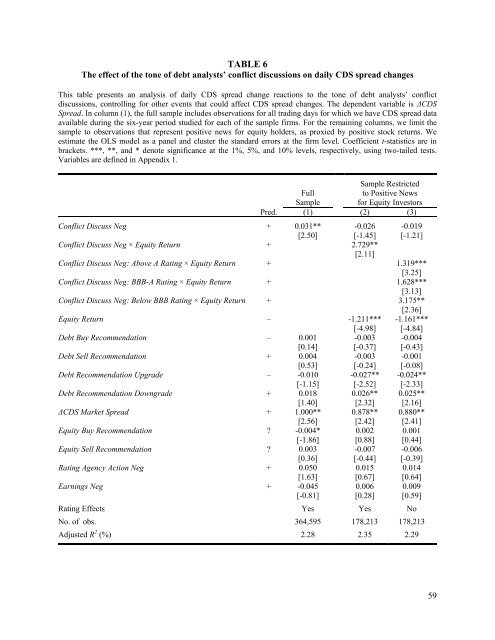

TABLE 6<br />

The effect <strong>of</strong> the tone <strong>of</strong> debt analysts’ conflict discussions on daily CDS spread changes<br />

This table presents an analysis <strong>of</strong> daily CDS spread change reactions to the tone <strong>of</strong> debt analysts’ conflict<br />

discussions, controlling for other events that could affect CDS spread changes. The dependent variable is ΔCDS<br />

Spread. In column (1), the full sample includes observations for all trading days for which we have CDS spread data<br />

available during the six-year period studied for each <strong>of</strong> the sample firms. For the remaining columns, we limit the<br />

sample to observations that represent positive news for equity holders, as proxied by positive stock returns. We<br />

estimate the OLS model as a panel and cluster the standard errors at the firm level. Coefficient t-statistics are in<br />

brackets. ***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively, using two-tailed tests.<br />

Variables are defined in Appendix 1.<br />

Full<br />

Sample Restricted<br />

to Positive News<br />

Sample for <strong>Equity</strong> Investors<br />

Pred. (1) (2) (3)<br />

Conflict Discuss Neg + 0.031** -0.026 -0.019<br />

[2.50] [-1.45] [-1.21]<br />

Conflict Discuss Neg × <strong>Equity</strong> Return + 2.729**<br />

[2.11]<br />

Conflict Discuss Neg: Above A Rating × <strong>Equity</strong> Return + 1.319***<br />

[3.25]<br />

Conflict Discuss Neg: BBB-A Rating × <strong>Equity</strong> Return + 1.628***<br />

[3.13]<br />

Conflict Discuss Neg: Below BBB Rating × <strong>Equity</strong> Return + 3.175**<br />

[2.36]<br />

<strong>Equity</strong> Return – -1.211*** -1.161***<br />

[-4.98] [-4.84]<br />

<strong>Debt</strong> Buy Recommendation – 0.001 -0.003 -0.004<br />

[0.14] [-0.37] [-0.43]<br />

<strong>Debt</strong> Sell Recommendation + 0.004 -0.003 -0.001<br />

[0.53] [-0.24] [-0.08]<br />

<strong>Debt</strong> Recommendation Upgrade – -0.010 -0.027** -0.024**<br />

[-1.15] [-2.52] [-2.33]<br />

<strong>Debt</strong> Recommendation Downgrade + 0.018 0.026** 0.025**<br />

[1.40] [2.32] [2.16]<br />

ΔCDS Market Spread + 1.000** 0.878** 0.880**<br />

[2.56] [2.42] [2.41]<br />

<strong>Equity</strong> Buy Recommendation ? -0.004* 0.002 0.001<br />

[-1.86] [0.88] [0.44]<br />

<strong>Equity</strong> Sell Recommendation ? 0.003 -0.007 -0.006<br />

[0.36] [-0.44] [-0.39]<br />

Rating Agency Action Neg + 0.050 0.015 0.014<br />

[1.63] [0.67] [0.64]<br />

Earnings Neg + -0.045 0.006 0.009<br />

[-0.81] [0.28] [0.59]<br />

Rating Effects Yes Yes No<br />

No. <strong>of</strong> obs. 364,595 178,213 178,213<br />

Adjusted R 2 (%) 2.28 2.35 2.29<br />

59